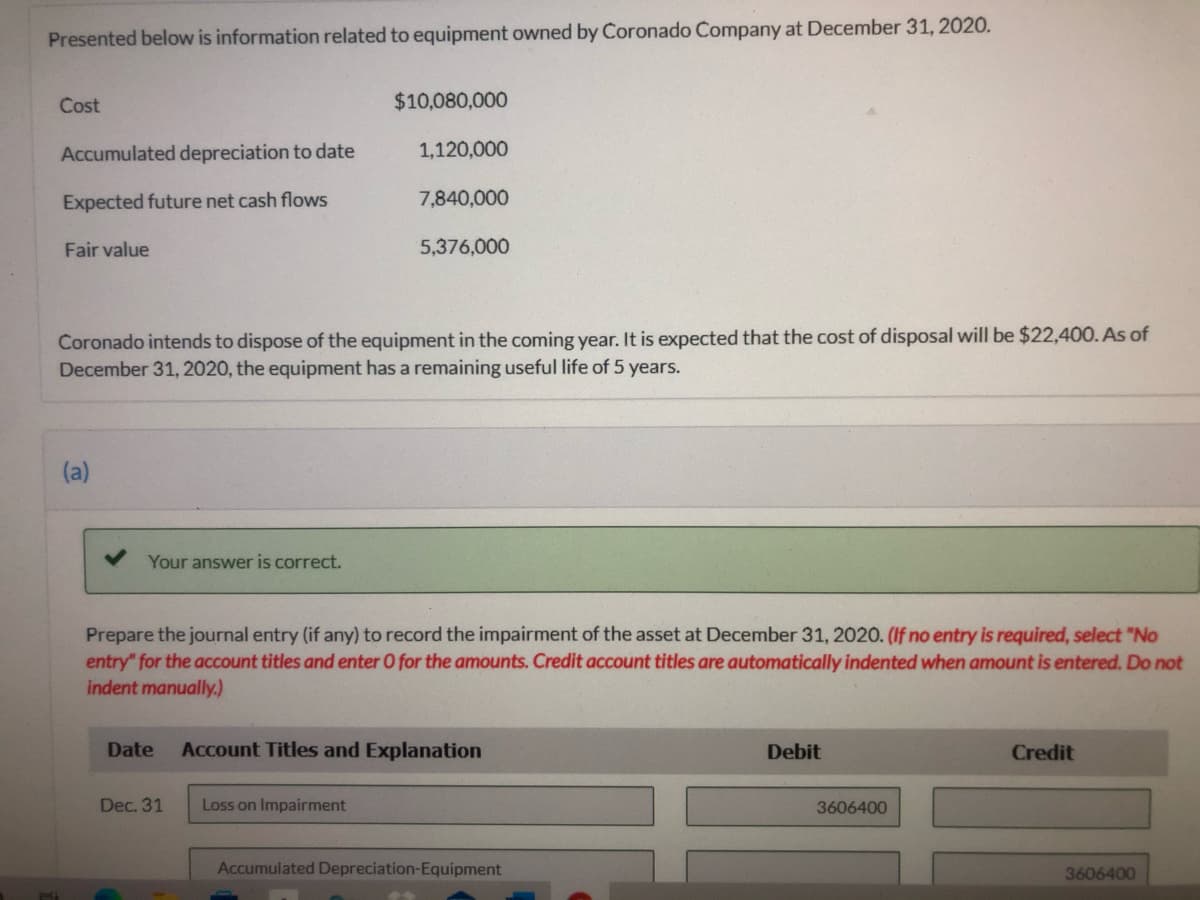

Presented below is information related to equipment owned by Coronado Company at December 31, 2020. Cost $10,080,000 Accumulated depreciation to date 1,120,000 Expected future net cash flows 7,840,000 Fair value 5,376,000 Coronado intends to dispose of the equipment in the coming year. It is expected that the cost of disposal will be $22,400. As of December 31, 2020, the equipment has a remaining useful life of 5 years. (a) Your answer is correct. Prepare the journal entry (if any) to record the impairment of the asset at December 31, 2020. (If no entry is required, select "No entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit Dec. 31 Loss on Impairment 3606400 Accumulated Depreciation-Equipment 3606400

Presented below is information related to equipment owned by Coronado Company at December 31, 2020. Cost $10,080,000 Accumulated depreciation to date 1,120,000 Expected future net cash flows 7,840,000 Fair value 5,376,000 Coronado intends to dispose of the equipment in the coming year. It is expected that the cost of disposal will be $22,400. As of December 31, 2020, the equipment has a remaining useful life of 5 years. (a) Your answer is correct. Prepare the journal entry (if any) to record the impairment of the asset at December 31, 2020. (If no entry is required, select "No entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit Dec. 31 Loss on Impairment 3606400 Accumulated Depreciation-Equipment 3606400

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter11: Depreciation, Depletion, Impairment, And Disposal

Section: Chapter Questions

Problem 4P: Cost of Asset and Depreciation Method Heist Company purchased a machine on January 2, 2019, and uses...

Related questions

Question

Only need help with part C.

Transcribed Image Text:Presented below is information related to equipment owned by Coronado Company at December 31, 2020.

Cost

$10,080,000

Accumulated depreciation to date

1,120,000

Expected future net cash flows

7,840,000

Fair value

5,376,000

Coronado intends to dispose of the equipment in the coming year. It is expected that the cost of disposal will be $22,400. As of

December 31, 2020, the equipment has a remaining useful life of 5 years.

(a)

Your answer is correct.

Prepare the journal entry (if any) to record the impairment of the asset at December 31, 2020. (If no entry is required, select "No

entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when amount is entered. Do not

indent manually.)

Date

Account Titles and Explanation

Debit

Credit

Dec. 31

Loss on Impairment

3606400

Accumulated Depreciation-Equipment

3606400

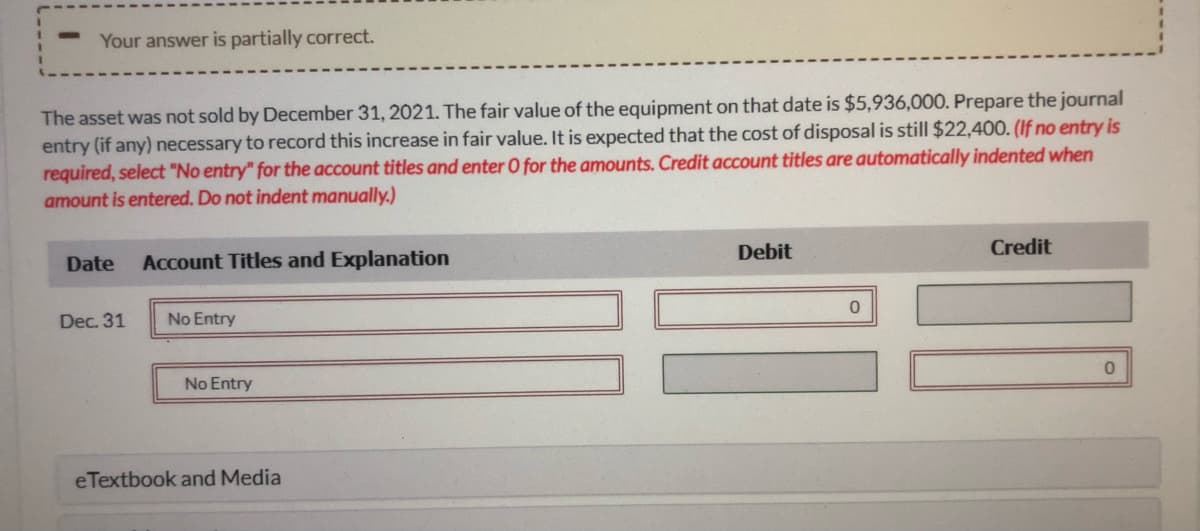

Transcribed Image Text:Your answer is partially correct.

The asset was not sold by December 31, 2021. The fair value of the equipment on that date is $5,936,000. Prepare the journal

entry (if any) necessary to record this increase in fair value. It is expected that the cost of disposal is still $22,400. (If no entry is

required, select "No entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when

amount is entered. Do not indent manually.)

Debit

Credit

Date

Account Titles and Explanation

Dec. 31

No Entry

No Entry

eTextbook and Media

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College