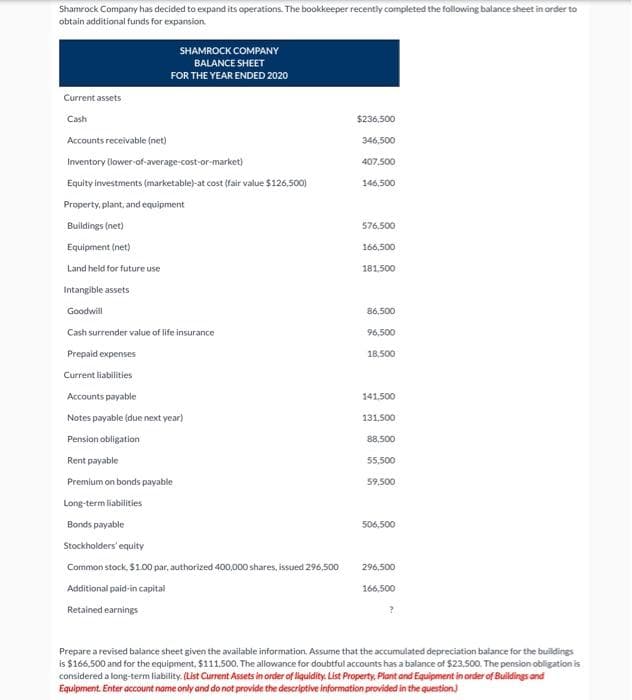

Prepare a revised balance sheet given the available information, Assume that the accumulated depreciation balance for the buildings is $166,500 and for the equipment, $111.500. The allowance for doubtful accounts has a balance of $23.500. The pension obligation is considered a long-term liability. (List Current Assets in order of liquidity. List Property, Plant and Equipment in order of Buildings and Equipment. Enter account name only and do not provide the descriptive information provided in the question)

Prepare a revised balance sheet given the available information, Assume that the accumulated depreciation balance for the buildings is $166,500 and for the equipment, $111.500. The allowance for doubtful accounts has a balance of $23.500. The pension obligation is considered a long-term liability. (List Current Assets in order of liquidity. List Property, Plant and Equipment in order of Buildings and Equipment. Enter account name only and do not provide the descriptive information provided in the question)

Fundamentals Of Financial Management, Concise Edition (mindtap Course List)

10th Edition

ISBN:9781337902571

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter16: Financial Planning And Forecasting

Section: Chapter Questions

Problem 8P: LONG-TERM FINANCING NEEDED At year-end 2019, total assets for Arrington Inc. were 1.8 million and...

Related questions

Question

Transcribed Image Text:Shamrock Company has decided to expand its operations. The bookkeeper recently completed the following balance sheet in order to

obtain additional funds for expansion.

SHAMROCK COMPANY

BALANCE SHEET

FOR THE YEAR ENDED 2020

Current assets

Cash

$236,500

Accounts receivable (net)

346,500

Inventory (lower-of-average-cost-or-market)

407,500

Equity investments (marketable)-at cost (fair value $126,500)

146,500

Property, plant, and equipment

Buildings (net)

576,500

Equipment (net)

166,500

Land held for future use

181.500

Intangible assets

Goodwill

86,500

Cash surrender value of life insurance

96,500

Prepaid expenses

18,500

Current liabilities

Accounts payable

141.500

Notes payable (due next year)

131,500

Pension obligation

88,500

Rent payable

55,500

Premium on bonds payable

59,500

Long-term liabilities

Bonds payable

506,500

Stockholders' equity

Common stock, $1.0 par, authorized 400,000 shares, issued 296,500

296,500

Additional paid-in capital

166,500

Retained earnings

Prepare a revised balance sheet given the available information. Assume that the accumulated depreciation balance for the buildings

is $166,500 and for the equipment, $111.500. The allowance for doubtful accounts has a balance of $23.500. The pension obligation is

considered a long-term liability. (List Current Assets in order of liquidity. List Property, Plant and Equipment in order of Buildings and

Equipment. Enter account name only and do not provide the descriptive information provided in the question)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning