Presented below are two independent situations: i) Horton Company redeemed $400,000fa value, 12% bonds at 96 on July 31, 2021. Th carrving value of the bonds on the retireme

Presented below are two independent situations: i) Horton Company redeemed $400,000fa value, 12% bonds at 96 on July 31, 2021. Th carrving value of the bonds on the retireme

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter22: Corporations: Bonds

Section: Chapter Questions

Problem 4SEA: REDEMPTION OF BONDS ISSUED AT FACE VALUE Levesque Lumber Co. issued 800,000 in bonds at face value...

Related questions

Question

100%

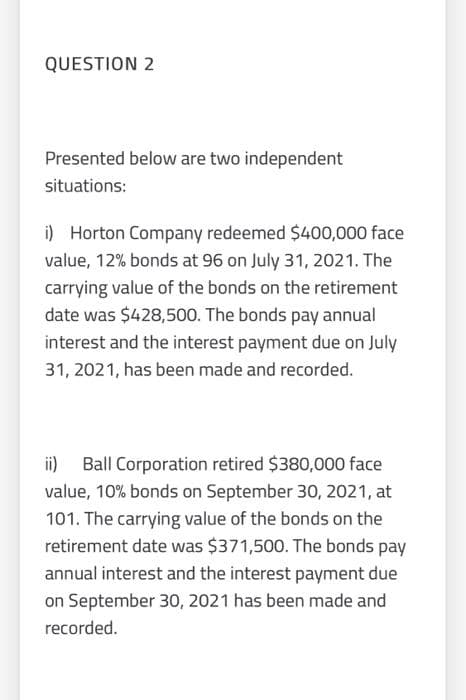

Transcribed Image Text:QUESTION 2

Presented below are two independent

situations:

i) Horton Company redeemed $400,000 face

value, 12% bonds at 96 on July 31, 2021. The

carrying value of the bonds on the retirement

date was $428,500. The bonds pay annual

interest and the interest payment due on July

31, 2021, has been made and recorded.

ii)

Ball Corporation retired $380,000 face

value, 10% bonds on September 30, 2021, at

101. The carrying value of the bonds on the

retirement date was $371,500. The bonds pay

annual interest and the interest payment due

on September 30, 2021 has been made and

recorded.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College