Prepare Cashflow Statement for ABC company from the following information. Showing your workings.

Q: PLEASE, PERFORM THE EXERCISE IN EXCEL AND SHOW THE FORMULAS PLEASE, PERFORM THE EXERCISE IN EXCEL…

A: The question is related to operating cycle, cash conversion cycle cash turnover. The details are…

Q: The primary purpose of the statement of cash flows is to provide information about Oa. the…

A: The cash flows statement is part of financial statements. cash flows statement shows the cash flows…

Q: A company uses a spreadsheet to prepare its statement of cash flows. Indicate whether each of the…

A: Statement of cash flows: Statement of cash flow is a financial statement that shows the cash and…

Q: Prepare the Cash flow from operating activities section ONLY of the statement of cash flows for…

A: Particulars Calculation Amount( in Pounds) Profits for the year 17440 Add: Corporation Tax…

Q: Using a spreadsheet to complete the statement of cash flows—indirect method Companies can use a…

A:

Q: What is the Indirect Method used when preparing the Statement of Cash Flows and please give me a few…

A: Indirect method: Under indirect method the net income is adjusted with the increase or decrease of…

Q: Please give me an information about : cash reciepts, capital investments, loans, interest payment,…

A: Every feild had its own terminology. Same is with Accounting. Accounting has its own terminology,…

Q: A company uses a spreadsheet to prepare its statement of cash flows. Indicate whether each of the…

A: Statement of cash flows: Statement of cash flow is a financial statement that shows the cash and…

Q: The company La Planetaria, S.A., presents you with the following income statement and additional…

A: SOLUTION WORKING NOTE- 1-AVERAGE INVENTORY AGE = 360 /INVENTORY TURNOVER. =360 / 12 =30 DAYS…

Q: Prepare the statement of cash flows for richcorp using the direct method

A: Statement of cash flows shows all cash inflows and cash outflows of business during the particular…

Q: A company uses a spreadsheet to prepare its statement of cash flows. Indicate whether each of the…

A: Cash-flow statement: Cash-flow statement is one of the important statements which companies prepared…

Q: Prepare a statement of cash flows using the direct method. (Show amounts in the investing and…

A: Cash Flow Statement is prepared to analyze the Inflow and Outflow of Cash in the organisation.

Q: A company uses a spreadsheet to prepare its statement of cash flows. Indicate whether each of the…

A: Cash flow statements are the statements that determine the inflow and outflow of cash from three…

Q: When using the spreadsheet (work sheet) for the statement of cash flows, under the indirect method,…

A: Spreadsheet: A spreadsheet is a worksheet that is used while preparing the financial statement. It…

Q: Explain the cash flow activities by the business cycle,showing where the cash is generated and where…

A: Cash Flow statement: The statement which summarizes the net amount of cash disbursed and received in…

Q: PLEASE, PERFORM THE EXERCISE IN EXCEL AND SHOW THE FORMULAS PLEASE, PERFORM THE EXERCISE IN EXCEL…

A: The question is related to operating cycle, cash conversion cycle cash turnover. The details are…

Q: The primary objective of the statement of cash flows is to provide information about a company's: O…

A: Solution: Statement of cash flows is a financial statement that provides data regarding all cash…

Q: using the indirect method, prepare a statement of cash flows. Can you spell out the calculation…

A: Cash Flow Statement is a statement which shows the actual inflow and outflow of cash and cash…

Q: he ___________ is the process by which a company spends cash, generates revenues, and receives cash…

A: Solution Concept In a business there may be various activities conducted Every business has its core…

Q: Please prepare a statement of cash flows using the following data. Please include any equations or…

A: Cash Flow statements are the statement of changes in cash in an organization. Any non-cash item will…

Q: Use the following information to complete the operating section of the statement of cash flows. Test…

A: Cash flow statement One of the important function to preparation of the cash flow statement to find…

Q: The statement of cash flows is designed to assist users inassessing each of the following, except:a.…

A: Cash flow Statement: It is prepared by the companies. It is a tool in the hands of users of…

Q: ct one: a. Financing Activities cash outflow b. Investing Activities cash outflow c. Financing…

A: The correct option is (B) Investing Activities cash outflow

Q: How would I input the formulas into excel to get those numbers for the statement of cash flows

A: Activities in cash flow statement includes: Cash flows from operating activities Cash flows from…

Q: What are the steps necessary to create a statement of cash flows in quickbooks.

A: Statement of cash flows: This statement reports all the cash transactions which are responsible for…

Q: Define the 3 sections of the Cash flow Statement without copying straight from the text. - Cash from…

A: Cash flow statement has been divided in three parts :- (i) Cash flow from operating activities (ii)…

Q: When a company purchases machines by issuing a long-term note payable for the entire amount, the…

A: Cash flow statement is a financial statement which is used to summarize the amount of cash inflows…

Q: Write him a brief memo explaining the form and content of the statement of cash flows.

A: A cash flow statement is such type of statement in which it is shown from which sources and from…

Q: An intern at Block Financials, specializing in block chain transactions is preparing the operating…

A: Statement of cash flows: It is a financial statement that shows the increase or decrease in the cash…

Q: Th e statement of cash fl ows presents the fl ows into which three groups of business activities? A…

A: The question is based on the concept of cash flow statement to present summary of cash and cash…

Q: describe how the cash fl ow statement is linked to the income statement and the balance sheet

A: Cash flows are the receipts and payments of cash and cash equivalent in the organization. It is…

Q: A company uses a spreadsheet to prepare its statement of cash flows. Indicate whether each of the…

A: Spreadsheet: The spreadsheet is a supplementary device which helps to prepare the worksheet in…

Q: The cash flow statement provides information on the cash that is obtained from operating activities,…

A: Cash Flow Statement Cash flow statement which has three important segment are there. These segment…

Q: Which of the following is the final step in preparing a spreadsheet (work sheet) for the statement…

A: Solution: The final step in preparing a spreadsheet (work sheet) for the statement of cash flows…

Q: When using the indirect method of preparing the statement of cash flows, the starting pointto…

A: Introduction: Statement of cash flows: All cash in and out transactions are recorded in Statement of…

Q: Required Record the events in a horizontal statement model. In the Cash Flow column, use OA to…

A:

Q: Which of the following would be classified as an operating activity on the statement of cash flows…

A: Statement of cash flows: It is a financial statement that shows the increase or decrease in the…

Q: In the statement of cash flows, financing activities are those activities a. that include cash…

A: Lets understand the basics. Cashflow statement shows the cash inflow and cash outflow from the…

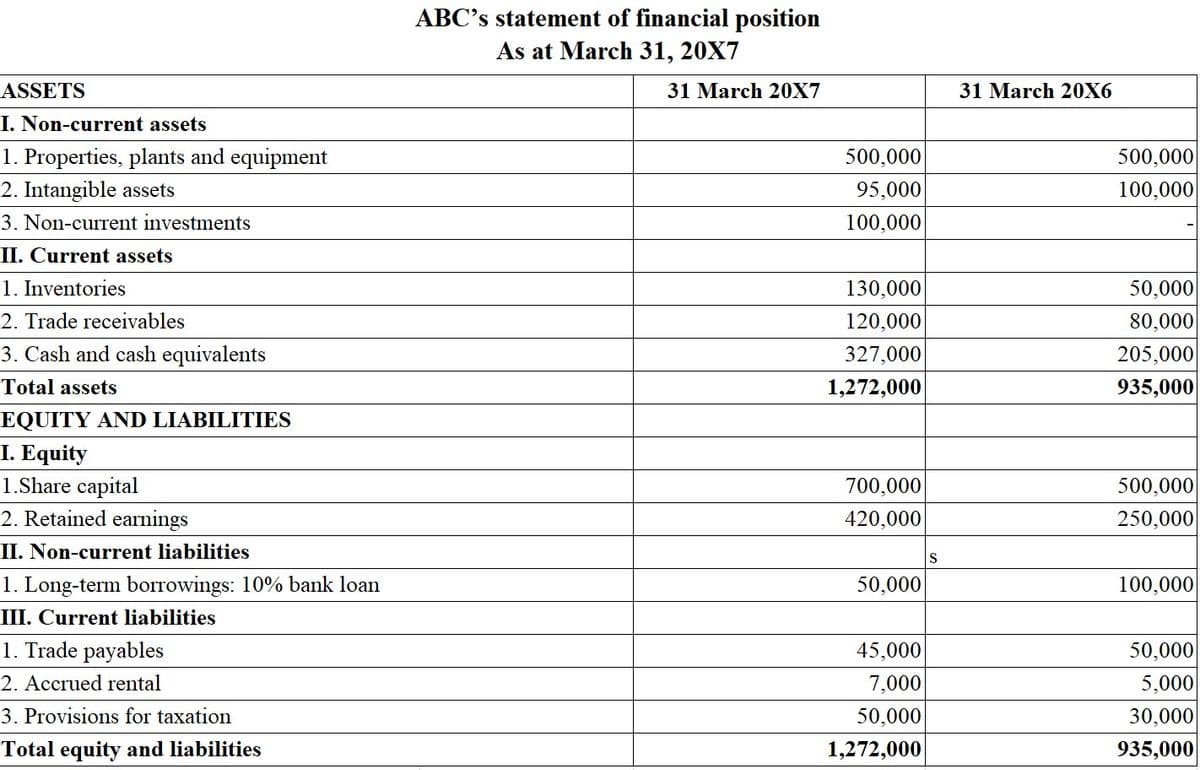

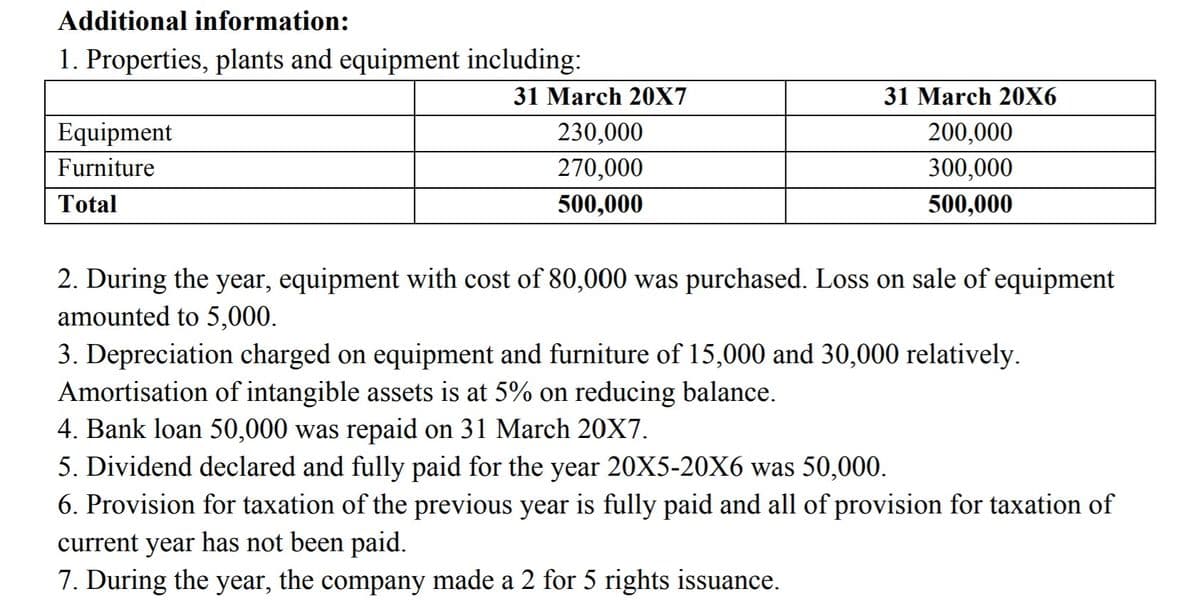

Prepare Cashflow Statement for ABC company from the following information. Showing your workings. (Unit: CU1000)

Step by step

Solved in 2 steps with 1 images

- The comparative statement of financial position for Moose Jaw Ltd. is as follows:Moose Jaw Ltd.Comparative Statement of Financial PositionAs at December 312021 2020Cash $20,500 $12,500Accounts receivable 34,000 25,500Inventories 20,000 30,000Prepaid insurance 2,500 2,000Equipment 102,000 90,000Accumulated depreciation - equipment (22,500) (12,500)Total assets $156,500 $147,500Accounts payable $23,000 $20,000Interest payable 2,000 3,000Wages payable 4,000 2,000Income taxes payable 4,000 5,000Long-term note payable 30,000 34,500Common shares 65,000 65,000Retained earnings 28,500 18,000Total liabilities and equity $156,500 $147,500More information about Moose Jaw’s operations for 2021:• A machine which the company paid $10,000 for was sold for a gain of$1,000. The equipment’s accumulated depreciation was $7,000.• The company had net income for of $13,500.RequiredConstruct the operating activities section of Moose Jaw Ltd.’s statement of cashflows using the indirect method. Use proper…Orbit Limited : Statement of Financial Position as at 31 December 2022 2021 Non-current Assets R11 810 000 R7 560 000 Property, Plant, Equipment R10 025 000 R6 250 000 Investments R1 785 000 R1 310 000 Current Assets R4 190 000 R4 690 000 Inventories R 1 875 000 R2 350 000 Account Receivable R1 925 000 R2 200 000 Cash R390 000 R140 000 Toatal Assets R16 000 000 R12 250 000 Equities & Liabilities Equity ? ? Oridanary share capital R5 480 000 R3 680 000 Retained earnings ? ? Non-current Liabilities R4 500 000 R3 800 000 Loan (20% p.a) R4 500 000 R3 800 000 Current Liabilities R2 300 000 R1 500 000 Accounts payable? R2 300 000 R1 500 000 Calculate the increase in the retained earnings over the two-year period.ASSET EXPENSES LIABILITIES CAPITAL REVENUES (i) 67,500 85,700 50,500 53,700 49,000 (ii) 92,000 7,000 8,000 21,000 70,000 (iii) 112,000 85,000 200 171,000 25,800 (iv) 7,900 2,250 3,200 2,750 4,200 (v) 32,500 6,600 7,200 26,200 5,700 a) State the journal entries using the format given as in the picure

- 1.Presented below are the financial statements of KJ Electronics KJ Electronics Inc. Comparative Balance Sheets September 30 Assets 2021 2020 Current Assets Cash $92000 $42980 Short Term Investments 29500 22500 Accounts Receivable 56900 22300 Inventory 102,300 90220 Long Term Assets Long term Investments 96,300 103000 Equipment 198,000 215000 Accumulated depreciation- equipment (50000) (48000) Total $525,000 $448,000 Current Liabilities Accounts Payable $85,300 $30200 Accrued Expenses payable 26700 15000 Long Term Liabilities Bonds Payable 97,300 79,570 Stockholders’ Equity Common Stock 150,000 165500 Retained Earnings 165,700 157,730 Total $525,000 $448,000 KJ Electronics Inc. Income Statement For the Year Ended September 30, 2021 Sales Revenue Less: Sales Returns and Allowances Net…1. The following information is from Direct to You Corp.’s (DYC) financial records for its year ended December 31, 2020: Select statement of financial position information: 2020 2019 Investments in financial assets (at fair value through profit or loss [FVPL]) 12,000 10,000 Inventory 575,000 498,000 Property, plant, and equipment (PPE) 1,984,000 1,396,000 Less: accumulated depreciation (650,400) (487,000) Copyright 126,000 135,000 Patents 564,000 417,000 Select statement of comprehensive income information: Depreciation of property, plant, and equipment (334,400) Amortization of patents (65,000) Interest expense (75,000) Impairment loss — copyright (9,000) Gain on sale of PPE 23,000 Additional information: PPE that originally cost $570,000 was sold during the year. 100,000 common shares were issued in 2020 to acquire $450,000 of property, plant, and equipment. DYC is subject to IFRS. What amount of net cash used…Extract of Balance sheet items as at 31 December 2019 OR Equipment 20000 Account receivables 3500 Retained earnings 11500 Inventories 5000 Loan 3000 Bank overdraft 1500 Cash and bank 500 Mortgage loan 7500 Furniture 1650 Trade payables 6000 Accumulated Depreciation (Equipment) 1000 Short term Investments 200 Goodwill 4500 Drawings 1000 Capital 7150 Prepaid Expenses 1300 Calculate Total Net Assets(Total Assets)? Select one: a. 35350 OMR b. 34350 OMR c.35650 OMR d. 30350 OMR

- A2 aii Use the following information for Delta Corporation: Year 20X1 20X2 Net sales $1,500,000 $1,656,598 Cost of goods sold 675,000 745,469 Depreciation 270,000 298,188 Interest paid 43,600 44,000 Cash 127,500 140,811 Account’s receivable 450,000 496,980 Inventory 525,000 579,809 Net fixed assets 1,800,000 1,987,918 Accounts payable 375,000 414,150 Notes payable 45,000 50,000 Long-term debt 500,000 500,000 Common stock 1,000,000 1,000,000 Retained earnings 982,500 1,241,368 Tax rate 35% 35% Dividend payout 30% 30% Delta has 600,000 common shares outstanding. The firm is projecting a 20% increase in net sales for the coming year (20X3). Delta uses the percentage of sales approach to plan for its financing needs. In using this approach, the firm assumes that cost of goods sold, all assets (current and fixed), and accounts payable will all remain a constant…The following are the financial statement Kin Ltd. for the year ended 31 March 2020: Kin Ltd. Income statement For the year ended 31 March 2020 $”M” Revenue 1276.50 Cost of sales (907.00) 369.50 Distribution costs (62.50) Administrative expenses (132.00) 175.00 Interest received 12.50 Interest paid (37.50) 150.00 Tax (70.00) Profit after tax 80.00 Kin Ltd. Statement of financial position as at 31 March 2020 2019 $”M” $”M” ASSETS: Non- current assets: Property, plant and equipment 190 152.5 Intangible assets 125 100 Investments 12.5 Current assets: Inventories 75 51 Receivables 195 157.5 Short-term investment 25 Cash in hand 1 0.5 Total assets 611 474 Equity and liabilities: Equity: Share capital (10 million ordinary shares of $ 10 per value) 100 75 Share premium 80 75 Revolution reserve 50 45.5 Retained earnings 130 90 Non-current liabilities:…Question 5The following balances were extracted from the books of Billion Precision for the yearended 31 December 2020.Dr (RM) Cr (RM)Land 500,000Building 200,000Motor vehicles 120,000Plant and machinery 70,000Profit b/f as at 01.01.2020 237,650Capital 438,000Acc depreciation as at 1.1.2020 :-Building 60,000-Motor Vehicles 69,250-Plant & Machinery 40,000Returns 3,600 4,100Revenue 800,000Purchases 400,000Discounts 5,0006Carriage inwards 7,700Opening inventory 52,000Provision for bad debts 2,000Trade receivables / Trade payable 66,000 43,200Advertising 18,000Staff training cost 4,000Bad debts 12,500Motor expenses 27,000Rental 90,000Bank 7,600Wages and salaries 126,0001,701,800 1,701,800Additional information:i.i. The provision for bad debts should be 4% of trade receivables.ii. Depreciation is to be charged as follows:-Buildings 2% on cost.-Plant and machinery 20% on cost.-Vehicles 25% on cost.iii. The closing inventories is valued at RM57,000.Required:a. Prepare the Statement of…

- Dash (Pty) Ltd provided the following information that was extracted from the financial records for the year ended 31 December 2021. Relevant financial information are shown below. Information from the statement of financial position as at 31 December: 2021 R 2020 R Land and buildings at cost 620 000 520 000 Equipment at carrying amount 268 000 343 000 -Cost 354 000 441 000 -Accumulated depreciation (86 000) (98 000) Fixed deposits 70 000 100 000 Inventory 66 000 100 00 Debtors control 64 000 70 000 Bank – favourable (debit) balance 86 000 ----- Prepaid expense – Rent ----- 6 000 Creditors control 26 000 48 000 Bank overdraft – credit balance ----- 6 000 SARS - tax payable 22 000 18 000 Shareholders – dividends payable 30 000 75 000 Interest payable 10 000 12 000 Ordinary share capital 850 000 750 000 Retained earnings 96 000 30 000 Long term borrowings 140 000 200 000 Extract of items shown on the statement of profit and loss and other…Question 5The following balances were extracted from the books of Billion Precision for the year ended 31 December 2020. Dr (RM) Cr (RM) Land 500 000 Building 200 000 Motor Vehicles 120 000 Plant & machinery 70 000 Profit b/f as at 01.01.2020 237 650 Capital 438 000 Acc depreciation as at 1.1.2020 Building 60 000 Motor Vehicles 69 250 Plant & machinery 40 000 Returns 3 600 4 100 Revenue 800 000 Purchases 400 000 Discounts 5 000 Carriage inwards 7 700 Opening inventory 52 000 Provision for bad debts 2 000 Trade receivable / Trade payable 66 000 43 200 Advertising 18 000 Staff training cost 4 000 Bad debts 12 500 Motor expenses 27 000 Rental 90 000 Bank 7 600 Wages & Salaries 126 000 Grand Total 1 701 800 1 701 800 Additional information:i. The provision for bad debts should be 4% of trade receivables. ii. Depreciation is to be charged as follows:-Buildings 2% on…Hansel Corporation’s condensed balance sheets appear below: 20X3 20X2 20X1 Assets: Current assets $ 55,000 $ 56,500 $ 70,000 Plant & equipment, net 495,000 410,000 440,000 Intangible assets, net 20,000 27,500 40,000 Total assets $ 570,000 $ 494,000 $ 550,000 Liabilities & Stockholders’ Equity: Current liabilities $ 40,000 $ 35,000 $ 32,500 Long-term liabilities 395,000 310,000 375,000 Stockholders’ equity 135,000 149,000 142,500 Total liabilities & equity $ 570,000 $ 494,000 $ 550,000 In a trend balance sheet for 20X3, long-term liabilities are expressed as Multiple Choice 69.3% 100.0% 105.3% 127.4%