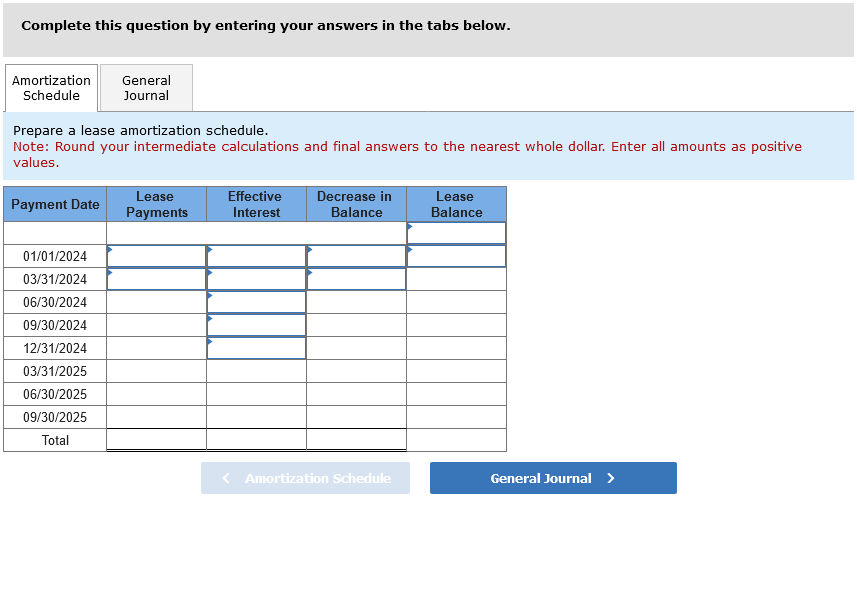

Prepare a lease amortization schedule and appropriate entries for Baillie Power from the beginning of the lease through December 31, 2024. December 31 is the fiscal year end for each company. Appropriate adjusting entries are recorded at the end of each quarter.

Baillie Power leased high-tech electronic equipment from Courtney Leasing on January 1, 2024. Courtney purchased the equipment from Doane Machines at a cost of $253,000, its fair value.

Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1)

Related Information: Lease term2years (8 quarterly periods)Quarterly lease payments$18,000on January 1, 2024, and on March 31, June 30, September 30, and December 31 thereafterEconomic life of asset5yearsInterest rate charged by the lessor8%

Required:

Prepare a lease amortization schedule and appropriate entries for Baillie Power from the beginning of the lease through December 31, 2024. December 31 is the fiscal year end for each company. Appropriate

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 3 images