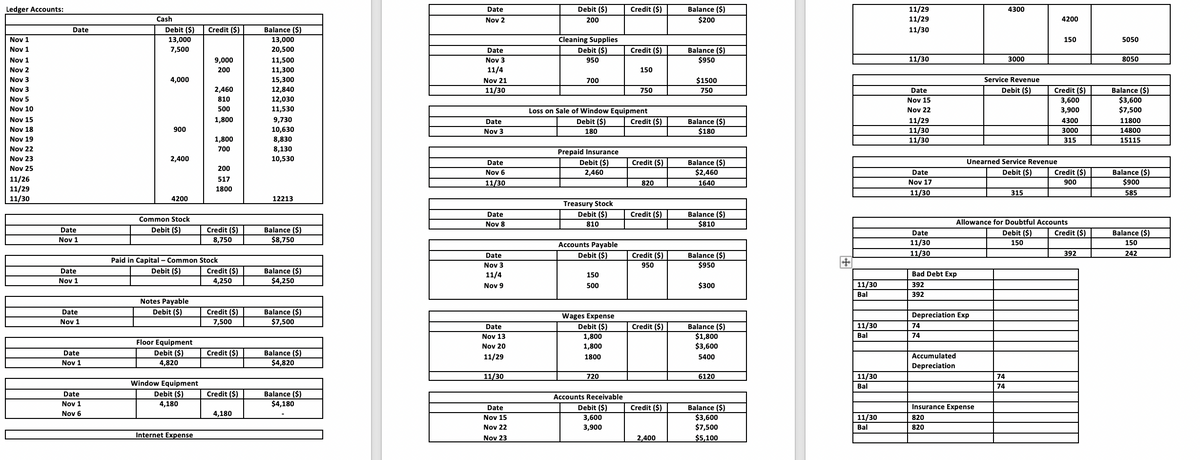

Prepare an Adjusted Trial Balance at November 30, 2021. Journalize the Closing Entries. (Hint—Use your Adjusted Trial Balance for accounts and amounts--?) Post the Closing Entries to the General Ledger accounts and find the final ending balances. Prepare a Post-Closing Trial Balance on November 30, 2021. Original: Nov. 1 Issued 5,000 shares of Sweet Angels common stock for $13,000. Each share has a $1.75 par. 1 Borrowed $7,500 on a 2-year, 8% note payable. 1 Paid $9,000 to purchase used floor and window cleaning equipment from a company going out of business ($4,820 was for the floor equipment and $4,180 for the window equipment). 2 Paid $200 for November for internet and phone service. 2 Purchased cleaning supplies for $950 on account. 2 Hired 4 employees. Each will be paid $450 per 5-day work week (Monday-Friday). Employees will begin working on Monday, November 8th. 3 Discussions with the insurance agent indicated that providing outside window cleaning services would cost too much to insure. Sylvia sold the window cleaning equipment for $4,000 cash. 3 Negotiated insurance coverage at a rate of $9,840 per year. Sylvia paid $2,460 cash for the first quarter of coverage. 4 Returned $150 of the cleaning supplies. 5 Paid $2.70 per share to buy 300 shares of Sweet Angels, Inc common stock from a shareholder who disagreed with management goals. The shares will be held as treasury stock. 10 Paid $500 on amount owed on cleaning supplies. 15 Paid for employees’ wages for the week of November 8-12. 15 Billed customers $3,600 for cleaning services performed through November 12, 2021. 18 Received $900 from a customer for 4 weeks of cleaning services to begin on November 22, 2021. 19 Purchased additional cleaning supplies for $700. 22 Paid employees’ wages for the week of November 15-19. 22 Billed customers $3,900 for cleaning services performed through November 19th. 23 Collected $2,400 cash from customers billed on November 15. 25 Paid $200 for Internet and phone services for December. 26 Declared and paid a cash dividend of $0.11 per share. 29 Paid employees’ wages for the week of November 22-26. 29 Billed customers $4,300 for cleaning services performed through November 26th 30 Collected $4,200 from customers billed on November 15 & 22. 30 Received notice that a customer who was billed $150 for services performed November 10th has filed for bankruptcy. Sweet Angels, Inc does not expect to collect any portion of this outstanding receivable. (Sweet Angels will follow the GAAP Guidelines for uncollectible accounts.) Adjustment Data: Services performed for customers through November 30, 2021, but unbilled and uncollected were $3,000. Sweet Angels used the allowance method to estimate bad debts. Sweet Angels estimates that 3% of its month-end receivables will not be collected. Record 1 month of depreciation for the floor equipment. Use the straight-line method, an estimated life of 5 years, and $400 salvage value. Record 1 month of insurance expense. An inventory count shows $750 of supplies on hand on November 30th. Record services performed for the customer who paid in advance on November 18th. Accrue for wages owed through November 30, 2021. Accrue interest expense for one month.

- Prepare an Adjusted

Trial Balance at November 30, 2021. - Journalize the Closing Entries. (Hint—Use your Adjusted Trial Balance for accounts and amounts--?)

- Post the Closing Entries to the General Ledger accounts and find the final ending balances.

- Prepare a Post-Closing Trial Balance on November 30, 2021.

Original:

|

Nov. 1

|

Issued 5,000 shares of Sweet Angels common stock for $13,000. Each share has a $1.75 par. |

|

1 |

Borrowed $7,500 on a 2-year, 8% note payable. |

|

1 |

Paid $9,000 to purchase used floor and window cleaning equipment from a company going out of business ($4,820 was for the floor equipment and $4,180 for the window equipment). |

|

2 |

Paid $200 for November for internet and phone service. |

|

2 |

Purchased cleaning supplies for $950 on account. |

|

2 |

Hired 4 employees. Each will be paid $450 per 5-day work week (Monday-Friday). Employees will begin working on Monday, November 8th. |

|

3 |

Discussions with the insurance agent indicated that providing outside window cleaning services would cost too much to insure. Sylvia sold the window cleaning equipment for $4,000 cash. |

|

3 |

Negotiated insurance coverage at a rate of $9,840 per year. Sylvia paid $2,460 cash for the first quarter of coverage. |

|

4 |

Returned $150 of the cleaning supplies. |

|

5 |

Paid $2.70 per share to buy 300 shares of Sweet Angels, Inc common stock from a shareholder who disagreed with management goals. The shares will be held as |

|

10 |

Paid $500 on amount owed on cleaning supplies. |

|

15 |

Paid for employees’ wages for the week of November 8-12. |

|

15 |

Billed customers $3,600 for cleaning services performed through November 12, 2021. |

|

18 |

Received $900 from a customer for 4 weeks of cleaning services to begin on November 22, 2021. |

|

19 |

Purchased additional cleaning supplies for $700. |

|

22 |

Paid employees’ wages for the week of November 15-19. |

|

22 |

Billed customers $3,900 for cleaning services performed through November 19th. |

|

23 |

Collected $2,400 cash from customers billed on November 15. |

|

25 |

Paid $200 for Internet and phone services for December. |

|

26 |

Declared and paid a cash dividend of $0.11 per share. |

|

29 |

Paid employees’ wages for the week of November 22-26. |

|

29 |

Billed customers $4,300 for cleaning services performed through November 26th |

|

30 |

Collected $4,200 from customers billed on November 15 & 22. |

|

30 |

Received notice that a customer who was billed $150 for services performed November 10th has filed for bankruptcy. Sweet Angels, Inc does not expect to collect any portion of this outstanding receivable. (Sweet Angels will follow the GAAP Guidelines for uncollectible accounts.) |

Adjustment Data:

- Services performed for customers through November 30, 2021, but unbilled and uncollected were $3,000.

- Sweet Angels used the allowance method to estimate

bad debts. Sweet Angels estimates that 3% of its month-end receivables will not be collected. - Record 1 month of

depreciation for the floor equipment. Use the straight-line method, an estimated life of 5 years, and $400 salvage value. - Record 1 month of insurance expense.

- An inventory count shows $750 of supplies on hand on November 30th.

- Record services performed for the customer who paid in advance on November 18th.

- Accrue for wages owed through November 30, 2021.

- Accrue interest expense for one month.

Here's what I have done:

![Supplies Expense

+Journal Entries

Nov 29

Wages Expense

1800.00

11/30

750

Date

Account Title

Post

Debit ($)

Credit ($)

Cash

1800.00

Bal

750

Ref.

Nov 26

Dividends

517.00

Nov 1

Cash

13000.00

Cash

517.00

Nov 30

Cash

4200.00

Salaries & Wages

Payable

Common Stock

8750.00

Paid In Capital in Excess of Par - Common Stock

4250.00

Accounts Receivable

4200.00

11/30

720

Nov 1

Cash

7500.00

Nov 29

Accounts Receivable

4300.00

Bal

720

Notes Payable

7500.00

Service Revenue

4300.00

Floor Equipment

Window Equipment

Nov 1

4820.00

11/30

Allowance for Doubtful Accounts

150

Interest Expense

4180.00

Accounts Receivable

150

11/30

50

Cash

9000.00

Adjusting Entries

Bal

50

Nov 2

Internet Expense

200.00

11/30

Accounts Receivable

3000

Cash

200.00

Service Revenue

3000

Bad Debt Expense

Cleaning Supplies

Accounts Payable

No Journal Entry

Interest Payable

Nov 2

950.00

11/30

150

11/30

50

950.00

Allowance for Doubtful Accounts

|150

Bal

50

Nov 2

(5050+3000)X.03=241.50 & 242 + 150

Cash

4000.00

Depreciation Expense

Accumulated Depreciation

Nov 3

11/30

74

Loss on Sale of Window Equipment

Window Equipment

Dividends

180.00

74

4180.00

[(4820-400)/5]/12 = 73.67

Insurance Expense

11/26

517

Bal

517

Nov 3

Prepaid Insurance

2460.00

11/30

820

Cash

2460.00

Prepaid Insurance

(2460/3)

Supplies Expense

820

11/4

Accounts Payable

Cleaning Supplies

Treasury Stock

150

Prepaid Internet

11/25

200

150

11/30

750

Nov 5

810.00

Supplies

(1500-7500

Bal

200

750

Cash

810.00

Nov 10

Accounts Payable

500.00

11/30

Unearned Service Revenue

315

Cash

500.00

Service Revenue

315

Nov 15 Wages Expense

1800.00

(900/4)/5 = 45 per day & 7 Days Worked (11/22-

26) & (11/29-30)

Cash

1800.00

Nov 15

Accounts Receivable

3600.00

11/30

Salaries & Wages Expense

720

Service Revenue

3600.00

Salaries & Wages Payable

720

Nov 18

Cash

900.00

(1800/5)= 360 per day & 2 days worked (11/29-30)

Unearned Service Revenue

900.00

11/30

Interest Expense

50

Nov 22

Wages Expense

1800.00

Interest Payable

50

Cash

1800.00

(7500x.08)/12

Nov 19

Cleaning Supplies

700.00

Cash

700.00

Nov 22

Accounts Receivable

3900.00

Service Revenue

3900.00

Nov 23

Cash

2400.00

Accounts Receivable

2400.00

Nov 25

Prepaid Internet

200.00

Cash

200.00](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2F02a680d9-e7e7-40ae-9044-f36366b75cde%2F00be43cf-ca28-460d-ace0-269213ab31fb%2Frbo8ww_processed.png&w=3840&q=75)

Trending now

This is a popular solution!

Step by step

Solved in 3 steps