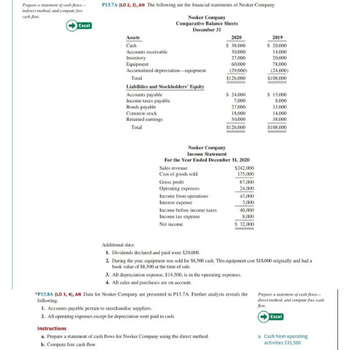

Prepare a statement of cash f indirect mehed, and compade free Excel P13.7A (LO 2, 3), AN The following are the financial statements of Nosker Company, Nosker Company Comparative Balance Sheets December 31 Assets Cash Accounts receivable Inventory Equipment Accumulated depreciation equipment Total Liabilities and Stockholders' Equity Accounts payable Income taxes payable Bonds payable Common stock Retained earnings Total Sales revenue Cost of goods sold Gross profit Operating expenses Income from operations Interest expense Income before income taxes Income tax expense Net income 2020 5 38.000 30,000 27,000 60,000 $126,000 Nosker Company Income Statement For the Year Ended December 31, 2020 $242,000 $ 24,000 7,000 27,000 18,000 50,000 $126,000 Instructions a. Prepare a statement of cash flows for Nosker Company using the direct method. b. Compute free cash flow. 175,000 67,000 24,000 43,000 3,000 40,000 8,000 $ 32,000 3. All depreciation expense, $14,500, is in the operating expenses. 4. All sales and purchases are on account *P13.8A (LO 3, 4), AN Data for Nosker Company are presented in P13.7A. Further analysis reveals the following. 1. Accounts payable pertain to merchandise suppliers. 2. All operating expenses except for depreciation were paid in cash 2019 $ 20,000 14,000 20,000 78,000 (24,000) $108,000 Additional data: 1. Dividends declared and paid were $20,000. 2. During the year, equipment was sold for $8.500 cash. This equipment cost $18.000 originally and had a book value of $8,500 at the time of sale. $ 15,000 8,000 $108.000 Prepare a statement of cash firs direct method, and compute free cas Excel a. Cash from operating activities $31,500

Prepare a statement of cash f indirect mehed, and compade free Excel P13.7A (LO 2, 3), AN The following are the financial statements of Nosker Company, Nosker Company Comparative Balance Sheets December 31 Assets Cash Accounts receivable Inventory Equipment Accumulated depreciation equipment Total Liabilities and Stockholders' Equity Accounts payable Income taxes payable Bonds payable Common stock Retained earnings Total Sales revenue Cost of goods sold Gross profit Operating expenses Income from operations Interest expense Income before income taxes Income tax expense Net income 2020 5 38.000 30,000 27,000 60,000 $126,000 Nosker Company Income Statement For the Year Ended December 31, 2020 $242,000 $ 24,000 7,000 27,000 18,000 50,000 $126,000 Instructions a. Prepare a statement of cash flows for Nosker Company using the direct method. b. Compute free cash flow. 175,000 67,000 24,000 43,000 3,000 40,000 8,000 $ 32,000 3. All depreciation expense, $14,500, is in the operating expenses. 4. All sales and purchases are on account *P13.8A (LO 3, 4), AN Data for Nosker Company are presented in P13.7A. Further analysis reveals the following. 1. Accounts payable pertain to merchandise suppliers. 2. All operating expenses except for depreciation were paid in cash 2019 $ 20,000 14,000 20,000 78,000 (24,000) $108,000 Additional data: 1. Dividends declared and paid were $20,000. 2. During the year, equipment was sold for $8.500 cash. This equipment cost $18.000 originally and had a book value of $8,500 at the time of sale. $ 15,000 8,000 $108.000 Prepare a statement of cash firs direct method, and compute free cas Excel a. Cash from operating activities $31,500

Oh no! Our experts couldn't answer your question.

Don't worry! We won't leave you hanging. Plus, we're giving you back one question for the inconvenience.

Submit your question and receive a step-by-step explanation from our experts in as fast as 30 minutes.

You have no more questions left.

Message from our expert:

Our experts need more information to provide you with a solution. <add additional info if available. clear image. Please resubmit your question, making sure it's detailed and complete. We've credited a question to your account.

Your Question:

Transcribed Image Text:Prepare a statement of cash f

indirect mehed, and compade free

Excel

P13.7A (LO 2, 3), AN The following are the financial statements of Nosker Company,

Nosker Company

Comparative Balance Sheets

December 31

Assets

Cash

Accounts receivable

Inventory

Equipment

Accumulated depreciation equipment

Total

Liabilities and Stockholders' Equity

Accounts payable

Income taxes payable

Bonds payable

Common stock

Retained earnings

Total

Sales revenue

Cost of goods sold

Gross profit

Operating expenses

Income from operations

Interest expense

Income before income taxes

Income tax expense

Net income

2020

5 38.000

30,000

27,000

60,000

$126,000

Nosker Company

Income Statement

For the Year Ended December 31, 2020

$242,000

$ 24,000

7,000

27,000

18,000

50,000

$126,000

Instructions

a. Prepare a statement of cash flows for Nosker Company using the direct method.

b. Compute free cash flow.

175,000

67,000

24,000

43,000

3,000

40,000

8,000

$ 32,000

3. All depreciation expense, $14,500, is in the operating expenses.

4. All sales and purchases are on account

*P13.8A (LO 3, 4), AN Data for Nosker Company are presented in P13.7A. Further analysis reveals the

following.

1. Accounts payable pertain to merchandise suppliers.

2. All operating expenses except for depreciation were paid in cash

2019

$ 20,000

14,000

20,000

78,000

(24,000)

$108,000

Additional data:

1. Dividends declared and paid were $20,000.

2. During the year, equipment was sold for $8.500 cash. This equipment cost $18.000 originally and had a

book value of $8,500 at the time of sale.

$ 15,000

8,000

$108.000

Prepare a statement of cash firs

direct method, and compute free cas

Excel

a. Cash from operating

activities $31,500

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning