Prepare a statement of cash flows, using the indirect method of presenting cash flows from operating activities. Use the minus sign to indicate cash outflows, cash payments, decreases in cash, or any negative adjustments.

Prepare a statement of cash flows, using the indirect method of presenting cash flows from operating activities. Use the minus sign to indicate cash outflows, cash payments, decreases in cash, or any negative adjustments.

Financial And Managerial Accounting

15th Edition

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:WARREN, Carl S.

Chapter13: Statement Of Cash Flows

Section: Chapter Questions

Problem 3PA: Statement of cash flowsindirect method The comparative balance sheet of Whitman Co. at December 31,...

Related questions

Question

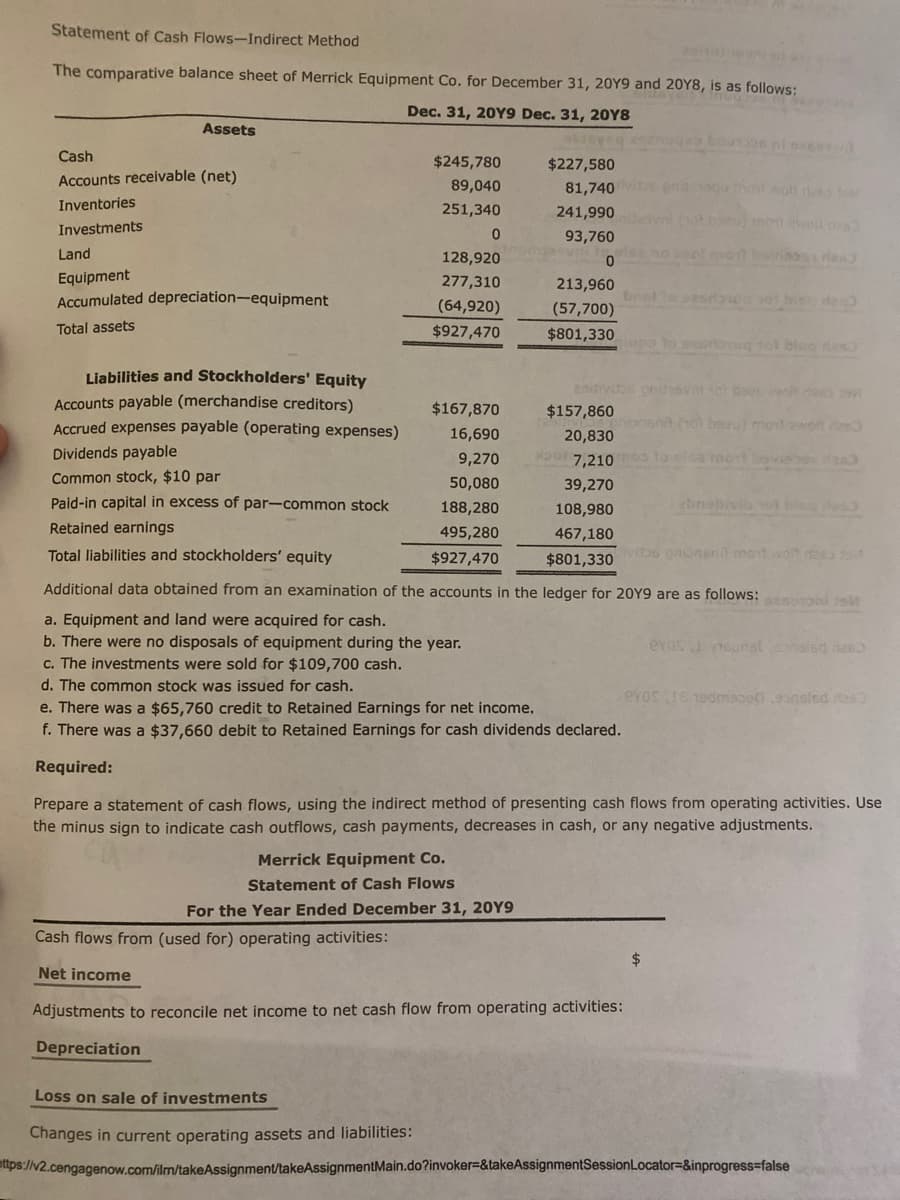

Transcribed Image Text:Statement of Cash Flows-Indirect Method

The comparative balance sheet of Merrick Equipment Co. for December 31, 20Y9 and 208, is as follows:

Dec. 31, 20Y9 Dec. 31, 20Y8

Assets

bour

Cash

$245,780

$227,580

Accounts receivable (net)

89,040

wolt es to

81,740

Inventories

251,340

241,990

woll e

Investments

93,760

Land

128,920

rlan

Equipment

Accumulated depreciation-equipment

277,310

213,960

wa vot bi ste

(64,920)

(57,700)

Total assets

$927,470

$801,330

sot blo das

Liabilities and Stockholders' Equity

29divitos onuasvnt dee te

Accounts payable (merchandise creditors)

Accrued expenses payable (operating expenses)

$167,870

$157,860

16,690

20,830

Dividends payable

9,270

p7,210

Common stock, $10 par

50,080

39,270

Paid-in capital in excess of par-common stock

188,280

108,980

ebnabivib o bls ed

Retained earnings

495,280

467,180

Total liabilities and stockholders' equity

$927,470

$801,330

vibs paoneril mont wot eo fo

Additional data obtained from an examination of the accounts in the ledger for 20Y9 are as follows: i

a. Equipment and land were acquired for cash.

b. There were no disposals of equipment during the year.

c. The investments were sold for $109,700 cash.

evas eunstonalsd nee

d. The common stock was issued for cash.

eYos 18 19dmsoodansled tes

e. There was a $65,760 credit to Retained Earnings for net income.

f. There was a $37,660 debit to Retained Earnings for cash dividends declared.

Required:

Prepare a statement of cash flows, using the indirect method of presenting cash flows from operating activities. Use

the minus sign to indicate cash outflows, cash payments, decreases in cash, or any negative adjustments.

Merrick Equipment Co.

Statement of Cash Flows

For the Year Ended December 31, 20Y9

Cash flows from (used for) operating activities:

$

Net income

Adjustments to reconcile net income to net cash flow from operating activities:

Depreciation

Loss on sale of investments

Changes in current operating assets and liabilities:

attps://v2.cengagenow.com/ilm/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress=false

Transcribed Image Text:CengageNO

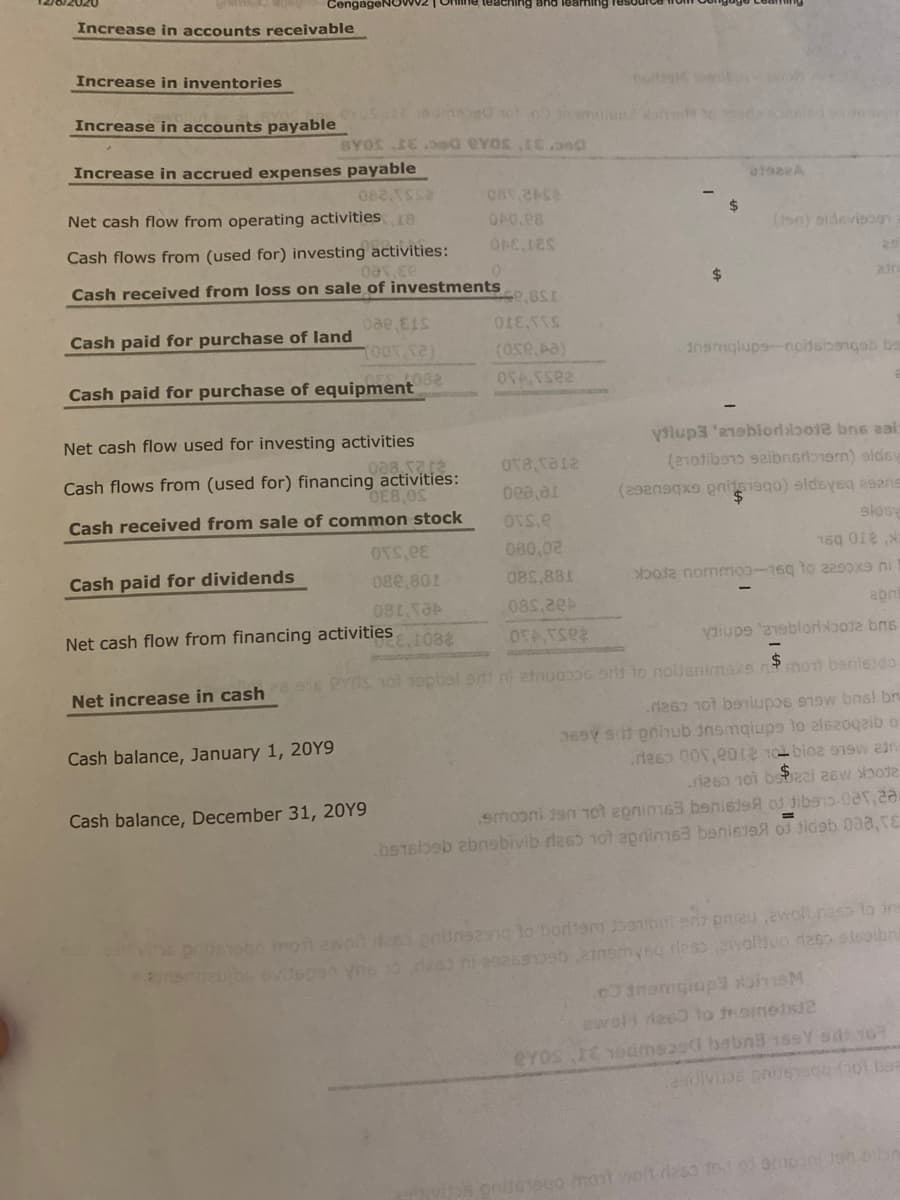

Increase in accounts receivable

Increase in inventories

Increase in accounts pavable nd

BYOS E d eYos ,tEa

Increase in accrued expenses payable

Net cash flow from operating activities 18

24

(t0) sidevisog

OP0.88

Cash flows from (used for) investing activities:

3se0

Cash received from loss on sale of investments

%$4

air

Cash paid for purchase of land

Insmglups-noltsbangab be

(ed'aso)

082

Cash paid for purchase of equipment

Net cash flow used for investing activities

ylupa 'aneblordalboie bne aai

(210tibono salibnisoern) sldsy

Cash flows from (used for) financing activities:

OE8,0S

Cash received from sale of common stock

(29enagx9 pnits1sqo) eldsyeq asens

$4

sldsy

080,02

Cash paid for dividends

08e,801

088,881

bota normmo-16g to 2290x9 ni

08S,22

Net cash flow from financing activities

Vaiupe 2sblorlbot2 bns

6 PYOS 10l 1opbal s ni etnuop6 ard to nojenimaxs n mor baniesdo

Net increase in cash

.r26 1ot baniupos e19w bnsl bru

169Y si pniub insmqiups to alszogaib o

.deso 00,e012 1 bioz s1sw an

Cash balance, January 1, 20Y9

Cash balance, December 31, 20Y9

smoɔni jan 10t epnims3 benisisA of Jibs15-0a5,2a

bstsloob abnsbivib rlass 1ot epriims3 benis o idab 03a,te

PDETOO mol 2won des onns2ng lo bordtem Jbanont enz pnieu,wol raso to ire

ewoli de60 lo trometsie

eYos e 1odms20 bebn 15SY sd 1o

e00 mont wolt deso to o omooni ton sbn

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning