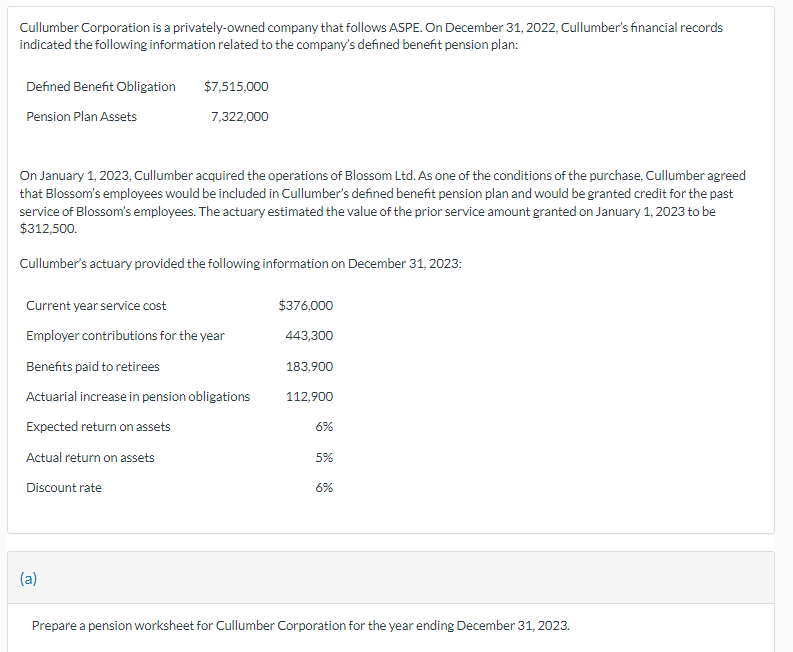

Prepare a pension worksheet for Cullumber Corporation for the year ending December 31, 2023.

Q: In its first month of operations, Sheridan Company made three purchases of merchandise in the…

A: To calculate the cost of ending inventory under the FIFO (First-In, First-Out) and LIFO (Last-In,…

Q: Required: a1. Compute the amount of goodwill recognized in Holland's acquisition of Zeeland. a2.…

A: a) Computation of goodwill and its allocation:DetailsAmountConsideration transferred by Holland ($8…

Q: m (years) rate of return (known by lessee) incremental borrowing rate e of lease asset Situation 2…

A: A right-of-use assets represents a lessee's right to use a leased asset over the lease term. It is…

Q: Question 8.1.25 The following information relates to the sale of a piece of land in the current…

A: Capital Gain Reserve is the reserve that can be utilized when you make a sale of capital property…

Q: Shadee Corporation expects to sell 580 sun shades in May and 400 in June. Each shade sells for $134.…

A: Budget is an estimate prepared by the company showing the income and expenses to be generated and…

Q: A company reports the following information for its direct labor. Actual hours of direct labor used…

A: Direct labor cost variance results due to differences in the actual cost paid for labor and the…

Q: Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care…

A: The objective of the question is to calculate the PPE Asset Appraised Values, the Ratio of…

Q: The Pearl Company issued $210,000 of 9% bonds on January 1, 2025. The bonds are due January 1, 2030,…

A: The bonds are issued to raise the money from the market or investors. The bonds are reported as the…

Q: Hi-Tek Manufacturing, Incorporated, makes two industrial component parts-B300 and T500. An…

A: Product margin, also known as gross margin or gross profit margin, is a financial metric used to…

Q: beginning of the year. If Gordon leaves the employer mid-year, what happens to the $500 employer…

A: Employer contributions to an employee's HSA under an HSA/HDHP (Health Savings Account/High…

Q: Variable and Absorption CostingChandler Company sells its product for $108 per unit. Variable…

A: Part 1: Answer:Using variable costing, Chandler Company's net income would be…

Q: The total costs transferred to Finished Goods for units started and completed were

A: FIFO METHOD:— Under this method, equivalent units are calculated by adding equivalent units in…

Q: Exercise 20-17 (Algo) Preparation of cash budgets (for Kayak Company budgeted the following cash…

A: The cash budget is prepared to record the cash receipts and cash disbursements during the period.…

Q: Alyssum, Inc., a merchandising company, has provided the following extracts from their budget for…

A: The cash budget is part of the master budget and it shows estimated; cash inflow and cash outflow…

Q: a. Prepare all journal entries, including December 31 adjusting entries, to record the foreign…

A: Forward Exchange Contact :Simply, forward exchange contract is entered into by two parties to buy or…

Q: Madeline Monteith is a Staff Sergeant in the U.S. Marine Corps. In March of 2023, her duty station…

A: The persons working in army are provided moving tax deductions and they can deduct the expenses…

Q: please double underline need answer for all or skip answer with explanation , computation for each…

A: Variable overhead efficiency variance :Variable overhead efficiency variance is the difference…

Q: The following facts relate to Wildhorse Corporation. 1. Deferred tax liability, January 1, 2025,…

A: A corporation can use a Deferred Tax Asset (DTA) to lower its future income tax obligations by…

Q: [The following information applies to the questions displayed below.] At December 31, Hawke Company…

A: Required blance in allowance account at year end = Balance in accounts receivables *%…

Q: [The following information applies to the questions displayed below.] Following are transactions of…

A: Notes indicate a written consent of the customer which contains the detailed statement of the…

Q: Required information [The following information applies to the questi In its first month of…

A: FIFO stands for First in First out. Using FIFO, the older units are sold out and newer units are…

Q: Alternative Inventory Methods Garrett Company has the following transactions during the months of…

A: Inventory includes all the items, merchandise, and raw materials that are used by the business…

Q: The employees of Ethereal Bank are paid on a semimonthly basis. All employees are single. Required:…

A: FICA taxes are deducted from each paycheck of employees, with equivalent contributions from the…

Q: Beckenworth had cost of goods sold of $10,921 million, ending inventory of $3,589 million, and…

A: Days sales in inventory is calculated by dividing the number of days in a year by inventory…

Q: Shadee Corporation expects to sell 560 sun shades in May and 320 in June. Each shade sells for $163.…

A: A Purchase Budget is a financial plan that plans the amount of goods that a company needs to…

Q: Bergo Bay's accounting system generated the following account balances on December 31. The company's…

A: The written documents known as financial statements provide information about a company's finances.…

Q: What amount will Andrew debit to Work in Process Inventory for the month of March?

A: The inventory that is sold or distributed and that has been purchased as finished goods or requires…

Q: A company's gross profit (or gross margin) was $73,920 and its net sales were $352, 000. Its gross…

A: Gross margin ratio is the ratio between gross margin and net sales revenue. It is calculated by…

Q: Bergo Bay's accounting system generated the following account balances on December 31. The company's…

A: Solution:-The query concerns financial accounting and centers on Bergo Bay Company's accounting…

Q: Mrs. Shine was registered in Jamaica as a sole trader in 2015. To grow her practice Mrs. Shine…

A: The objective of the question is to calculate the adjusted profit or loss for the partnership of…

Q: Required information [The following information applies to the questions displayed below.) Fausett…

A: Earnings per share: Measures a company's profitability per share of outstanding stock. It is…

Q: equipment $ 6,350 oints Office supplies expense Fit-for-Life Foods reports the following income…

A: The objective of the question is to prepare a multiple-step income statement for Fit-for-Life Foods…

Q: Assets Cash and equivalents Accounts receivable Inventories Total current assets Net plant and…

A: Shareholder's EquityThe amount available for the shareholders in the company is called shareholder's…

Q: Periodic Inventory by Three Methods; Cost of Merchandise Sold The units of an item available for…

A: FIFO method is one of the methods of inventory valuation in which it is assumed that old purchases…

Q: ! Required information Problem 8-71 (LO 8-4) (Algo) [The following information applies to the…

A: The Internal Revenue Service (IRS) offers the Child and Dependent Care Credit as a tax credit to…

Q: The company purchased a piece of Equipment on 12/1/2023 for use in its business operations. The…

A: The loan is taken by the entity when it needs money. The entity can take a loan which can be repaid…

Q: Required: 1. Prepare a summary journal entry to record the monthly bad debt accrual and the…

A: Accounts receivables:The accounts receivables refer to the account that is open when the sales are…

Q: Calculate the operating and cash cycles.

A: The operating cycle measures the time it takes for a company to convert its inventory into cash…

Q: Here is Pharoah Company's portfolio of long-term stock investments at December 31, 2021, the end of…

A: Solution:-The query pertains to creating an adjusted journal entry for a company's investment…

Q: Allocate the service department costs using the reciprocal method. (Matrix algebra is not required…

A: Reciprocal method of cost allocation:The reciprocal method, also known as the algebraic method, is a…

Q: Determine the following at December 31, 2024:

A: Balance Sheet -Balance Sheet includes Assets, Liabilities and Stockholder's Equity.Assets include…

Q: 1.Tyler and Candice are married and file a joint tax return. They have adjusted gross income of…

A: Social security benefits as the name suggests are the benefits provided by the government for…

Q: Windhoek Mines, Limited, of Namibia, is contemplating the purchase of equipment to exploit a mineral…

A: Net Present Value (NPV) is a financial metric used to evaluate the profitability of an investment or…

Q: Sales Mix and Break-Even Sales Home Run Sports Inc. manufactures and sells two products, baseball…

A: Break even point (BEP): Breakeven is the point where total expenses are equal to total revenue. at…

Q: Required: On January 3, 2024, Matteson Corporation acquired 40 percent of the outstanding common…

A: Under the equity method of accounting for investments, the investor (Matteson Corporation, in this…

Q: On October 1, 2023, Corporation 1 issued a $100,000 note payable to Corporation 2. The note carries…

A: Note receivable refers to a written promise for the amounts to be received within a stipulated…

Q: If the market rate of interest is 10%, a $10,000, 12%, 10-year bond that pays interest semiannually…

A: Bonds give the issuer of the bond to collect necessary funds by selling the bonds in the market. The…

Q: These six documents must be processed to bring the accounting records up to date. Materials…

A: If applied overhead is less than actual overhead, called as underapplied overhead.If applied…

Q: What advice can you give that is unique to the self-employed individual (vice W-2 employee)?

A: The first thing to understand is that self-employed individuals and W-2 employees have different tax…

Q: A condensed income statement by product line for Crown Beverage Inc. indicated the following for…

A: Differential analysis is a decision-making method that examines the net effects of two options by…

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

- Cullumber Corporation is a privately-owned company that follows ASPE. On December 31, 2022, Cullumber's financial records indicated the following information related to the company's defined benefit pension plan: Defined Benefit Obligation $7,612,000 Pension Plan Assets 7,266,000 On January 1, 2023, Cullumber acquired the operations of Ivanhoe Ltd. As one of the conditions of the purchase, Cullumber agreed that Ivanhoe's employees would be ingluded in Cullumber's defined benefit pension plan and would be granted credit for the past service of Ivanhoe's employees. The actuary estimated the value of the prior service amount granted on January 1, 2023 to be $332,000. Cullumber's actuary provided the following information on December 31, 2023: Current year service cost Employer contributions for the year Benefits paid to retirees Actuarial increase in pension obligations Expected return on assets Actual return on assets Discount rate O L $379,500 441.200 181.200 119,600 6% 5% 6% prepare a…Bonita Company received the following selected information from its pension plan trustee concerning the operation of the company’s defined benefit pension plan for the year ended December 31, 2020. January 1, 2020 December 31, 2020 Projected benefit obligation $1,499,000 $1,527,000 Market-related and fair value of plan assets 802,000 1,127,200 Accumulated benefit obligation 1,622,000 1,742,500 Accumulated OCI (G/L)—Net gain 0 (199,900 ) The service cost component of pension expense for employee services rendered in the current year amounted to $78,000 and the amortization of prior service cost was $120,500. The company’s actual funding (contributions) of the plan in 2020 amounted to $245,000. The expected return on plan assets and the actual rate were both 10%; the interest/discount (settlement) rate was 10%. Accumulated other comprehensive income (PSC) had a balance of $1,205,000 on January 1, 2020. Assume no benefits paid in 2020.…Crane Company received the following selected information from its pension plan trustee concerning the operation of the company’s defined benefit pension plan for the year ended December 31, 2020. January 1, 2020 December 31, 2020 Projected benefit obligation $1,499,000 $1,527,000 Market-related and fair value of plan assets 802,000 1,127,200 Accumulated benefit obligation 1,622,000 1,742,500 Accumulated OCI (G/L)—Net gain 0 (199,900 ) The service cost component of pension expense for employee services rendered in the current year amounted to $78,000 and the amortization of prior service cost was $120,500. The company’s actual funding (contributions) of the plan in 2020 amounted to $245,000. The expected return on plan assets and the actual rate were both 10%; the interest/discount (settlement) rate was 10%. Accumulated other comprehensive income (PSC) had a balance of $1,205,000 on January 1, 2020. Assume no benefits paid in 2020.…

- Crane Company received the following selected information from its pension plan trustee concerning the operation of the company’s defined benefit pension plan for the year ended December 31, 2020. January 1, 2020 December 31, 2020 Projected benefit obligation $1,499,000 $1,527,000 Market-related and fair value of plan assets 802,000 1,127,200 Accumulated benefit obligation 1,622,000 1,742,500 Accumulated OCI (G/L)—Net gain 0 (199,900 ) The service cost component of pension expense for employee services rendered in the current year amounted to $78,000 and the amortization of prior service cost was $120,500. The company’s actual funding (contributions) of the plan in 2020 amounted to $245,000. The expected return on plan assets and the actual rate were both 10%; the interest/discount (settlement) rate was 10%. Accumulated other comprehensive income (PSC) had a balance of $1,205,000 on January 1, 2020. Assume no benefits paid in 2020.…Crane Company received the following selected information from its pension plan trustee concerning the operation of the company’s defined benefit pension plan for the year ended December 31, 2020. January 1, 2020 December 31, 2020 Projected benefit obligation $1,499,000 $1,527,000 Market-related and fair value of plan assets 802,000 1,127,200 Accumulated benefit obligation 1,622,000 1,742,500 Accumulated OCI (G/L)—Net gain 0 (199,900 ) The service cost component of pension expense for employee services rendered in the current year amounted to $78,000 and the amortization of prior service cost was $120,500. The company’s actual funding (contributions) of the plan in 2020 amounted to $245,000. The expected return on plan assets and the actual rate were both 10%; the interest/discount (settlement) rate was 10%. Accumulated other comprehensive income (PSC) had a balance of $1,205,000 on January 1, 2020. Assume no benefits paid in 2020. (c)…Crane Company received the following selected information from its pension plan trustee concerning the operation of the company’s defined benefit pension plan for the year ended December 31, 2020. January 1, 2020 December 31, 2020 Projected benefit obligation $1,499,000 $1,527,000 Market-related and fair value of plan assets 802,000 1,127,200 Accumulated benefit obligation 1,622,000 1,742,500 Accumulated OCI (G/L)—Net gain 0 (199,900 ) The service cost component of pension expense for employee services rendered in the current year amounted to $78,000 and the amortization of prior service cost was $120,500. The company’s actual funding (contributions) of the plan in 2020 amounted to $245,000. The expected return on plan assets and the actual rate were both 10%; the interest/discount (settlement) rate was 10%. Accumulated other comprehensive income (PSC) had a balance of $1,205,000 on January 1, 2020. Assume no benefits paid in 2020.…

- Crane Company received the following selected information from its pension plan trustee concerning the operation of the company’s defined benefit pension plan for the year ended December 31, 2020. January 1, 2020 December 31, 2020 Projected benefit obligation $1,499,000 $1,527,000 Market-related and fair value of plan assets 802,000 1,127,200 Accumulated benefit obligation 1,622,000 1,742,500 Accumulated OCI (G/L)—Net gain 0 (199,900 ) The service cost component of pension expense for employee services rendered in the current year amounted to $78,000 and the amortization of prior service cost was $120,500. The company’s actual funding (contributions) of the plan in 2020 amounted to $245,000. The expected return on plan assets and the actual rate were both 10%; the interest/discount (settlement) rate was 10%. Accumulated other comprehensive income (PSC) had a balance of $1,205,000 on January 1, 2020. Assume no benefits paid in 2020.…Wildhorse, Inc. received the following information from its pension plan trustee concerning the operation of the company's defined-benefit pension plan for the year ended December 31, 2021: January 1, 2021 December 31, 2021 Projected benefit obligation $2,480,000 $2,790,000 Fair value of plan assets 1,150,000 1,460,000 Accumulated benefit obligation 1,921,000 2,611,000 Accumulated OCI―(PSC) 532,000 296,000 The service cost component for 2021 is $137,500 and the amortization of prior service cost is $236,000. The company's actual funding of the plan in 2021 amounted to $500,000. The expected return on plan assets and the settlement rate were both 9%. (a) Determine the pension expense to be reported in 2021. Pension expense $ Save for Later (b) The parts of this question must be completed in order. This part will be available when you complete the part above.Pumpkin Ltd. received the following information from its pension plan trustee concerning their defined benefit pension plan for the year ended December 31, 2023 January 1, 2023 December 31, 2023 Defined benefit obligation $3,500,000 $3,990,000 Fair value of plan assets 1,750,000 1,882,000 For 2023, the service cost is $210,000 and past service cost (effective Jan. 1) is $100,000. During 2023, Pumpkin contributed $595,000 to the plan. The discount rate is 8%. Pumpkin uses IFRS. Instructions Prepare the journal entries to record the defined benefit expense and the employer’s contribution for 2023. IFRS

- Pumpkin Ltd. received the following information from its pension plan trustee concerning their defined benefit pension plan for the year ended December 31, 2023 January 1, 2023 December 31, 2023 Defined benefit obligation $3,500,000 $3,990,000 Fair value of plan assets 1,750,000 1,882,000 For 2023, the service cost is $210,000 and past service cost (effective Jan. 1) is $100,000. During 2023, Pumpkin contributed $595,000 to the plan. The discount rate is 8%. Pumpkin uses IFRS. a)Calculate the defined benefit expense to be reported in 2023. b) Prepare the journal entries to record the defined benefit expense and the employer’s contribution for 2023.On January 1, 2020, GALANTY Company granted XYZ, its president 20,000 share appreciation rights for past services. These rights are exercisable immediately and expire on January 1, 2022. During exercise, XYZ is entitled to receive cash for the excess of the share market price on the exercise date over the market price on the grant date. XYZ did not exercise any of the rights during 2020. The market price of GALANTY’s share was P30 on January 1, 2020 and P45 on December 31, 2020. As a result of the share appreciation rights, GALANTY should recognize compensation expense for 2020 of?a. 0b. 100,000c. 300,000d. 600,000e. answer not givenBB Inc. received the following information from its pension plan trustee concerning the operation of the company's defined-benefit pension plan for the year ended December 31, 2020. 1/1/20 12/31/20 Defined benefit obligation P11,400,000 P11,760,000 Pension assets (at fair value) 6,000,000 6,900,000 Net (gains) and losses 0 240,000 The service cost component of pension expense for 2020 is P840,000 and the past service cost due to an increase in benefits is P180,000 effective January 1, 2020. The discount rate is 10%. What is the amount of pension expense for 2020?