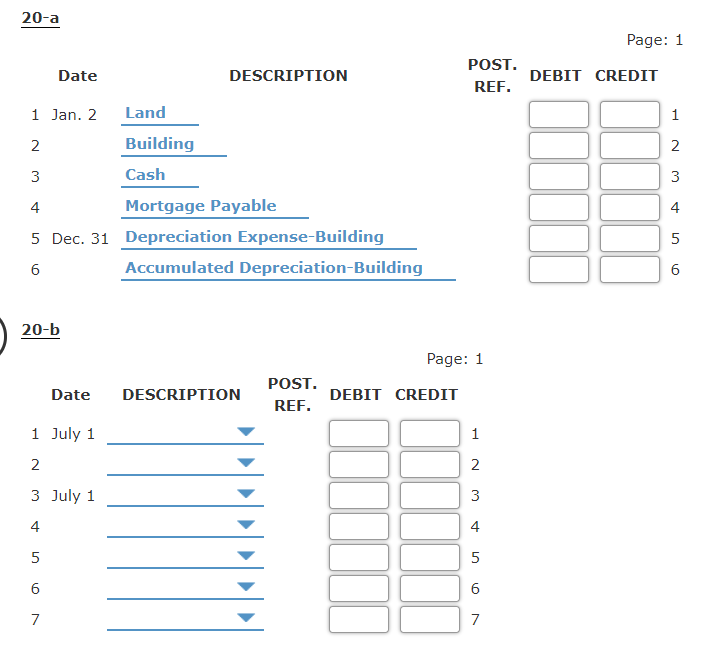

Prepare the general journal entries for the following transactions. 20-a Jan. 2 Purchased land with a building on it for $750,000. The land is worth $300,000. Paid $150,000 down and signed a mortgage to be paid over 20 years. Dec. 31 Depreciation is computed using the straight-line method. The building has an estimated salvage value of $75,000 and an estimated life of 20 years.20-b Jul. 1 The building and the land are sold for $825,000 cash. If an amount box does not require an entry, leave it blank

Prepare the general journal entries for the following transactions. 20-a Jan. 2 Purchased land with a building on it for $750,000. The land is worth $300,000. Paid $150,000 down and signed a mortgage to be paid over 20 years. Dec. 31 Depreciation is computed using the straight-line method. The building has an estimated salvage value of $75,000 and an estimated life of 20 years.20-b Jul. 1 The building and the land are sold for $825,000 cash. If an amount box does not require an entry, leave it blank

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter3: Basic Accounting Systems: Accrual Basis

Section: Chapter Questions

Problem 3.23E: Adjustment for depreciation The estimated amount of depredation on equipment for the current year is...

Related questions

Question

Practice Pack

Prepare the general

| Jan. | 2 | Purchased land with a building on it for $750,000. The land is worth $300,000. Paid $150,000 down and signed a mortgage to be paid over 20 years. |

| Dec. | 31 |

| Jul. | 1 | The building and the land are sold for $825,000 cash. |

If an amount box does not require an entry, leave it blank.

Transcribed Image Text:20-a

Page: 1

POST.

Date

DESCRIPTION

DEBIT CREDIT

REF.

1 Jan. 2

Land

1

2

Building

2

3

Cash

3

Mortgage Payable

4

4

5 Dec. 31 Depreciation Expense-Building

5

Accumulated Depreciation-Building

6.

20-b

Page: 1

POST.

Date

DESCRIPTION

DEBIT CREDIT

REF.

1 July 1

1

2

2

3 July 1

3

4

4

6

7

7

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Includes step-by-step video

Trending now

This is a popular solution!

Learn your way

Includes step-by-step video

Step by step

Solved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning