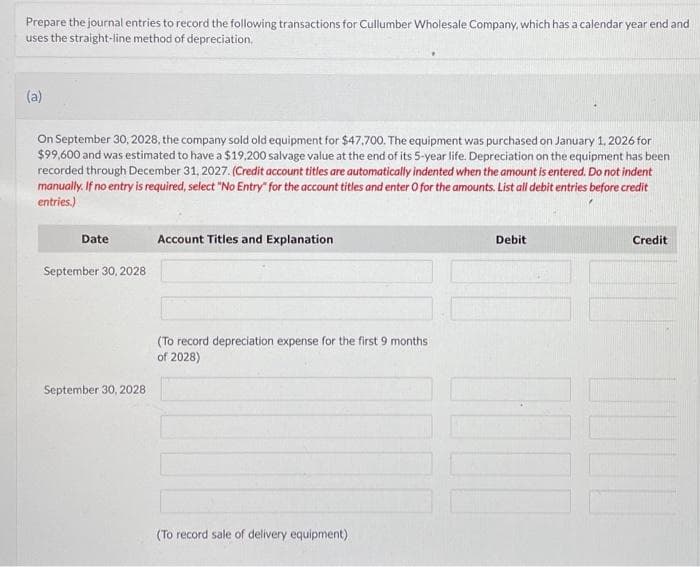

Prepare the journal entries to record the following transactions for Cullumber Wholesale Company, which has a calendar year end and uses the straight-line method of depreciation. (a) On September 30, 2028, the company sold old equipment for $47,700. The equipment was purchased on January 1, 2026 for $99,600 and was estimated to have a $19,200 salvage value at the end of its 5-year life. Depreciation on the equipment has been recorded through December 31, 2027. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.) Date September 30, 2028 September 30, 2028 Account Titles and Explanation (To record depreciation expense for the first 9 months of 2028) (To record sale of delivery equipment) Debit Credit

Prepare the journal entries to record the following transactions for Cullumber Wholesale Company, which has a calendar year end and uses the straight-line method of depreciation. (a) On September 30, 2028, the company sold old equipment for $47,700. The equipment was purchased on January 1, 2026 for $99,600 and was estimated to have a $19,200 salvage value at the end of its 5-year life. Depreciation on the equipment has been recorded through December 31, 2027. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.) Date September 30, 2028 September 30, 2028 Account Titles and Explanation (To record depreciation expense for the first 9 months of 2028) (To record sale of delivery equipment) Debit Credit

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter11: Depreciation, Depletion, Impairment, And Disposal

Section: Chapter Questions

Problem 9P: During 2019, Ryel Companys controller asked you to prepare correcting journal entries for the...

Related questions

Question

Do not give image format

Transcribed Image Text:Prepare the journal entries to record the following transactions for Cullumber Wholesale Company, which has a calendar year end and

uses the straight-line method of depreciation.

(a)

On September 30, 2028, the company sold old equipment for $47,700. The equipment was purchased on January 1, 2026 for

$99,600 and was estimated to have a $19,200 salvage value at the end of its 5-year life. Depreciation on the equipment has been

recorded through December 31, 2027. (Credit account titles are automatically indented when the amount is entered. Do not indent

manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit

entries.)

Date

September 30, 2028

September 30, 2028

Account Titles and Explanation

(To record depreciation expense for the first 9 months

of 2028)

(To record sale of delivery equipment)

Debit

10

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning