Presented below are two independent situations. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal WileyPLUS Support jes in the order presented in the problem.) (a) On January 6, Brumbaugh Co. sells merchandise on account to Pryor Inc. for $7,000, terms 2/10, n/30. On January 16, Pryor Inc. pays the amount due. Prepare the entries on Brumbaugh's books to record the sale and related collection. (Omit cost of goods sold entries.) (b) On January 10, Andrew Farley uses his Paltrow Co.credit card to purchase merchandise from Paltrow Co. for $9,000. On February 10, Farley is billed for the amount due of $9,000. On February 12, Farley pays $5,000 on the balance due. On March 10, Farley is billed for the amount due, including interest at 1% per month on the unpaid balance as of February 12. Prepare the entries on Paltrow Co's books related to the transactions that occurred on January 10, February 12, and March 10. (Omit cost of goods sold entries.) No. Date Account Titles and Explanation Debit Credit (a) Jan. 6 Accounts Receivable 7000 Sales Revenue 7000 Jan. 16 Cash Sales Discounts (b) Jan. 10 Accounts Receivable 9000 Sales Revenue 9000 Feb. 12 Cash 5000 Accounts Receivable 5000

Presented below are two independent situations. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal WileyPLUS Support jes in the order presented in the problem.) (a) On January 6, Brumbaugh Co. sells merchandise on account to Pryor Inc. for $7,000, terms 2/10, n/30. On January 16, Pryor Inc. pays the amount due. Prepare the entries on Brumbaugh's books to record the sale and related collection. (Omit cost of goods sold entries.) (b) On January 10, Andrew Farley uses his Paltrow Co.credit card to purchase merchandise from Paltrow Co. for $9,000. On February 10, Farley is billed for the amount due of $9,000. On February 12, Farley pays $5,000 on the balance due. On March 10, Farley is billed for the amount due, including interest at 1% per month on the unpaid balance as of February 12. Prepare the entries on Paltrow Co's books related to the transactions that occurred on January 10, February 12, and March 10. (Omit cost of goods sold entries.) No. Date Account Titles and Explanation Debit Credit (a) Jan. 6 Accounts Receivable 7000 Sales Revenue 7000 Jan. 16 Cash Sales Discounts (b) Jan. 10 Accounts Receivable 9000 Sales Revenue 9000 Feb. 12 Cash 5000 Accounts Receivable 5000

Chapter12: Current Liabilities

Section: Chapter Questions

Problem 5PB: Review the following transactions and prepare any necessary journal entries. A. On January 5, Bunnet...

Related questions

Topic Video

Question

Presented below are two independent situations. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Record

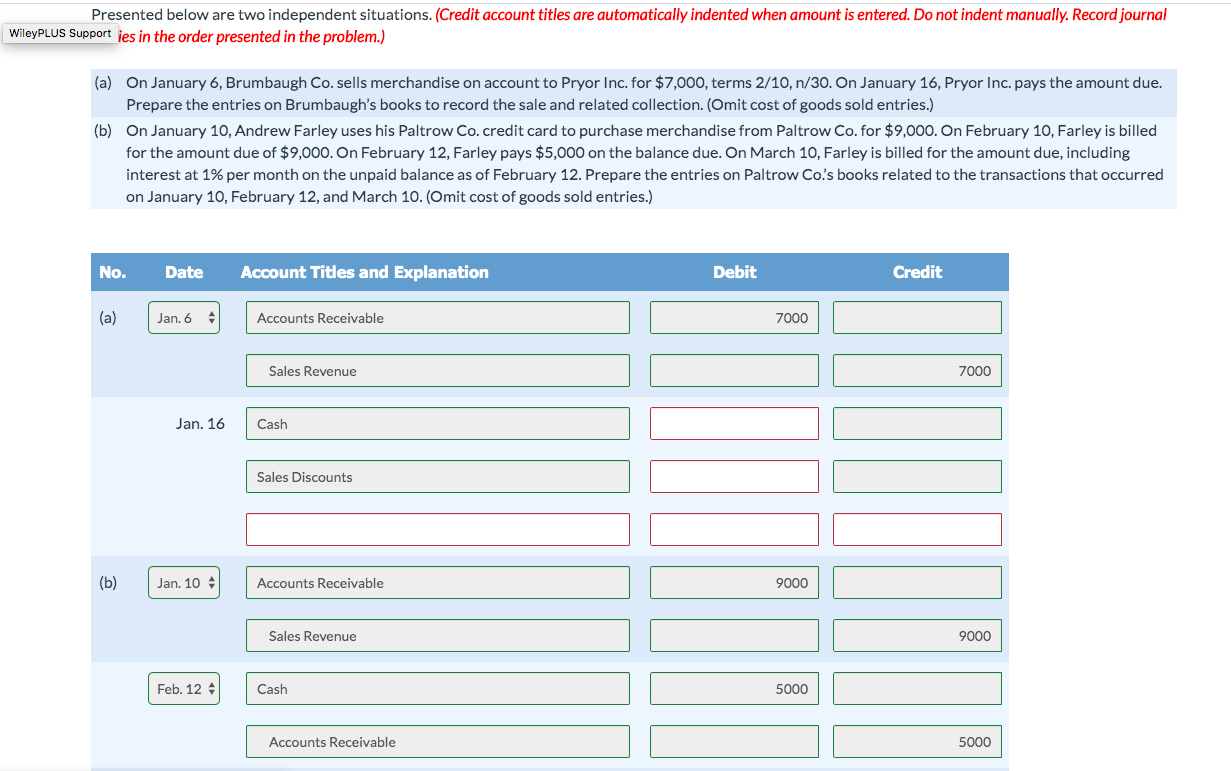

| (a) | On January 6, Brumbaugh Co. sells merchandise on account to Pryor Inc. for $7,000, terms 2/10, n/30. On January 16, Pryor Inc. pays the amount due. Prepare the entries on Brumbaugh’s books to record the sale and related collection. (Omit cost of goods sold entries.) | |

| (b) | On January 10, Andrew Farley uses his Paltrow Co. credit card to purchase merchandise from Paltrow Co. for $9,000. On February 10, Farley is billed for the amount due of $9,000. On February 12, Farley pays $5,000 on the balance due. On March 10, Farley is billed for the amount due, including interest at 1% per month on the unpaid balance as of February 12. Prepare the entries on Paltrow Co.’s books related to the transactions that occurred on January 10, February 12, and March 10. (Omit cost of goods sold entries.) |

Transcribed Image Text:Presented below are two independent situations. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal

WileyPLUS Support jes in the order presented in the problem.)

(a) On January 6, Brumbaugh Co. sells merchandise on account to Pryor Inc. for $7,000, terms 2/10, n/30. On January 16, Pryor Inc. pays the amount due.

Prepare the entries on Brumbaugh's books to record the sale and related collection. (Omit cost of goods sold entries.)

(b) On January 10, Andrew Farley uses his Paltrow Co.credit card to purchase merchandise from Paltrow Co. for $9,000. On February 10, Farley is billed

for the amount due of $9,000. On February 12, Farley pays $5,000 on the balance due. On March 10, Farley is billed for the amount due, including

interest at 1% per month on the unpaid balance as of February 12. Prepare the entries on Paltrow Co's books related to the transactions that occurred

on January 10, February 12, and March 10. (Omit cost of goods sold entries.)

No.

Date

Account Titles and Explanation

Debit

Credit

(a)

Jan. 6

Accounts Receivable

7000

Sales Revenue

7000

Jan. 16

Cash

Sales Discounts

(b)

Jan. 10

Accounts Receivable

9000

Sales Revenue

9000

Feb. 12

Cash

5000

Accounts Receivable

5000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning