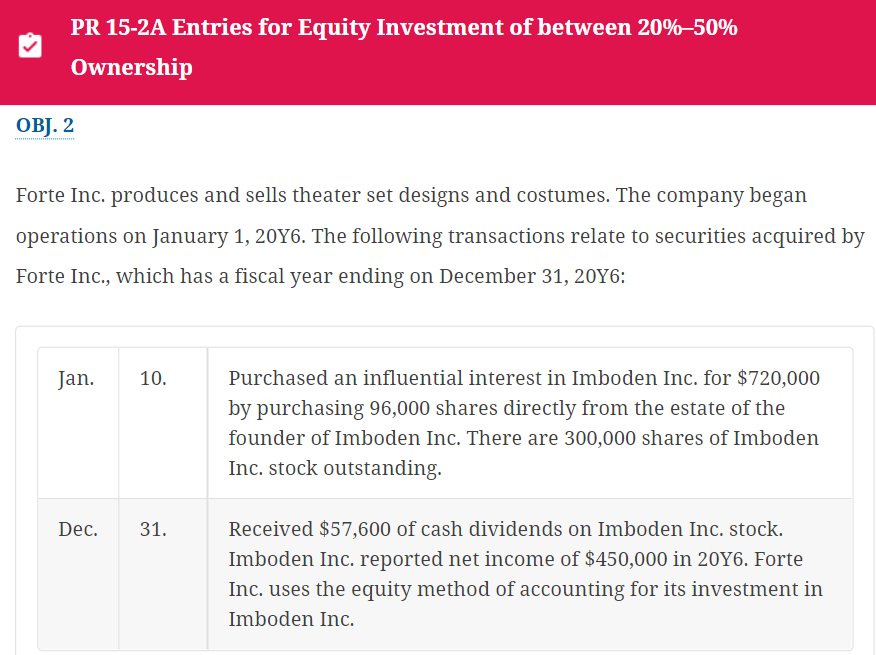

PR 15-2A Entries for Equity Investment of between 20%-50% Ownership OBJ. 2 Forte Inc. produces and sells theater set designs and costumes. The company began operations on January 1, 20Y6. The following transactions relate to securities acquired Forte Inc., which has a fiscal year ending on December 31, 20Y6: Jan. 10. Dec. 31. Purchased an influential interest in Imboden Inc. for $720,000 by purchasing 96,000 shares directly from the estate of the founder of Imboden Inc. There are 300,000 shares of Imboden Inc. stock outstanding. Received $57,600 of cash dividends on Imboden Inc. stock. Imboden Inc. reported net income of $450,000 in 20Y6. Forte Inc. uses the equity method of accounting for its investment in Imboden Inc.

PR 15-2A Entries for Equity Investment of between 20%-50% Ownership OBJ. 2 Forte Inc. produces and sells theater set designs and costumes. The company began operations on January 1, 20Y6. The following transactions relate to securities acquired Forte Inc., which has a fiscal year ending on December 31, 20Y6: Jan. 10. Dec. 31. Purchased an influential interest in Imboden Inc. for $720,000 by purchasing 96,000 shares directly from the estate of the founder of Imboden Inc. There are 300,000 shares of Imboden Inc. stock outstanding. Received $57,600 of cash dividends on Imboden Inc. stock. Imboden Inc. reported net income of $450,000 in 20Y6. Forte Inc. uses the equity method of accounting for its investment in Imboden Inc.

Accounting (Text Only)

26th Edition

ISBN:9781285743615

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter15: Investments And Fair Value Accounting

Section: Chapter Questions

Problem 15.16EX

Related questions

Question

100%

Please write the calculation

Transcribed Image Text:PR 15-2A Entries for Equity Investment of between 20%-50%

Ownership

OBJ. 2

Forte Inc. produces and sells theater set designs and costumes. The company began

operations on January 1, 20Y6. The following transactions relate to securities acquired by

Forte Inc., which has a fiscal year ending on December 31, 20Y6:

Jan. 10.

Dec.

31.

Purchased an influential interest in Imboden Inc. for $720,000

by purchasing 96,000 shares directly from the estate of the

founder of Imboden Inc. There are 300,000 shares of Imboden

Inc. stock outstanding.

Received $57,600 of cash dividends on Imboden Inc. stock.

Imboden Inc. reported net income of $450,000 in 20Y6. Forte

Inc. uses the equity method of accounting for its investment in

Imboden Inc.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning