PQR, Inc., has an issue of preferred stock outstanding that pays a $4.93 dividend every year, in perpetuity. If this issue currently sells for $37.92 per share, what is the required return in percent? Answer to two decimals.

PQR, Inc., has an issue of preferred stock outstanding that pays a $4.93 dividend every year, in perpetuity. If this issue currently sells for $37.92 per share, what is the required return in percent? Answer to two decimals.

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter8: Basic Stock Valuation

Section: Chapter Questions

Problem 4P

Related questions

Question

Transcribed Image Text:PQR, Inc., has an issue of preferred stock outstanding that pays a $4.93 dividend every year, in

perpetuity. If this issue currently sells for $37.92 per share, what is the required return in percent?

Answer to two decimals.

Expert Solution

Step 1

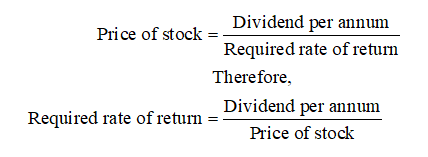

Formula:

Step 2

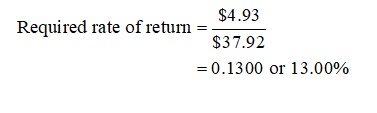

Computation:

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning