Preferred Stock-6%, $60 par value; 2,000 shares authorized, 1,000 shares issued and outstanding $ 60,000 Common Stock-$5 par value; 80,000 shares authorized, 48,000 shares issued, 46,700 shares outstanding 240,000 470,000 (26,000) Paid-In Capital in Excess of Par-Common Treasury Stock-Common; 1,300 shares at cost

Q: FV Company earned net income of $75,000 during the year ended December 31, 2012. On December 15, FV…

A: Dividend: A dividend is distribution of company’s earnings to its shareholders as determined by…

Q: Assume that the following data relative to Cullumber Company for 2021 is available: Net Income…

A: Shares refer to the units that a company issue to raise funds from the market and that shareholders…

Q: Lucas Company reports net income of $2,520 for the year ended December 31, 2019, its first year of…

A: Basic Earning Per Share - It means annualize earning rate per share. It simply means shares are…

Q: The following financial information is available for Sheridan Ltd. as at December 31 (in thousands,…

A: Profit available to common stock holders= Profit- Preference dividend EPS= Profit available to…

Q: Commons, Inc. provides the following information for 2018: Net income $ 38 comma…

A: Dividend Yield refers to the dividend per share divided by price per share. It shows total income…

Q: . Li Travel Company reported net income for 2021 in the amount of $900,000. During 2021, Li declared…

A: Earnings per share are the earnings available to each shareholder. The earnings per share are…

Q: Information from the financial statements of Henderson-Niles Industries included the following at…

A: Earnings Per Share- EPS is the portion of net profits available to equity stockholders after…

Q: On January 1, 2017 a company had the following data: Issued 5,000 shares of $1.00 par value common…

A: Cumulative preference shares give the shareholder a right to receive dividends that is not received…

Q: Comparative Earnings per Share Lucas Company reports net income of $2,460 for the year ended…

A: The following computations are done for Lucas Company.

Q: Compute Earnings per share. Romeo electic cars sold sold various electric cars for the year 2021…

A: Introduction:- EPS is an important financial measure, it indicates the profitability of a company.…

Q: Data pertaining to Classic Corp.’s common stock are presented for the fiscalbyear ending May 31,…

A: Solution: Price earning ratio of a company represents how much time of earning per share have a…

Q: Comparative Earnings per Share Lucas Company reports net income of $2,580 for the year ended…

A: 1. Basic earnings per share for 2019 = Net Income / weighted average number of shares outstanding…

Q: Calculate the amount of 1) Basic and 2)Diluted Earnings per Share for the Year ended December 31,…

A: EPS is Earnings per share is the measuring rod of the profitability of the company. The basic EPS is…

Q: Computing earnings per share, price/earnings ratio, and rate of return on common stockholders’…

A:

Q: he shareholders' equity section of Propel Company's comparative balance sheets for the years ended…

A: Closing Retained Earnings = Opening retained Earnings + Net Income - Dividend

Q: Comparative Earnings per Share Lucas Company reports net income of $2,580 for the year ended…

A: Answer 1) The Basic Earnings per share that would be disclosed in the 2019 annual report: Net Income…

Q: Computing earnings per share HEB Corporation had net income for 2018 of $60,450. HEB had 15,500…

A: Earnings per share: Earnings per share represent the amount of income earned per share of…

Q: Hardaway Fixtures' balance sheet at December 31, 2017, included the following: Shares…

A: Earnings per share: It tells about the profit earned on each share. Formula: EPS = ( Net income -…

Q: Flyaway Travel Company reported net income for 2021 in the amount of $90,000. During 2021, Flyaway…

A:

Q: Comparative Earnings per Share Lucas Company reports net income of $2,520 for the year ended…

A: Earnings per share indicate the profits per share of common stockholders. It can be calculated by…

Q: Madison Company earned net income of $75,000 during the year ended December 31, 2018. On December…

A: Annual Dividend to Preferred shareholders = Par value of preferred share x rate of dividend =…

Q: Ratio Analysis Consider the following information taken from the shareholders' equity section:…

A: Earning per share (EPS) is determined as an organization's benefit separated by the remarkable…

Q: At December 31, 2017, Albrecht Corporation had outstanding 373,000 shares of common stock and 8,000…

A:

Q: Moche Company named net income of $105,000 during the year ended December 31, 2018. On December 15,…

A: The dividend is the portion of retained earnings of the company which is distributed to the…

Q: Hardaway Fixtures’ balance sheet at December 31, 2015, included the following: Shares issued and…

A: Weighted average no. of common stock = Beginning outstanding shares + Stock dividend shares =…

Q: The shareholders' equity section of Time Company's comparative balance sheets for the years ended…

A: Dividend declared is reduced from retained earnings and net income is transferred to retained…

Q: On January 1, 2020, Ivanhoe Corporation had the following stockholders' equity accounts. Common…

A: stockholders' equity is one of the three main components of a corporation's balance sheet. Balance…

Q: Comparative Earnings per Share Lucas Company reports net income of $2,580 for the year ended…

A: Introduction: Net income is the entire amount of money made by an individual or firm in a specific…

Q: Rodgers Corporation reported basic earnings per share of $1.25 for the year ended December 31, 2019.…

A: Net income is the excess of revenue over operating expenses for a given period.

Q: Templet Corp. earned net income of $118,400 and paid the minimum dividend to preferred stockholders…

A: 1) Calculation of Earning Per Share (EPS) EPS will be calculated on the earnings available to common…

Q: Reporting earnings per share Return to the ABC data in Short Exercise S-12. ABC had 8,000 shares of…

A: Earnings per share: It is a profitability ratio which shows the profit earned on each share of the…

Q: Computing earnings per share, price/earnings ratio, and rate of return on common stockholders’…

A:

Q: Thurman Comfort Specialists, Inc. reported the following stockholders' equity on its balance sheet…

A: Hello. Since your question has multiple sub-parts, we will solve the first three sub-parts for you.…

Q: 1. Compute the basic earnings per share that would be disclosed in the 2019 annual report. $ per…

A: Basic EPS: It is company's net earnings which is allocable to the common stockholders. Basic…

Q: FV Company earned net income of $75,000 during the year ended December 31, 2012. On December 15, FV…

A: Dividend: When the business then generate the profit of more than the expectation then it’s called…

Q: . Applewood Electronics ltd reported net earnings of $ 500 000 for the year ending…

A: Earnings Per Share: Earnings Per Share is one of the Market Prospect Ratios. It is also known as the…

Q: Shamrock Corporation has 9,400 shares of $100 par value, 8%, preferred stock and 48,400 shares of…

A: For cumulative preferred stocks, the preferred dividend keeps on cumulating for all the periods for…

Q: Reporting earnings per share Return to the ABC data in Short Exercise S13-12. ABC had 8,000 shares…

A: Income statement is a financial statement that shows the net income earned or net loss suffered by a…

Q: 1. Calculate the following for 2018 (Note: Round answers to two decimal places): Shareholder…

A: Ratio analysis: It is the financial analysis tool for measuring the profitability, liquidity,…

Q: Prepare a condensed income statement for 2021, including earnings per share fir par value common…

A: Disclaimer: “Since you have posted a question with multiple sub-parts, we will solve first three…

Q: Statement of Shareholders' Equity At the end of 2017, Jeffco Inc. had the following equity accounts…

A: As posted two sub parts only first sub part is answered kindly repost the unanswered question as a…

Q: The following financial information is available for Blossom Ltd. as at December 31 (in thousands,…

A: EPS = Net income / Number of shares outstanding Price earning ratio = Market price per share / EPS…

Q: Triumph's has 40,000 common shares outstanding during 2018. Requirement 1. Compute earnings per…

A: The following computations are done for Triumph's Companies.

Q: 1. Compute Tidepool's EPS for the year. 2. Assume Tidepool's market price of a share of common…

A: Earning per share (EPS) is calculated by dividing net income earned by the company from the number…

Q: During the year 2019, Howard industries reported net income of P1,000,000. The company declared and…

A: Earnings per share = Earnings after payment of preferred dividends Weighted Number of common shares…

Q: Journalizing a stock dividend and reporting stockholders’ equity The stockholders’ equity of…

A: 1. 400 shares * $16 * 13% is 832

Q: Jupiter corporation had the following shares outstanding at December 31. 2018: Ordinary shares, par…

A: Annual Dividend to Preferred shareholders = No. of preferred share outstanding x Par value per share…

Q: Please answer in good accounting form. Thankyou During 2021, CAPTAIN AMERICA Company had two…

A: The basic earnings per share is calculated as net income available to common shareholders divided by…

Q: Payout Ratio and Book Value per Share Divac Company has developed a statement of stockholders'…

A: Dividend payout ratio - Dividend payout ratio indicates the dividend paid out of the net income…

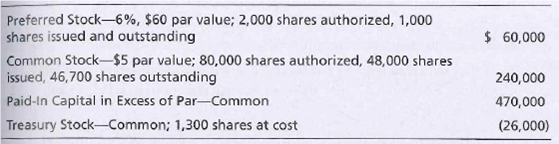

Computing earnings per share and price/earnings ratio

Rocket Corp. earned net income of $153,040 and paid the minimum dividend to preferred stockholders for 2018. Assume that there are no changes in common shares outstanding during 2018. Rocket’s books include the following figures:

Requirements

- Compute Rocket’s EPS for the year.

- Assume Rocket’s market price of a share of common stock is $12 per share. Compute Rocket’s price/earnings ratio.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- Selected transactions completed by Equinox Products Inc. during the fiscal year ended December 31, 2016, were as follows: a. Issued 15,000 shares of 20 par common stock at 30, receiving cash. b. Issued 4, 000 shares of 80 par preferred 5% stock at 100, receiving cash. c. Issued 500,000 of 10-year, 5% bonds at 104, with interest payable semiannually. d. Declared a quarterly dividend of 0.50 per share on common stock and 1.00 per share on preferred stock. On the date of record, 100,000 shares of common stock were outstanding, no treasury shares were held, and 20,000 shares of preferred stock were outstanding. e. Paid the cash dividends declared in (d). f. Purchased 7,500 shares of Solstice Corp. at 40 per share, plus a 150 brokerage commission. The investment is classified as an available-for-sale investment. g. Purchased 8,000 shares of treasury common stock at 33 per share. h. Purchased 40,000 shares of Pinkberry Co. stock directly from the founders for 24 per share. Pinkberry has 125,000 shares issued and outstanding. Equinox Products Inc. treated the investment as an equity method investment. i. Declared a 1.00 quarterly cash dividend per share on preferred stock. On the date of record, 20,000 shares of preferred stock had been issued. j. Paid the cash dividends to the preferred stockholders. k. Received 27,500 dividend from Pinkberry Co. investment in (h). l. Purchased 90,000 of Dream Inc. 10-year, 5% bonds, directly from the issuing company, at their face amount plus accrued interest of 37 5. The bonds are classified as a held-to-maturity long -term investment. m. Sold, at 38 per share, 2,600 shares of treasury common stock purchased in (g). n. Received a dividend of 0 .60 per share from the Solstice Corp. investment in (f). o. Sold 1,000 shares of Solstice Corp. at 45, including commission. p. Recorded the payment of semiannual interest on the bonds issue d in (c) and the amortization of the premium for six months. The amortization is determined using the straight-line method . q. Accrued interest for three months on the Dream Inc. bonds purchased in (I). r. Pinkberry Co. recorded total earnings of 240 ,000. Equinox Products recorded equity earnings for its share of Pinkberry Co. net income. s. The fair value for Solstice Corp. stock was 39. 02 per share on December 31, 2016. The investment is adjusted to fair value , using a valuation allowance account. Assume Valuation Allowance for Available-for-Sale Investments h ad a beginning balance of zero. Instructions 1. Journalize the selected transactions. 2. After all of the transaction s for the year ended December 31, 201 6, had been poste d [including the transactions recorded in part (1) and all adjusting entries), the data that follows were taken from the records of Equinox Products Inc. a. Prepare a multiple-step in come statement for the year ended December 31, 201 6, concluding with earnings per share . In computing earnings per share, assume that the average number of common shares outstanding was 100,000 and preferred dividends were 100,000. ( Round earnings per share to the nearest cent.) b. Prepare a retained earnings statement for the year ended December 31, 20 6. c. Prepare a balance sheet in report form as of December 31, 2016.Stockholders equity accounts and other related accounts of Gonzales Company as of January 1, 20--, the beginning of its fiscal year, are shown below. Preferred stock subscriptions receivable 50,000 Preferred stock, 10 par, 9% (200,000 shares authorized; 20,000 shares issued)200,000 Preferred stock subscribed (10,000 shares)100,000 Paid-in capital in excess of parpreferred stock40,000 Common stock, 10 par (100,000 shares authorized; 60,000 shares issued)600,000 Paid-in capital in excess of parcommon stock250,000 Retained earnings750,000 During 20--, Gonzales Company completed the following transactions affecting stockholders equity: (a) Received 20,000 for the balance due on subscriptions for 4,000 shares of preferred stock with a par value of 40,000 and issued the stock. (b) Purchased 10,000 shares of common treasury stock for 18 per share. (c) Received subscriptions for 10,000 shares of common stock at 19 per share, collecting down payments of 45,000. (d) Issued 15,000 shares of common stock in exchange for land with a fair market value of 290,000. (e) Sold 5,000 shares of common treasury stock for 100,000. (f) Issued 10,000 shares of preferred stock at 11.50 per share, receiving cash. (g) Sold 3,000 shares of common treasury stock for 17 per share. REQUIRED 1. Prepare general journal entries for the transactions, identifying each transaction by letter. 2. Post the journal entries to appropriate T accounts. The cash account has a beginning balance of 300,000. 3. Prepare the stockholders equity section of the balance sheet as of December 31, 20--. Net income for the year was 825,000 and dividends of 400,000 were paid.Issuances of Stock Cada Corporation is authorized to issue 10,000 shares of 100 par, convertible, callable preferred stock and 80,000 shares of no-par, no-stated value common stock. There are currently 7,000 shares of preferred and 30,000 shares of common stock outstanding. The following are several alternative transactions: 1. Purchased land by issuing 640 shares of preferred stock and 1,000 shares of common stock. Preferred and common are currently selling at 113 and 36 per share, respectively, No reliable appraisal of the land is available. 2. Same as Transaction 1, except that land is appraised at 104,000, and the preferred stock has no current market value. 3. Issued, for 99,000 cash, a combination of 400 shares of preferred stock and bonds payable with a face value of 50,000. Currently, the preferred stock is selling for 120 per share and the bonds at 104. 4. Same as Transaction 3, except that the bonds do not have a current market value. 5. Same as Transaction 3, except that the preferred stock does not have a current market value. 6. Preferred shareholders (who had originally paid the corporation 110 per share for their stock) convert 6,500 preferred shares into 19,500 shares of common stock. The current market prices of the preferred stock and the common stock are 120 and 41 per share, respectively. 7. The corporation calls the 7,000 shares of preferred stock (originally issued at 110 per share) at 123 per share. Common stock is currently selling for 42 per share. Shareholders elect not to convert into common stock. 8. Same as Transaction 7, except that shareholders owning 2,000 shares of preferred stock elect to convert each share into 3 shares of common stock The remaining 5,000 preferred shares are retired. Required: Next Level Prepare the journal entry necessary to record each transaction. Below each entry, explain your reason for the values used.

- STATED VALUE, COMMON AND PREFERRED STOCK, AND NONCASH ASSETS Dans Hobby Stores had the following stock transactions during the year: (a) Issued 5,000 shares of no-par common stock with a stated value of 10 per share for 50,000 cash. (b) Issued 6,000 shares of no-par common stock with a stated value of 10 per share for 63,000 cash. (c) Issued 3,500 shares of no-par, 6% preferred stock with a stated value of 22 per share for 77,000 cash. (d) Issued 10,000 shares of 10 par common stock for land with a fair market value of 100,000. (e) Issued 11,000 shares of 10 par common stock with an 11 fair market value for a building with an uncertain fair market value. (f) Issued 8,000 shares of 30 par, 6% preferred stock for land with a fair market value of 243,000. REQUIRED Prepare general journal entries for these transactions, identifying each by letter.PAR AND NO-PAR, COMMON AND PREFERRED STOCK Hernandez Company had the following stock transactions during its first 5 years of operations: (a) Issued 25,000 shares of 1 par common stock for 25,000 cash. (b) Issued 20,000 shares of 1 par common stock for 22,000 cash. (c) Issued 2,000 shares of 50 par, 8% preferred stock for 100,000 cash. (d) Issued 1,000 shares of 50 par, 8% preferred stock for 51,500 cash. (e) Issued 2,500 shares of no-par common stock for 11,875 cash. (f) Issued 1,500 shares of no-par, 7 preferred stock for 72,000 cash. REQUIRED 1. Prepare general journal entries for these transactions, identifying each by letter. 2. Assume that stock transactions a, b, and c occurred in year 1. The amount available for dividends at the end of year 1 is 26,000. Prepare the dividend allocation between the preferred and common shares in total and per share for year 1.COMMON AND PREFERRED CASH DIVIDENDS Ramirez Company currently has 100,000 shares of 1 par common stock outstanding and 5,000 shares of 50 par preferred stock outstanding. On July 10, the board of directors declared a semiannual dividend of 0.30 per share on common stock to shareholders of record on August 1, payable on August 5. On July 15, the board of directors declared a semiannual dividend of 5 per share on preferred stock to shareholders of record on August 5, payable on August 10. Prepare journal entries for the declaration and payment of the common and preferred stock cash dividends.

- STATED VALUE, COMMON AND PREFERRED STOCK, AND NONCASH ASSETS Kris Kraft Stores had the following stock transactions during the year: (a) Issued 8,000 shares of no-par common stock with a stated value of 5 per share for 40,000 cash. (b) Issued 6,000 shares of no-par common stock with a stated value of 5 per share for 33,000 cash. (c) Issued 5,000 shares of no-par, 6% preferred stock with a stated value of 15 per share for 75,000 cash. (d) Issued 10,000 shares of 5 par common stock for land with a fair market value of 50,000. (e) Issued 20,000 shares of 5 par common stock with a 7 fair market value for a building with an uncertain fair market value. (f) Issued 8,000 shares of 50 par, 8% preferred stock for land with a fair market value of 405,000. REQUIRED Prepare general journal entries for these transactions, identifying each by letter.Stockholders equity accounts and other related accounts of Gonzales Company as of January 1, 20--, the beginning of its fiscal year, are shown below. (a)Received 20,000 for the balance due on subscriptions for preferred stock with a par value of 40,000 and issued the stock. (b)Purchased 10,000 shares of common treasury stock for 18 per share. (c)Received subscriptions for 10,000 shares of common stock at 19 per share, collecting down payments of 45,000. (d)Issued 15,000 shares of common stock in exchange for land with a fair market value of 290,000. (e)Sold 5,000 shares of common treasury stock for Si00,000. (f)Issued 10,000 shares of preferred stock at 11.50 per share, receiving cash. (g)Sold 3,000 shares of common treasury stock for 17 per share. REQUIRED 1. Prepare general journal entries for the transactions, identifying each transaction by letter. 2. Post the journal entries to appropriate T accounts. The cash account has a beginning balance of 300,000. 3. Prepare the stockholders equity section of the balance sheet as of December 31, 20--. Net income for the year was 825,000 and dividends of 400,000 were paid.PAR AND NO-PAR, COMMON AND PREFERRED STOCK Valdez Company had the following stock transactions during the first 5 years of operations: (a) Issued 24,000 shares of 1 par common stock for 26,000 cash. (b) Issued 18,000 shares of 1 par common stock for 18,000 cash. (c) Issued 3,000 shares of 10 par, 7% preferred stock for 30,000 cash. (d) Issued 4,500 shares of 10 par, 7% preferred stock for 46,500 cash. (e) Issued 1,800 shares of no-par common stock for 10,475 cash. (f) Issued 1,100 shares of no-par, 7 preferred stock for 32,000 cash. REQUIRED 1. Prepare general journal entries for these transactions, identifying each by letter. 2. Assume that stock transactions a, b, and c occurred in year 1. The amount available for dividends at the end of year 1 is 12,600. Prepare the dividend allocation between the preferred and common shares in total and per share for year 1.

- STOCK SUBSCRIPTIONS Juneau Associates had the following stock transactions during the year: (a) Received subscriptions for 100,000 shares of 1 par common stock for 105,000. (b) Received subscriptions for 5,000 shares of 15 par, 8% preferred stock for 80,000. (c) Received a payment of 55,000 on the common stock subscription. (d) Received a payment of 40,000 on the preferred stock subscription. (e) Issued 40,000 shares of 1 par common stock in exchange for a truck with a fair market value of 48,000. (f) Received the balance in full for the common stock subscription and issued the stock. (g) Received the balance in full for the preferred stock subscription and issued the stock. REQUIRED Prepare general journal entries for these transactions, identifying each by letter.A company issued 30 shares of $.50 par value common stock for $12,000. The credit to additional paid-in capital would be ________. A. $11,985 B. $12,000 C. $15 D. $10,150Contributed Capital Adams Companys records provide the following information on December 31, 2019: Additional information: 1. Common stock has a 5 par value, 50,000 shares are authorized, 15,000 shares have been issued and are outstanding. 2. Preferred stock has a 100 par value, 3,000 shares are authorized, 800 shares have been issued and are outstanding. Two hundred shares have been subscribed at 120 per share. The stock pays an 8% dividend, is cumulative, and is callable at 130 per share. 3. Bonds payable mature on January 1, 2023. They carry a 12% annual interest rate, payable semiannually. Required: Prepare the Contributed Capital section of the December 31, 2019, balance sheet for Adams. Include appropriate parenthetical notes.