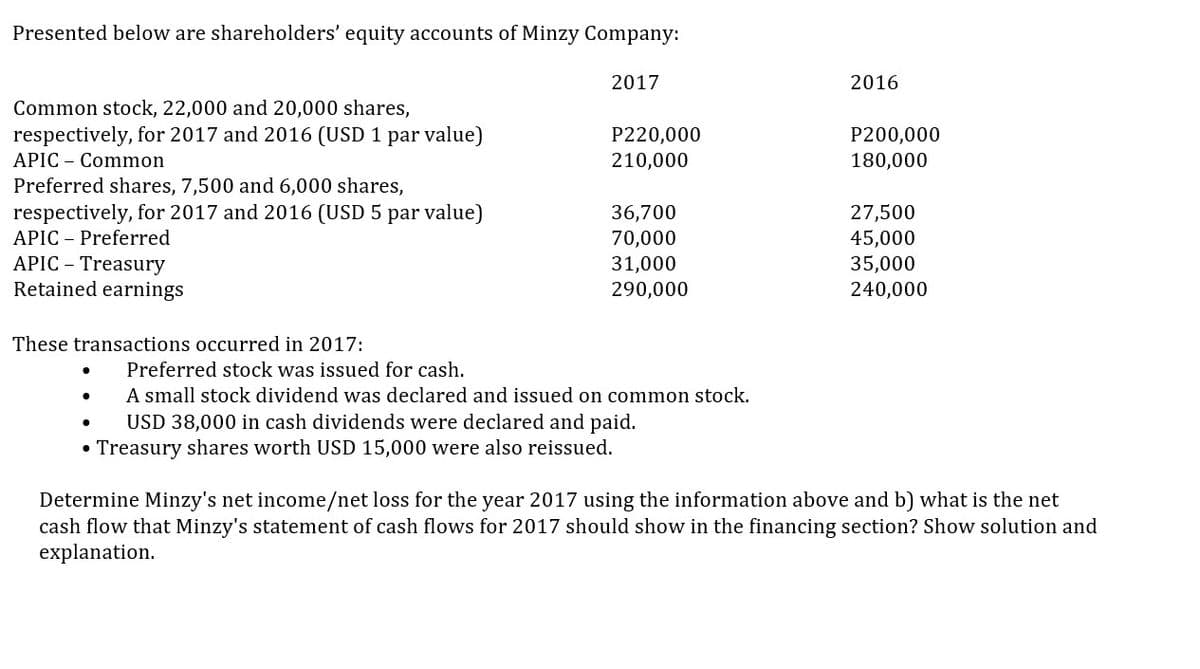

Presented below are shareholders' equity accounts of Minzy Company: 2017 2016 Common stock, 22,000 and 20,000 shares, respectively, for 2017 and 2016 (USD 1 par value) APIC Common P220,000 P200,000 210,000 180,000 Preferred shares, 7,500 and 6,000 shares, 36,700 27,500 respectively, for 2017 and 2016 (USD 5 par value) APIC - Preferred 70,000 45,000 APIC-Treasury 31,000 35,000 Retained earnings 290,000 240,000 These transactions occurred in 2017: Preferred stock was issued for cash. ● A small stock dividend was declared and issued on common stock. ● USD 38,000 in cash dividends were declared and paid. • Treasury shares worth USD 15,000 were also reissued. Determine Minzy's net income/net loss for the year 2017 using the information above and b) what is the net cash flow that Minzy's statement of cash flows for 2017 should show in the financing section? Show solution and explanation.

Presented below are shareholders' equity accounts of Minzy Company: 2017 2016 Common stock, 22,000 and 20,000 shares, respectively, for 2017 and 2016 (USD 1 par value) APIC Common P220,000 P200,000 210,000 180,000 Preferred shares, 7,500 and 6,000 shares, 36,700 27,500 respectively, for 2017 and 2016 (USD 5 par value) APIC - Preferred 70,000 45,000 APIC-Treasury 31,000 35,000 Retained earnings 290,000 240,000 These transactions occurred in 2017: Preferred stock was issued for cash. ● A small stock dividend was declared and issued on common stock. ● USD 38,000 in cash dividends were declared and paid. • Treasury shares worth USD 15,000 were also reissued. Determine Minzy's net income/net loss for the year 2017 using the information above and b) what is the net cash flow that Minzy's statement of cash flows for 2017 should show in the financing section? Show solution and explanation.

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter11: Stockholders' Equity

Section: Chapter Questions

Problem 11.8E

Related questions

Question

Show solution and explanation.

Transcribed Image Text:Presented below are shareholders' equity accounts of Minzy Company:

2017

2016

Common stock, 22,000 and 20,000 shares,

P220,000

P200,000

respectively, for 2017 and 2016 (USD 1 par value)

APIC Common

210,000

180,000

Preferred shares, 7,500 and 6,000 shares,

36,700

27,500

respectively, for 2017 and 2016 (USD 5 par value)

APIC Preferred

70,000

45,000

APIC - Treasury

31,000

35,000

Retained earnings

290,000

240,000

These transactions occurred in 2017:

Preferred stock was issued for cash.

A small stock dividend was declared and issued on common stock.

•

USD 38,000 in cash dividends were declared and paid.

• Treasury shares worth USD 15,000 were also reissued.

Determine Minzy's net income/net loss for the year 2017 using the information above and b) what is the net

cash flow that Minzy's statement of cash flows for 2017 should show in the financing section? Show solution and

explanation.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning