Sage Hill Leasing Company signs an agreement on January 1, 2020, to lease equipment to Cole Company. The following information relates to this agreement. 1. The term of the non-cancelable lease is 6 years with no renewal option. The equipment has an estimated economic life of 6 years. The cost of the asset to the lessor is $451,000. The fair value of the asset at January 1, 2020, is $451,000. The asset will revert to the lessor at the end of the lease term, at which time the asset is expected to have a residual value of $24,225, none of which is guaranteed. The agreement requires equal annual rental payments, beginning on January 1, 2020. Collectibility of the lease payments by Sage Hill is probable. Click here to view factor tables. Assuming the lessor desires a 10% rate of return on its investment, calculate the amount of the annual rental payment required. (For calculation purposes, use 5 decimal places as displayed in the factor table provided and the final answer to O decimal places eg. 5,275.) 2. 3. 4. 5. Amount of the annual rental payment $ Prepare an amortization schedule that is suitable for the lessor for the lease term. (Round answers to O decimal places e.g. 5,275.)

Sage Hill Leasing Company signs an agreement on January 1, 2020, to lease equipment to Cole Company. The following information relates to this agreement. 1. The term of the non-cancelable lease is 6 years with no renewal option. The equipment has an estimated economic life of 6 years. The cost of the asset to the lessor is $451,000. The fair value of the asset at January 1, 2020, is $451,000. The asset will revert to the lessor at the end of the lease term, at which time the asset is expected to have a residual value of $24,225, none of which is guaranteed. The agreement requires equal annual rental payments, beginning on January 1, 2020. Collectibility of the lease payments by Sage Hill is probable. Click here to view factor tables. Assuming the lessor desires a 10% rate of return on its investment, calculate the amount of the annual rental payment required. (For calculation purposes, use 5 decimal places as displayed in the factor table provided and the final answer to O decimal places eg. 5,275.) 2. 3. 4. 5. Amount of the annual rental payment $ Prepare an amortization schedule that is suitable for the lessor for the lease term. (Round answers to O decimal places e.g. 5,275.)

Chapter7: Deductions And Losses: Certain Business Expenses And Losses

Section: Chapter Questions

Problem 28CE

Related questions

Question

100%

Transcribed Image Text:CH 21 POST-CLASS - SU21

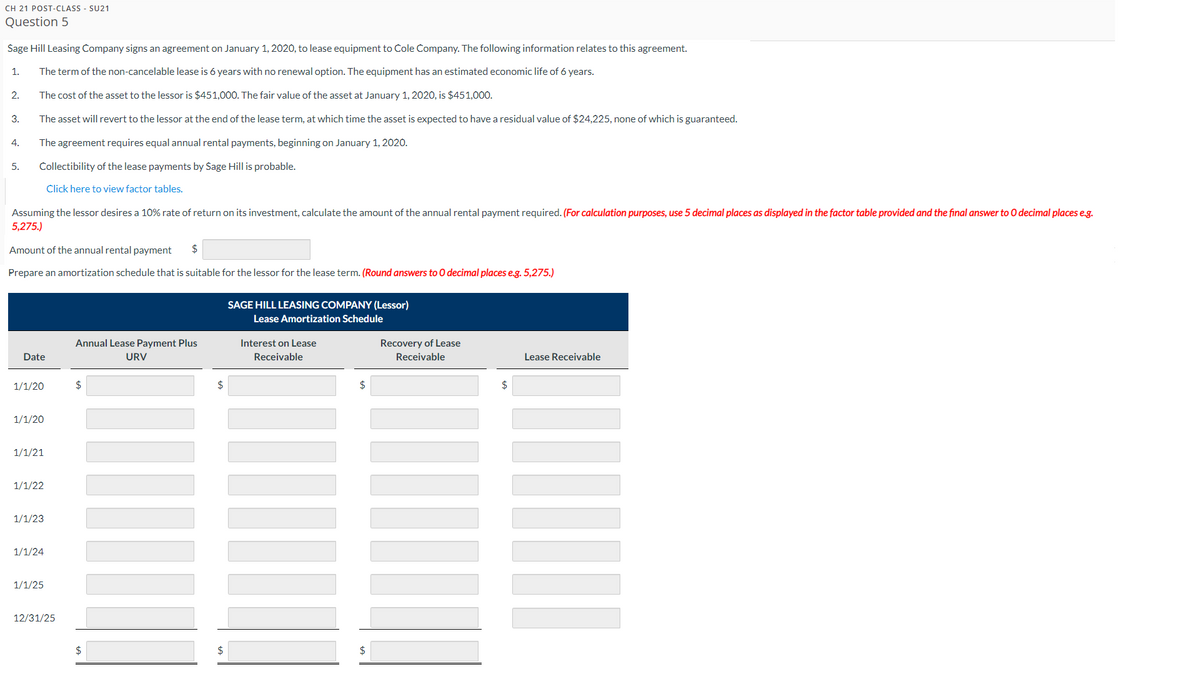

Question 5

Sage Hill Leasing Company signs an agreement on January 1, 2020, to lease equipment to Cole Company. The following information relates to this agreement.

1. The term of the non-cancelable lease is 6 years with no renewal option. The equipment has an estimated economic life of 6 years.

The cost of the asset to the lessor is $451,000. The fair value of the asset at January 1, 2020, is $451,000.

The asset will revert to the lessor at the end of the lease term, at which time the asset is expected to have a residual value of $24,225, none of which is guaranteed.

The agreement requires equal annual rental payments, beginning on January 1, 2020.

Collectibility of the lease payments by Sage Hill is probable.

Click here to view factor tables.

2.

3.

4.

5.

Assuming the lessor desires a 10% rate of return on its investment, calculate the amount of the annual rental payment required. (For calculation purposes, use 5 decimal places as displayed in the factor table provided and the final answer to O decimal places e.g.

5,275.)

Amount of the annual rental payment $

Prepare an amortization schedule that is suitable for the lessor for the lease term. (Round answers to O decimal places e.g. 5,275.)

Date

1/1/20

1/1/20

1/1/21

1/1/22

1/1/23

1/1/24

1/1/25

12/31/25

Annual Lease Payment Plus

URV

$

$

$

$

SAGE HILL LEASING COMPANY (Lessor)

Lease Amortization Schedule

Interest on Lease

Receivable

$

$

Recovery of Lease

Receivable

$

Lease Receivable

Transcribed Image Text:WP Ch 21 Post-Class - SU21

с

hp HP Connected

HH

NWP Assessment Player Ul Applic X

Home Page - Retail... WP WileyPLUS Achieve Greatness:...

education.wiley.com/was/ui/v2/question-player/index.html?renderMode=readOnly&questionId=5304c771-d2c2-4ce7-a680-82d57b542e11&questionIndex=4&launchId=9d3d5de9-d5f1-4b11-b334-4583aabbbfa1#/read

Date

Account Titles and Explanation

Question 5 (Read Only)

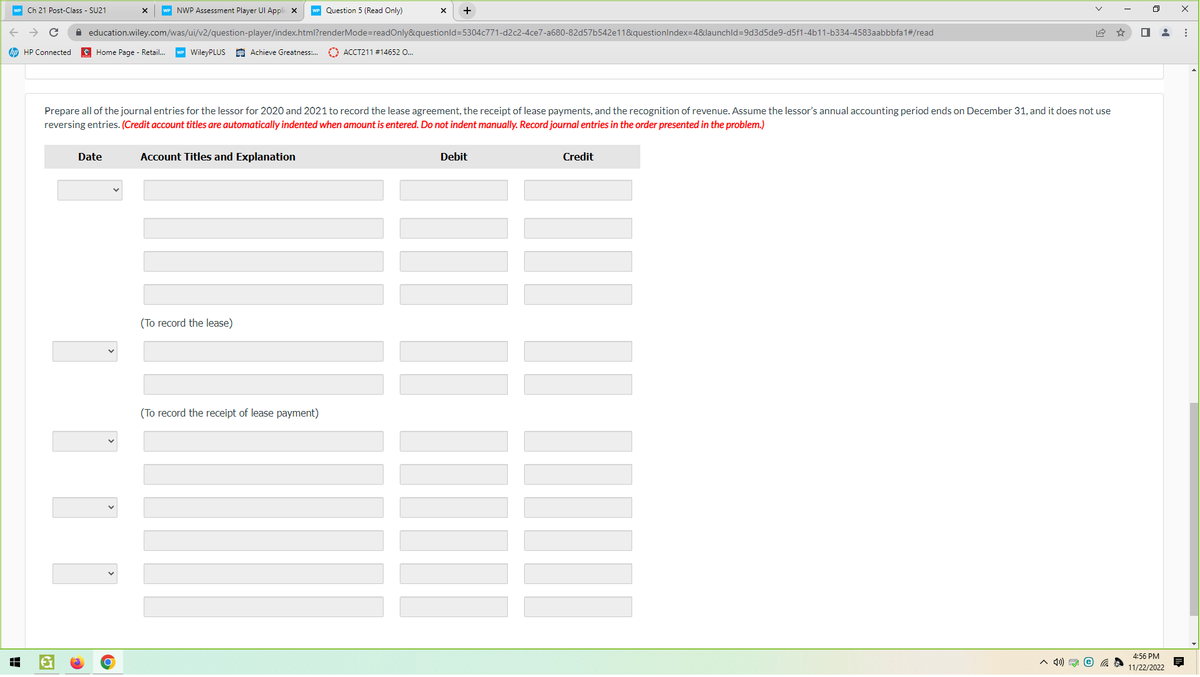

Prepare all of the journal entries for the lessor for 2020 and 2021 to record the lease agreement, the receipt of lease payments, and the recognition of revenue. Assume the lessor's annual accounting period ends on December 31, and it does not use

reversing entries. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem.)

(To record the lease)

(To record the receipt of lease payment)

X +

ACCT211 # 14652 O...

Debit

Credit

-----| || |--•

^ 4) e

■

4:56 PM

11/22/2022

X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Expert Answers to Latest Homework Questions

Q: A2 please help.....

Q: Please don't provide handwritten solution ...

Q: On May 22, Jarrett Company borrows 9, 200, signing a 90-day, 7% $9, 200 noteWhat is the journal…

Q: A 25.0-mL sample of 0.30 M HCI is titrated with 0.30 M KOH. What is the pH of the solution after 3.3…

Q: None

Q: None

Q: None

Q: What statement is TRUE about the coenzyme?

CH O

H CC-

O

NAD

Isocitrate

Dehydrogenase

NACH + H

O NAD+…

Q: The reaction below is exothermic. What energy released in this reaction is most likely to be used

to…

Q: Economics please help...

Q: Economics plwase help...

Q: Fill in the missing symbol in this nuclear chemical equation.

38.

38

19

19K

18 Ar +

Q: None

Q: None

Q: A red laser, shining on a double slit, creates the pattern shown in the figure below at the center…

Q: Part 1 of 2

Calculate the energy released when a Bi-210 isotope decays to Tl-206. Round your answer…

Q: Typed please

Q: A manufacturing company receives orders for engines from two assembly plants. Plant I needs at least…

Q: For each of the following compounds, decide whether the compound's solubility in aqueous solution…

Q: DFS Corporation is currently an all-equity firm, with assets with a market value of $ 163 million…

Q: Write the reagents and conditions necessary to perform this transformation