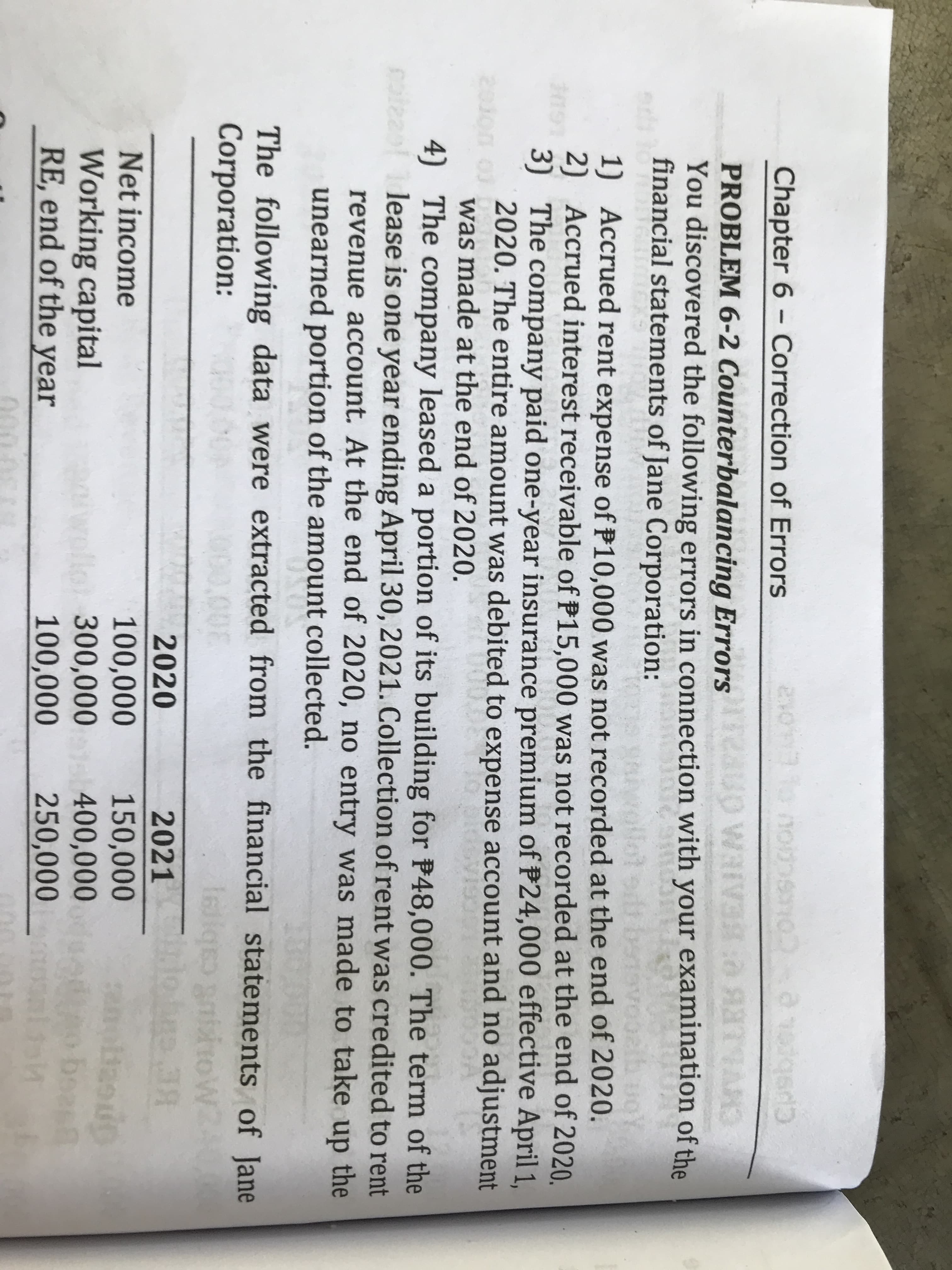

Prepare adjusting entries assuming errors were discovered in (a) 2020, (b) 2021, and (c) 2022.

Q: Problem #2: AMA cooperative store had the following activities for year ended 2021: gross sales…

A: Formula: Gross profit = Net sales - cost of goods sold

Q: Prepare a Flexible budget for overheads on the basis of the following data. Ascertain the overhead…

A: In budgetary control, various budgets are prepared namely, purchase budget, sales budget, cash…

Q: 1. Describe the meaning of Contribution Margin ratio. 2.Explain the relationship between…

A: Solution Formula used Total variable cost =$8+7+2…

Q: From page 10-3 of the VLN, when the company sells 100 shares of the treasury stock for $11 per…

A: When the company sells 100 shares of treasury stock at $11 per share which were purchased at The $12…

Q: Salaries and wages payable $1,700 Notes payable (long-term) $1,700 Salaries and wages expense 51,800…

A: GIVEN Salaries and wages payable$1,700 Salaries and wages expense$1800 Utilities expense$22500…

Q: The following information was available for Shekinahs business as at 31st December, 2018 Balances…

A: Debtors Control Ledger Account In the debtors ledger control account which provides the details of…

Q: Compute the (1) direct labor rate variance and (2) direct labor efficiency variance. (Inc favorable…

A: Standard hours are given for 1 unit produced. It's converted to Standard hours for actual production…

Q: On November 1, Kotler Company accepted a 3-month note receivable as payment for services provided to…

A: From November 1 to December 31 = 2 months Interest accrued on December 31 = $9,000 x 6% x 2/12 = $90…

Q: Assets = Liabilities + (Owner, Capital - Owner, Withdrawal + Revenues - Expenses) 2. What is a…

A: The question is related to Basic of Accounting and details are given. Since you have posted a…

Q: From the practice on page 10-4 of the VLN, how many of shares of common stock were issued?_____

A: Common stock: Common stock is a part of the total stock held by a corporation which are divided into…

Q: A company produces two (2) products, “ore” and “tin”. The following sales forecast for both products…

A: Sales budget and Production budget are two types of budget, under which sales and production can be…

Q: On January 1, 20x1, the partners of ABC Co. decided to liquidate their partnership. The following…

A: Realisation A/c Particulars Amount Particulars Amount To Accounts receivable P240,000 By…

Q: On October 1, 2021, Home Company issued to Security Bank a P6,000,000, 8-month, noninterest-bearing…

A: Bonds- The note/bond issuer offers collateral as security in this type of transaction. Such…

Q: 1. Cash balance according to the company's records at August 31, $25,520. 2. Cash balance according…

A: Introduction: Bank Reconciliation statement: To reconcile the difference between bank book and cash…

Q: A machine has a first cost of P97,198.62 and has an expected salvage value after 10 years…

A: Introduction: Depreciation: Decreasing value of fixed assets over its useful life period called as…

Q: Internal control is designed, implemented, and maintained to address identified business risks that…

A: The bank reconciliation or BRS is an important control tool for preventing and detecting…

Q: ot less than seven sentences, answer the following questions below: s an auditor, what do you think…

A: 1. While ascertaining audit procedures for PPE we need to test multiple audit results, valuation…

Q: Mr. J, Capital Office Equipment Accounts Payable 85 000.00 Notes Receivable 12 000.00 Notes Payable…

A: Formula: Net income = Total revenues - Total Expenses

Q: A primary objective of international financial accounting standards is to equip a company with…

A: Accounting standards refers to the set of rules, principles or the standards which are used for…

Q: What is a Balance Sheet and why is it important in a business?

A: Balance Sheet is a financial statements prepared for assessing the financial position of a company.…

Q: Required: a. Prepare a Schedule of Expected Cash Collections for November and December b. Prepare a…

A: Answer:

Q: The adjusted trial balance of Carla Vista Company for the year ended December 31, 2022, is as…

A: Multiple income statement is prepared to segregate the income and expenses into different…

Q: 22. Hot Mama's has prepared its fourth quarter budget and provided the following data: Oct Nov Dec…

A: Cash collections for October: $52,000 Purchases of direct materials: $35,000 Operating expenses:…

Q: nancial difficulties has negotiated a restructuring of its 10%, P10,000,000 note payable due on…

A: Interest expense refers to the costs incurred by a borrower while it tried to borrow funds or money…

Q: A plant asset was purchased for P19,000 on January 1, 2011 with a resio n 2014, the total useful…

A: Calculation of depreciation :- Some of Year Method = n(n+1)/2 Where n = number of years So SYD =…

Q: e books of K. Mullings, a trader, via th cord the daily transactions via the bod of May 2010

A: Closing Stock = Opening Stock + Purchases - Sales. By using the above formula we are going to…

Q: Erika Company makes 70,000 units per year of a part it uses in the products it manufactures. The…

A: Every business organization aims is to earn maximum profit, In the competitive environment is it not…

Q: Swathmore Clothing Corporation grants its customers 30 days’ credit. The company uses the allowance…

A: Bad debt expense is the amount that the company did not expect to recover from the customers on the…

Q: Granite Company purchased a machine with cost of $90,000 and salvage value of $6,000. The life of…

A: Introduction: Depreciation: Decreasing value of fixed assets over its useful life period called as…

Q: a. For the month ended January 31, determine Aricanly's cos Aricanly Manufacturing Company Cost of…

A: The cost of goods manufactured (COGM) is the sum of the cost of direct labor used, the cost of…

Q: Which of the following best describes why auditors audit leased assets in conjunction with the audit…

A: The question is related to the audit of leased assets. Lease is an agreement between two parties…

Q: 1. The term of the lease is 7 years with no renewal option, and the machinery has an estimated…

A: Term of lease 7 years Cost of machinery $ 507,000 Guaranteed Residual Value $…

Q: (c)Plug in the given in the formula if there is a derivation of the formul

A: The given information: Annual salary = 60,000increasing =5,000 yearInterest rate=10%Time period=8…

Q: Margin, Turnover, Return on Investment, Average Operating Assets Elway Company provided the…

A: Ratio analysis helps to analyze the financial statements of the company. The management can take…

Q: 5. Assuming four annual deposits of ($1,000) are made, and the first payment occurs at the end of…

A: Annuity can be defined as a series of payments or receipts of equal amounts of money at equal…

Q: The Northeast Regional Division of Bridgeport Corp. has been requested to prepare a quarterly…

A: Solution Working note- 1- Purchase amount : =Sales * Percentage of average purchase. = (725000…

Q: Sunland Company manufactures patio umbrellas. The direct labor standard for each umbrella is 1.25…

A: The direct labor rate variance arises due to the difference of actual rate versus the standard rate

Q: Cash 5,209 Accounts Receivable 2,798 Prepaid Expenses Equipment Accumulated Depreciation Accounts…

A: Introduction: Balance sheet: All Assets and liabilities are shown in balance sheet. It tells the net…

Q: A condominium unit is being amortized with a quarterly payment of P56,000 for 5 years at 3%…

A: Solution: When quarterly payments are made, amortization schedule will consist of nos of quarterly…

Q: How much is the impairment loss to be recorded on December 31, 2022? How much is the carrying…

A: Loan on 01.01.2020 12000000 Term of Loan-Principal Payment Annually 2000000 Interest @6%…

Q: Select one: O True O False

A: Cash transaction always affected the Bank Account, Petty cash or cash float.

Q: The TimpRiders LP has operated a motorcycle dealership for a number of years. Lance Is the limited…

A: given The TimpRiders LP has operated a motorcycle dealership for a number of years. Lance is the…

Q: On January 1st 2020, the Tesla Company purchased 400 of the 1000 shares of the Spaceship Enterprise…

A: Journal Entry The purpose of preparing the journal entry to enter the required transaction which are…

Q: Determine the account receivable balances at March 31, 2022.

A: Clients usually pay 60% of their fee in the month that service is provided, 30% the month after, and…

Q: The Beatrice Manufacturing Company increased its merchandise inventory by $29,000 over the year. The…

A: Cost of goods sold = Sales - Gross profit Cost of goods sold = $1,035,000 - ($1,035,000 x 45%) Cost…

Q: At January 1, 2020, Buffalo Company’s outstanding shares included the following. 298,000 shares of…

A: Earning per share is the ratio of earnings per outstanding share of common stock. Weighted average…

Q: Deanne, and Keon formed the Blue Bell General Portr e each contributed $112.000 and Keon transferred…

A: Partners adjusted basis refers to the concept which computed without taking into consideration the…

Q: any started op n and the com e market. As a n

A: Auditing is the method which has been carried out by the auditor and during the process auditor…

Q: On January 1, 2022, Frank Co. and Richard, Inc. combined. As of this date, the fair values of the…

A: Facts of the cases :- Richard…

Q: $fill in the blank 2 Should Petoskey keep or drop Conway?

A: Introduction: The contribution margin can be expressed as a percentage of the total or as a…

Step by step

Solved in 2 steps with 4 images

- Providing for doubtful accounts At the end of the current year, the accounts receivable account has a debit balance of 2,950,000 and sales for the year total 27,400,000. Determine the amount of the adjusting entry to provide for doubtful accounts under each of the following assumptions: A. The allowance account before adjustment has a debit balance of 9,500. Bad debt expense is estimated at of 1% of sales. B. The allowance account before adjustment has a debit balance of 9,500. An aging of the accounts in the customer ledger indicates estimated doubtful accounts of 188,000. C. The allowance account before adjustment has a credit balance of 31,400. Bad debt expense is estimated at 1/2 of 1% of sales. D. The allowance account before adjustment has a credit balance of 31,400. An aging of the accounts in the customer ledger indicates estimated doubtful accounts of 175,000.Hide or show questions Progress:51/69 items Calculator Allowance for Doubtful Accounts has a debit balance of $2,300 at the end of the year (before adjustment). The company prepares an analysis of customers' accounts and estimates the amount of uncollectible accounts to be $31,900. Which of the following adjusting entries is needed to record the Bad Debt Expense for the year? a.debit Allowance for Doubtful Accounts, $29,600; credit Bad Debt Expense, $29,600 b.debit Allowance for Doubtful Accounts, $34,200; credit Bad Debt Expense, $34,200 c.debit Bad Debt Expense, $29,600; credit Allowance for Doubtful Accounts, $29,600 d.debit Bad Debt Expense, $34,200; credit Allowance for Doubtful Accounts, $34,200Question no. 02 (b) (07)Wilson Corporation uses an income statement approach to estimate credit losses. Its Accounts Receivable of $5,000,000 at the beginning of the period had a net realizable value of $4,225,000.During year 2019 company wrote off all of its uncollectible accounts. Of these accounts 35% were subsequently collected. Prepare the entries to record write off using allowance for doubtful account and direct write off approaches. Draft Entry to record the accounts receivable that were subsequently collected. Allowance for doubtful account is treated as an expense or as a liability in general journal. Give reasons for your answer. Moreover explain the treatment of these in balance sheet. What is the characteristic common to all current assets? Many retail stores regularly sell merchandise on installment plans, calling for payments over a period of 24 or 36 months. Do such receivables qualify as current assets? Explain.

- Correction of errorsIn examining the books of Mulan Company, you found out that certain adjustments had been overlooked at the end of 2019 and 2020. You also discovered that other items had been improperly recorded. These omissions and other failures for each year are summarized below: 12/31/20 12/31/19Salaries payable P780,000 P873,600Interest receivable 213,000 259,200Prepaid insurance 307,800 384,000Advances from customers (Collections from customers had beenrecorded as sales but should have been recognized as advances from customers because goods were not shipped until the following year) 561,000 470,400 Machinery (Capital expenditures had been recorded as repairs but shouldhave been charged to Machinery; the depreciation rate is 10% per year, but depreciation in the year of expenditure is to be recognized at 5%) 522,000 564,000 Required:Compute for the total effect of errors in the net income of 2019 and 2020.Question 14 Santagos Industries gathered the following information from its accounting records for the year ended December 31, 2019, prior to adjustment: Net credit sales for the year $730,000 Accounts receivable balance, Dec. 31, 2019 145,000 Allowance for doubtful accounts balance, Dec. 31, 2019 1,850 Cr. Santagos uses the allowance method of accounting for uncollectible accounts and estimates bad-debt expense at 1.5% of net credit sales. Required: a) Prepare the adjusting entry to record bad-debt expense on December 31, 2019. b) Determine the balance in allowance for doubtful accounts after the adjusting entry is prepared. c) Show how the receivables would be reported on the December 31, 2019, balance sheet for Santagos Industries.Exercise 8-07 On December 31, 2021, when its Allowance for Doubtful Accounts had a debit balance of $1,521, Sheridan Company estimates that 9% of its accounts receivable balance of $105,300 will become uncollectible and records the necessary adjustment to Allowance for Doubtful Accounts. On May 11, 2022, Sheridan Company determined that B. Jared’s account was uncollectible and wrote off $1,165. On June 12, 2022, Jared paid the amount previously written off.Prepare the journal entries on December 31, 2021, May 11, 2022, and June 12, 2022. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem.) Date Account Titles and Explanation Debit Credit Choose a transaction date December 31, 2021May 11, 2022June 12, 2022 Enter an account title Enter a debit amount Enter a credit amount Enter an account title Enter a debit amount Enter a…

- Question 40 Accrued salaries payable of $102,000 were not recorded at December 31, 2020. Office supplies on hand of $58,000 at December 31, 2021 were erroneously treated as expense instead of supplies inventory. Neither of these errors was discovered nor corrected. The effect of these two errors would cause 2020 net income and December 31, 2020 retained earnings to be understated $102,000 each. 2021 net income to be understated $160,000 and December 31, 2021 retained earnings to be understated $58,000. 2021 net income and December 31, 2021 retained earnings to be understated $58,000 each. 2020 net income to be overstated $44,000 and 2021 net income to be understated $58,000.M8-16 (Supplement 8A) Recording Write-Offs and Reporting Accounts Receivable Using the Direct Write-Off Method [LO 8-S1] On December 31, 2017, Extreme Fitness has an adjusted balance of $720,000 in Accounts Receivable. On January 2, 2018, the company learns that certain customer accounts are not collectible, so management authorizes a write-off of these accounts totaling $50,400. Extreme Fitness uses the direct write-off method. What amount would the company report as its net accounts receivable on December 31, 2017? Prepare the journal entry to write off the accounts on January 2, 2018. Assuming no other transactions occurred between December 31, 2017, and January 3, 2018, what amount would the company report as its net accounts receivable on January 3, 2018? Has net accounts receivable changed from December 31, 2017? Req A: What amount would the company report as its net accounts receivable on December 31, 2017? Accounts Receivable Req…Question 11-7 The following are the unadjusted balances of Matheson Merchandising for the year ended December 31, 2019. Only half of Matheson's sales are on account as are the sales returns and allowances. Accounts receivable $110,500 Allowance for doubtful accounts, Dec. 31, 2019, prior to adjustment 520 Cr. Sales Revenue for 2019 400,400 Sales Returns and Allowances for 2019 10,400 Assuming that Matheson estimates bad debts at 2 % of outstanding accounts receivable, what is the amount of the bad-debt expense for the year.

- Question 6On 30 June, the end of its financial year, Aarav Ltd completed an age analysis of itsaccounts receivable and determined that an allowance for doubtful debts of $12 320was needed in order to report accounts receivable at their estimated collectableamount in the Balance Sheet.Required(a) Prepare the general journal entry to record bad debts expense assuming that theAllowance for Doubtful Debts account currently has a $1940 credit balance(narration not required).(b) Prepare an entry to write off an account receivable from V. Vijay for $781(narration not required). (c) From the following information, determine the amount of cash received fromcustomers during 2019-20:Accounts receivable (30-Jun-2019) $81 000Accounts receivable (30-Jun-2020) $76 000Sales (Credit) $350 000 (d) From the following information, determine the amount of purchases for the year:Beginning inventory $ 60 000Ending inventory 90 000Cost of sales 130 000 (e) If wages expense for the year is $480 000, wages…QUESTION 9 As at 30 March 2020 , the accounts receivable balance is $10,000. The allowance for doubtful account balance is $200(credit balance). The management determined to write off an accounts receivable of $400 and accounting entries (following IFRS) were recorded on 30 March 2020. At 31 March 2020. The management estimated that 8% of the outstanding accounts receivable balance is uncollectible. The adjusting entries for bad debt expense to be prepared on 31 March 2020 is $____________. (Assumption: the company prepares the financial statements on an annual basis)Question 9 Concord Company provides for bad debt expense at the rate of 3% of accounts receivable. The following data are available for 2018: Allowance for doubtful accounts, 1/1/18 (Cr.) $ 11300 Accounts written off as uncollectible during 2018 10400 Ending accounts receivable 1204000 The Allowance for Doubtful Accounts balance at December 31, 2018, should be $37020. $900. $36120. $35220.