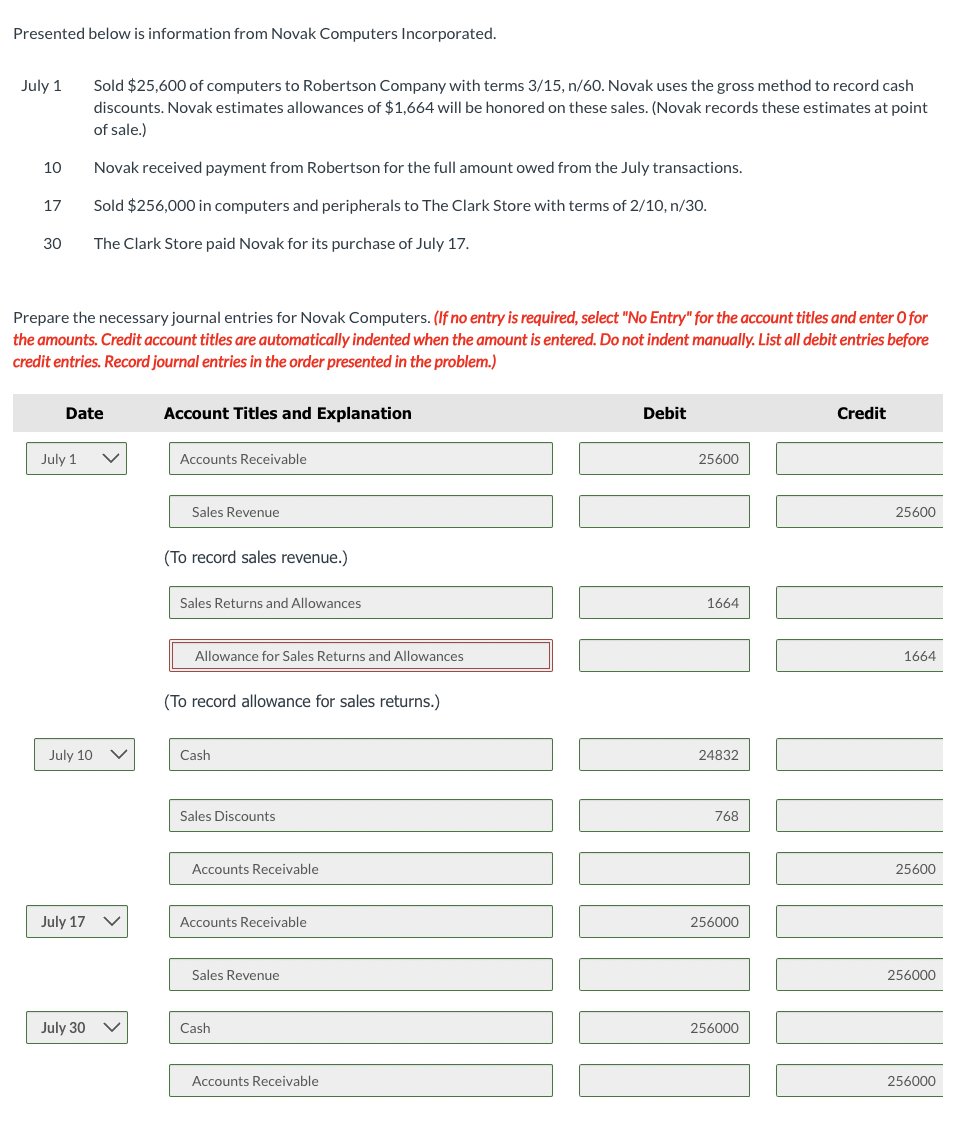

Presented below is information from Novak Computers Incorporated. July 1 10 17 30 Sold $25,600 of computers to Robertson Company with terms 3/15, n/60. Novak uses the gross method to record cash discounts. Novak estimates allowances of $1,664 will be honored on these sales. (Novak records these estimates at point of sale.) Novak received payment from Robertson for the full amount owed from the July transactions. Sold $256,000 in computers and peripherals to The Clark Store with terms of 2/10,n/30. The Clark Store paid Novak for its purchase of July 17. Prepare the necessary journal entries for Novak Computers. (If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries. Record journal entries in the order presented in the problem.)

Presented below is information from Novak Computers Incorporated. July 1 10 17 30 Sold $25,600 of computers to Robertson Company with terms 3/15, n/60. Novak uses the gross method to record cash discounts. Novak estimates allowances of $1,664 will be honored on these sales. (Novak records these estimates at point of sale.) Novak received payment from Robertson for the full amount owed from the July transactions. Sold $256,000 in computers and peripherals to The Clark Store with terms of 2/10,n/30. The Clark Store paid Novak for its purchase of July 17. Prepare the necessary journal entries for Novak Computers. (If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries. Record journal entries in the order presented in the problem.)

Financial Accounting

14th Edition

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Carl Warren, Jim Reeve, Jonathan Duchac

Chapter5: Accounting Systems

Section: Chapter Questions

Problem 7E: The revenue journal for Sapling Consulting Inc. follows. The accounts receivable controlling account...

Related questions

Question

What should I put for the red marked box if the answer is not "Allowance for sales returns and allowances"?

Transcribed Image Text:Presented below is information from Novak Computers Incorporated.

July 1

10

17

30

Prepare the necessary journal entries for Novak Computers. (If no entry is required, select "No Entry" for the account titles and enter O for

the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before

credit entries. Record journal entries in the order presented in the problem.)

Date

July 1

July 10

Sold $25,600 of computers to Robertson Company with terms 3/15, n/60. Novak uses the gross method to record cash

discounts. Novak estimates allowances of $1,664 will be honored on these sales. (Novak records these estimates at point

of sale.)

Novak received payment from Robertson for the full amount owed from the July transactions.

Sold $256,000 in computers and peripherals to The Clark Store with terms of 2/10, n/30.

The Clark Store paid Novak for its purchase of July 17.

July 17

July 30

Account Titles and Explanation

Accounts Receivable

Sales Revenue

(To record sales revenue.)

Sales Returns and Allowances

Allowance for Sales Returns and Allowances

(To record allowance for sales returns.)

Cash

Sales Discounts

Accounts Receivable

Accounts Receivable

Sales Revenue

Cash

Accounts Receivable

Debit

25600

1664

24832

768

256000

256000

Credit

25600

1664

25600

256000

256000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning