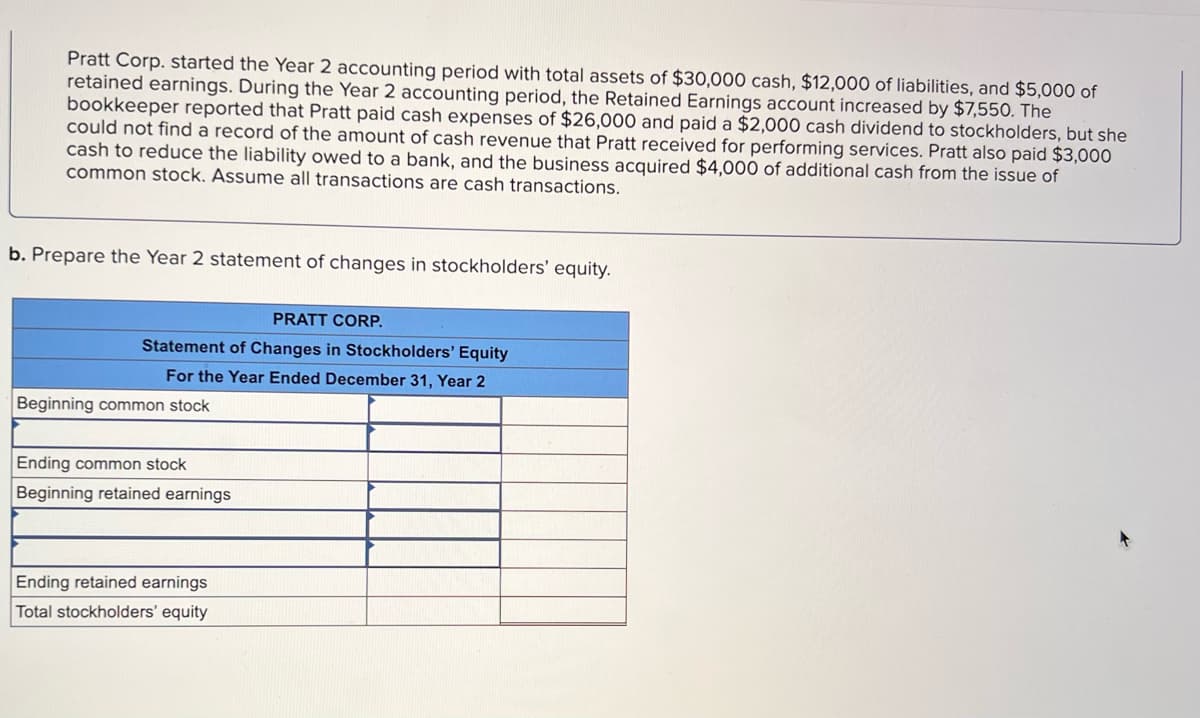

Pratt Corp. started the Year 2 accounting period with total assets of $30,000 cash, $12,000 of liabilities, and $5,000 of retained earnings. During the Year 2 accounting period, the Retained Earnings account increased by $7,550. The bookkeeper reported that Pratt paid cash expenses of $26,000 and paid a $2,000 cash dividend to stockholders, but she could not find a record of the amount of cash revenue that Pratt received for performing services. Pratt also paid $3,000 cash to reduce the liability owed to a bank, and the business acquired $4,000 of additional cash from the issue of common stock. Assume all transactions are cash transactions. b. Prepare the Year 2 statement of changes in stockholders' equity. PRATT CORP. Statement of Changes in Stockholders' Equity For the Year Ended December 31, Year 2 Beginning common stock Ending common stock Beginning retained earnings Ending retained earnings Total stockholders' equity

Pratt Corp. started the Year 2 accounting period with total assets of $30,000 cash, $12,000 of liabilities, and $5,000 of retained earnings. During the Year 2 accounting period, the Retained Earnings account increased by $7,550. The bookkeeper reported that Pratt paid cash expenses of $26,000 and paid a $2,000 cash dividend to stockholders, but she could not find a record of the amount of cash revenue that Pratt received for performing services. Pratt also paid $3,000 cash to reduce the liability owed to a bank, and the business acquired $4,000 of additional cash from the issue of common stock. Assume all transactions are cash transactions. b. Prepare the Year 2 statement of changes in stockholders' equity. PRATT CORP. Statement of Changes in Stockholders' Equity For the Year Ended December 31, Year 2 Beginning common stock Ending common stock Beginning retained earnings Ending retained earnings Total stockholders' equity

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter2: Basic Accounting Systems: Cash Basis

Section: Chapter Questions

Problem 2SEQ: The receipt of $8,000 cash for fees earned was recorded by Langley Consulting as an increase in cash...

Related questions

Question

100%

I am so confused on how to fill out this table. Please help me.

Transcribed Image Text:Pratt Corp. started the Year 2 accounting period with total assets of $30,000 cash, $12,000 of liabilities, and $5,000 of

retained earnings. During the Year 2 accounting period, the Retained Earnings account increased by $7,550. The

bookkeeper reported that Pratt paid cash expenses of $26,000 and paid a $2,000 cash dividend to stockholders, but she

could not find a record of the amount of cash revenue that Pratt received for performing services. Pratt also paid $3,000

cash to reduce the liability owed to a bank, and the business acquired $4,000 of additional cash from the issue of

common stock. Assume all transactions are cash transactions.

b. Prepare the Year 2 statement of changes in stockholders' equity.

PRATT CORP.

Statement of Changes in Stockholders' Equity

For the Year Ended December 31, Year 2

Beginning common stock

Ending common stock

Beginning retained earnings

Ending retained earnings

Total stockholders' equity

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,