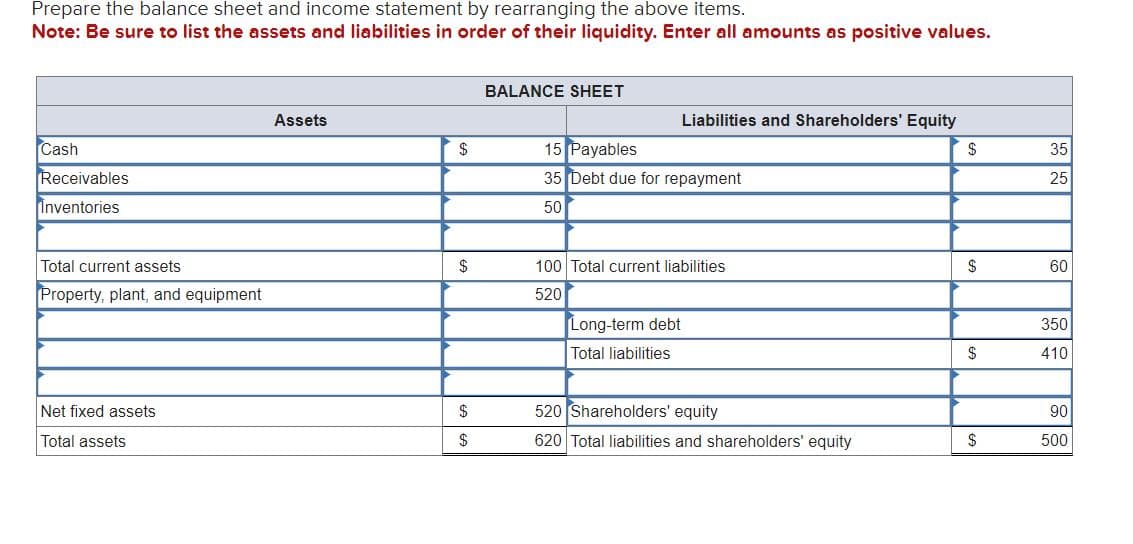

Prepare the balance sheet and income statement by rearranging the above items. Note: Be sure to list the assets and liabilities in order of their liquidity. Enter all amounts as positive values. Cash Receivables Inventories BALANCE SHEET Assets Liabilities and Shareholders' Equity $ 15 Payables $ 35 35 Debt due for repayment 25 50 Total current assets $ 100 Total current liabilities $ 60 Property, plant, and equipment 520 Long-term debt Total liabilities 350 $ 410 Net fixed assets Total assets $ 520 Shareholders' equity 90 $ 620 Total liabilities and shareholders' equity $ 500

Prepare the balance sheet and income statement by rearranging the above items. Note: Be sure to list the assets and liabilities in order of their liquidity. Enter all amounts as positive values. Cash Receivables Inventories BALANCE SHEET Assets Liabilities and Shareholders' Equity $ 15 Payables $ 35 35 Debt due for repayment 25 50 Total current assets $ 100 Total current liabilities $ 60 Property, plant, and equipment 520 Long-term debt Total liabilities 350 $ 410 Net fixed assets Total assets $ 520 Shareholders' equity 90 $ 620 Total liabilities and shareholders' equity $ 500

Financial Accounting

15th Edition

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter16: Statement Of Cash Flows

Section: Chapter Questions

Problem 3PB: The comparative balance sheet of Coulson, Inc. at December 31, 20Y2 and 20Y1, is as follows: The...

Related questions

Question

Transcribed Image Text:Prepare the balance sheet and income statement by rearranging the above items.

Note: Be sure to list the assets and liabilities in order of their liquidity. Enter all amounts as positive values.

Cash

Receivables

Inventories

BALANCE SHEET

Assets

Liabilities and Shareholders' Equity

$

15 Payables

$

35

35 Debt due for repayment

25

50

Total current assets

$

100 Total current liabilities

$

60

Property, plant, and equipment

520

Long-term debt

Total liabilities

350

$

410

Net fixed assets

Total assets

$

520 Shareholders' equity

90

$

620 Total liabilities and shareholders' equity

$

500

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning