Preparation of government-wide statement of activities

Q: Which of the following statements is correct about the reporting of governmental funds? Fund…

A:

Q: In government-wide financial statements, how do intra-activity and interactivity transactions…

A:

Q: Governmental auditing can extend beyond audits of financial statements to include audits ofan…

A:

Q: Using information in the relevant IPSASs, give a comprehensive definition (with examples) of revenue…

A: Comprehensive definition (with examples) of revenue appropriate for a Central Government: Revenue…

Q: Discuss the role of the government in supporting MFIs to realize the intended goals citing what MFIs…

A: MFIs is the abbreviation used for Micro financing Institutions which are the financial organizations…

Q: How have users’ needs impacted the development of accounting principles for state and local…

A: Accounting principles refers to the set of rules and regulations which companies must follow in…

Q: Explain the history of and the reasons for the unique characteristics of the financial statements…

A: The basic two types of financial statements that are produced by the state and local governments are…

Q: the fund-based and government-wide financial statements of a state or local government and the…

A: Not-for-profit (NFP) entities:It is an individual or group of people who work together to attain…

Q: What databases are appropriate for government accounting?

A: The term "Government Accounting" refers to recording & analyzing all income , expenses &…

Q: Describe the physical structure of a complete set of government-wide financial statements and a…

A: This question is answered generally by giving an overview of Governmental financial statements of…

Q: expenditure and ho

A: Reasons for India's rising govt expenditures include: (i) Development Programs: The majority of…

Q: how may resources in the general fund can be assigned to a specific purpose (if that is the intent…

A: The gap between assets as well as liabilities throughout the government expenditures balance sheet…

Q: What measurement focus is used in government-wide financial statements, and what system is applied…

A: The "current resources focus" is the measurement focus which is used in fund financial statements…

Q: Discuss briefly why fiscal responsibility shall to the greatest extent be shared by all those…

A: The answer is stated below:

Q: Define a financial reporting entity. Give an example of a primary government. Define and give an…

A:

Q: On what do the government-wide financial statements report? Multiple Choice Operational…

A: Financial statements: Financial statements are condensed summary of transactions communicated in the…

Q: What is the basic structure of government-wide financial statements and fund financial statements…

A: Financial statements: Financial statements are condensed summary of transactions communicated in the…

Q: rite the definition, recognition, measurement and derecognition of GOVERNMENT GRANT.

A: Government grant: It is the sum of the grant given to the business by the government that a…

Q: Compare the purchase and sale of government securities with the purchase and sale of agency…

A: Government Securities are the securities which are often sold by the government. Purchase and sale…

Q: Complete the blank as appropriate: Governmental financial reporting focuses on stewardship and…

A: This was related to the reporting of the financial statement of the government entity. The purpose…

Q: Which of the following statements is correct about the reporting of governmental funds? Choose the…

A: Financial statements are condensed summary of transactions communicated in the form of reports for…

Q: What benefits are derived from including the management’s discussion and analysis in state and local…

A: GASB: The GASB is the board that provides the guideline to the governmental units about proper…

Q: Explain the objectives of governmental financial reporting as developed by GASB

A: The Government Accounting Standard Board (GASB) is defined as an organization that performs the…

Q: Discuss various other government departments and their functions in cbsa/cfia

A: The CBSA is a Canadian federal agency responsible for federal law agency that is responsible for…

Q: 4. It is the area of the accountancy profession that encompasses the process of analyzing,…

A: Solution: Government accounting is the area of accountancy profession that encompasses the process…

Q: Explain the difference between expenses and expenditures in a state and a local government.

A: Given: The difference between the state and local government’s expenses and expenditures are given.…

Q: 1. What are the components that are included in the minimum requirements for general purpose…

A: "As per Bartleby guidelines, we will solve the first question for you. If you want any specific…

Q: Which of the following is true regarding the government-wide financial statements? a. The…

A: Government-wide Financial statement: It is the statement of consists of a statement of net assets…

Q: Which of the following statements is correct about the reporting of governmental funds? Choose the…

A:

Q: give the definition, recognition, measurement and derecognition of "government grant"

A: International Financial Reporting Standards, generally called IFRS, are the accounting standards…

Q: Which of the following items are included in the governmental activities column of the government-…

A:

Q: GENERAL PROVISIONS, BASIC STANDARDS AND POLICIES OF GOVERNMENT ACCOUNTING IMPORTANCE AS A WHOLE AND…

A: In the public monetary administration cycle, bookkeeping follows planning and and surveying an…

Q: Which office maintains accounts of financial transactions of all national government offices,…

A: Government Accounting is a process of recording, classifying, analysing and communicating all the…

Q: What are government expenditures

A: Government Expenditure multiplier factor is that the magnitude relation of the change in financial…

Q: Which of the following is not a category of program revenue reported on the statement of activities…

A: Answer: Option A is the Correct Answer i.e General program revenue.

Q: Enumerate the objectives of the government accounting according to Section 110, Presidential Decree…

A: The government accounting is a new system of accounting in which the government accounting describes…

Q: Government financial reporting should assist report users in evaluating:

A: Answer

Q: List some of the major adjustments required when converting from fund financial statements to…

A: Government accounting refers to the accounting under which all the financial transactions of the…

Q: Expenses that are specifically identified with a program or function are reported in the…

A: Direct expenses are the Expenses that are specifically identified with a program or function are…

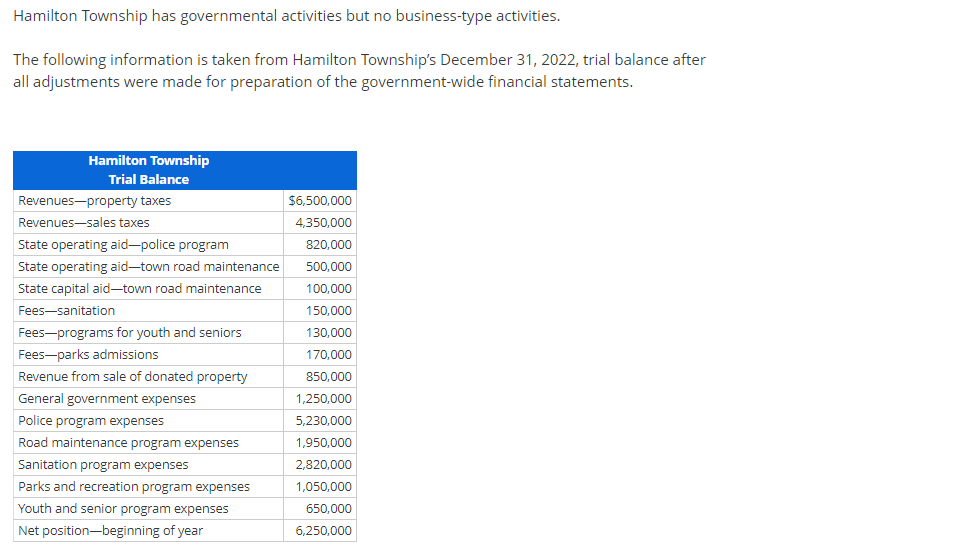

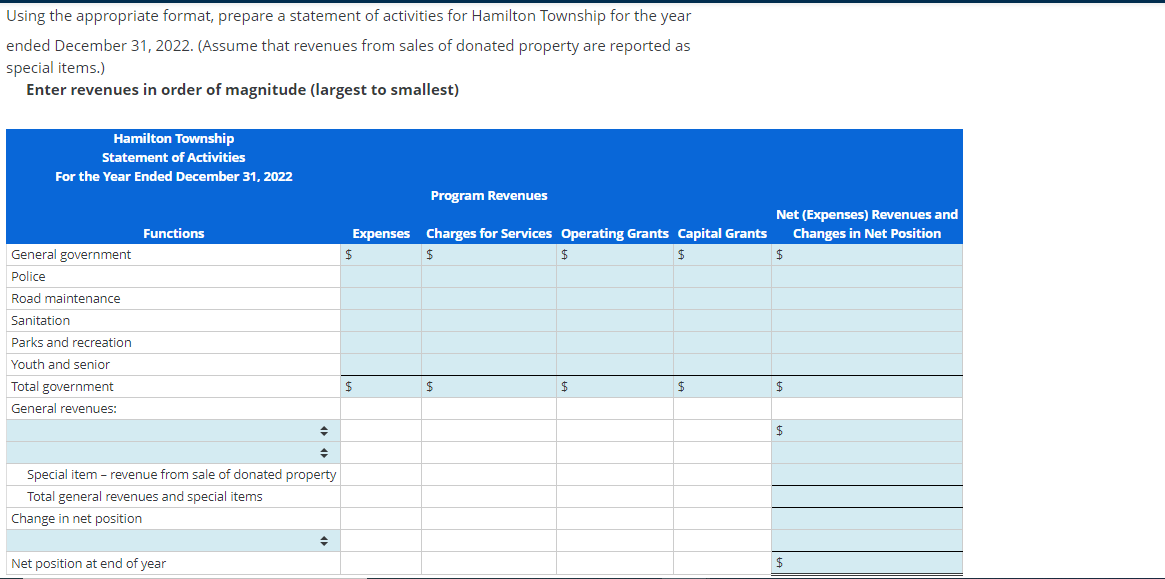

Preparation of government-wide statement of activities

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

- Benton County includes an independent school district and two individually chartered towns within the County. Benton County’s Treasurer assesses and collects property taxes on behalf of itself, the school district, and the towns. The County uses a tax collection custodial fund to record tax collections for the school district and towns. During the year ended December 31, 2024, the following transactions took place: The County levied taxes as follows: Benton County General Fund $23,700,000 School District 10,500,000 Towns 3,510,000 Total $37,710,000 The property taxes levied in part (a) were collected. The amounts collected were paid to the school district and towns. Required: a1. Record the transactions in the books of the Benton County Tax Agency Fund. a2. Record the transactions in the books of the Benton County General Fund. a3. Record the transactions in the books of the Benton County Independent School District General Fund.The following information is available for the preparation of the government-wide financial statements for the City of Northern Pines for the year ended June 30, 2020: Expenses: General government $ 12,060,000 Public safety 24,509,000 Public works 11,578,000 Health and sanitation 6,163,000 Culture and recreation 4,509,000 Interest on long-term debt, governmental type 739,000 Water and sewer system 10,977,000 Parking system 418,000 Revenues: Charges for services, general government 1,340,000 Charges for services, public safety 214,800 Operating grant, public safety 816,300 Charges for services, health and sanitation 2,409,000 Operating grant, health and sanitation 1,237,600 Charges for services, culture and recreation 2,248,100 Charges for services, water and sewer 11,852,000 Charges for services, parking system 396,700 Property taxes 27,719,800 Sales taxes…The following information is available for the preparation of the government-wide financial statements for the City of Northren Pines fot the year ended June 30,2020: Expenses: General government $11,960,000; Public Safety $23,900.000; Public Works $11,290,000 Health and sanitation $6,010,000, Culture and recreation $4,198,000; Interest on long term debt, governmental type $721,000; Water and Sewer system $10,710,000 Parking system $409,000 Revenues: Charges for service, general governemnt $1,510,000; Charges for services, public safety $210,000; Operating grant, public safety $798,000; Charges for services health and sanitation $2,335,000; Operating grant, health and sanitation $1,210,000; Charges for service, culture and recreation $1,998,000; Charges for services, water and sewer $11,588,000; Changes for services, parking system $388,000; Property Taxes $27,112,000; Sales Taxes $20,698,000 investment earnings, business-type $325,000; Special Item - gain on sale of unused land,…

- The following information pertains to the City of Williamson for 2020, its first year of legal existence. For convenience, assume that all transactions are for the general fund, which has three separate functions: general government, public safety, and health and sanitation. Receipts: Property taxes $320,000 Franchise taxes 42,000 Charges for general government services 5,000 Charges for public safety services 3,000 Charges for health and sanitation services 42,000 Issued long-term note payable 200,000 Receivables at end of year: Property taxes (90% estimated to be collectible) 90,000 Payments: Salary: General government 66,000 Public safety 39,000 Health and sanitation 22,000 Rent: General government 11,000 Public safety 18,000 Health and sanitation 3,000 Maintenance: General government 21,000 Public safety 5,000 Health and sanitation 9,000 Insurance: General government 8,000 Public safety ($2,000 still prepaid…Benton County includes an independent school district and two individually chartered towns within the County. Benton County’s Treasurer assesses and collects property taxes on behalf of itself, the school district, and the towns. The County uses a tax collection custodial fund to record tax collections for the school district and towns. During the year ended December 31, 2020, the following transactions took place:1. The County levied taxes as follows: Benton County General Fund $ 26,600,000 School District 14,100,000 Towns 4,100,000 Total $ 44,800,000 2. The property taxes levied in part (a) were collected.3. The amounts collected were paid to the school district and towns.Required:a. Prepare journal entries for Benton County and the Benton County Independent School District—identify the funds.The County includes an independent school district and two individually chartered towns within the County. The County’s Treasurer assesses and collects property taxes on behalf of itself, the school district, and the towns. The County uses a tax collection custodial fund to record tax collections for the school district and towns. During the year ended December 31, 2020, the following transactions took place:1. The County levied taxes as follows: County General Fund $27,000,000 School District 14,500,000 Towns 4,500,000 Total $46,000,000 2.The property taxes levied (in transaction #1) were collected. 3. The amounts collected were paid to the school district and towns.Required:Prepare journal entries to record the transactions for the County’s tax collection custodial fund. (If no entry is required for a transaction/event, state “No entry.”)

- Assume that the City of Coyote has produced its financial statements for December 31, 2020, and the year then ended. The city’s general fund was only used to monitor education and parks. Its capital projects funds worked in connection with each of these functions at times during the current year. The city also maintained an enterprise fund to account for its art museum. The government-wide financial statements provide the following figures: Education reports net expenses of $615,000. Parks reports net expenses of $102,000. Art museum reports net revenues of $51,000. General government revenues for the year were $894,000 with an overall increase in the city's net position of $228,000. The fund financial statements provide the following for the entire year: The general fund reports a $44,000 increase in its fund balance. The capital projects fund reports a $64,500 increase in its fund balance. The enterprise fund reports a $62,250 increase in its net position. The city asks the…Assume that the City of Coyote has produced its financial statements for December 31, 2020, and the year then ended. The city’s general fund was only used to monitor education and parks. Its capital projects funds worked in connection with each of these functions at times during the current year. The city also maintained an enterprise fund to account for its art museum. The government-wide financial statements provide the following figures: Education reports net expenses of $702,000. Parks reports net expenses of $144,000. Art museum reports net revenues of $50,250. General government revenues for the year were $966,750 with an overall increase in the city's net position of $171,000. The fund financial statements provide the following for the entire year: The general fund reports a $45,250 increase in its fund balance. The capital projects fund reports a $53,750 increase in its fund balance. The enterprise fund reports a $69,000 increase in its net position. The city asks the…The following information is available for the preperation of the Government- wide financial statements for the City of Southren Springs as of April 30, 2020: Cash and cash equivalents, governmental activities $480,000; Cash and cash equivalents, business- type activities $700,000; Receivables, Governemntal activities $450,000; Receivables, business-type activites $1,330,000; Inventories, business - type activities $520,000; Capitol assets, net governmental activities $12,500,000; Capitol Assets, net, business-type activities $7,200,000; Accounts payable, Governmental activites $650,000; Accounts payable, business - type activities $559,000; General obligation bonds, governmental activities $7,800,00; Revenue binds, business -type activities$3,210,000 Long term liability for compensated absences, governmental activities $359,000 From the preceeding information, prepare (in good form) a statement of Net Position for the City of Southern Springs as of April 30,2020. Assume that…

- Assume that the City of Coyote has produced its financial statements for December 31, 2020, and the year then ended. The city’s general fund was only used to monitor education and parks. Its capital projects funds worked in connection with each of these functions at times during the current year. The city also maintained an enterprise fund to account for its art museum. The government-wide financial statements provide the following figures: Education reports net expenses of $766,000. Parks reports net expenses of $163,000. Art museum reports net revenues of $58,250. General government revenues for the year were $1,069,750 with an overall increase in the city's net position of $199,000. The fund financial statements provide the following for the entire year: The general fund reports a $35,750 increase in its fund balance. The capital projects fund reports a $45,750 increase in its fund balance. The enterprise fund reports a $72,750 increase in its net position. The city asks…Assume that the City of Coyote has produced its financial statements for December 31, 2020, and the year then ended. The city’s general fund was only used to monitor education and parks. Its capital projects funds worked in connection with each of these functions at times during the current year. The city also maintained an enterprise fund to account for its art museum. The government-wide financial statements provide the following figures: Education reports net expenses of $766,000. Parks reports net expenses of $163,000. Art museum reports net revenues of $58,250. General government revenues for the year were $1,069,750 with an overall increase in the city's net position of $199,000. The fund financial statements provide the following for the entire year: The general fund reports a $35,750 increase in its fund balance. The capital projects fund reports a $45,750 increase in its fund balance. The enterprise fund reports a $72,750 increase in its net position. The city asks…Hi, I am in advanced accounting, and we are studying state and local governments. Can you help me create a balance sheet? The following unadjusted trial balance is for the governmental funds of the city of Copeland prepared from the current accounting records: Debit Credit Cash $19,000 taxes receivable 202,000 allowance for uncollectible taxes $2,000 vouchers payable 24,000 due to debt service fund 10,000 unavailable revenues 16,000 encumbrances outstanding 9,000 fund balance-unassigned…