Presented below is the December 31, 2020 pre-closing trial balance for Tumbleweed Painting Company. 1. Prepare a classified balance sheet as of December 31, 2020 in good form like you would present it to a client (i.e. proper heading, dollar signs, underlining, no abbreviations). 2. Calculate working capital and the current ratio, (round the ratio to 2 places past the decimal) Account Title Accounts payable $ 22,000 Accounts receivable 82,000 Arcumulated denreciation buildinns 7 500

Presented below is the December 31, 2020 pre-closing trial balance for Tumbleweed Painting Company. 1. Prepare a classified balance sheet as of December 31, 2020 in good form like you would present it to a client (i.e. proper heading, dollar signs, underlining, no abbreviations). 2. Calculate working capital and the current ratio, (round the ratio to 2 places past the decimal) Account Title Accounts payable $ 22,000 Accounts receivable 82,000 Arcumulated denreciation buildinns 7 500

Financial Accounting

14th Edition

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Carl Warren, Jim Reeve, Jonathan Duchac

Chapter6: Accounting For Merchandising Businesses

Section: Chapter Questions

Problem 6PB: Selected accounts and related amounts for Kanpur Co. for the fiscal year ended June 30, 2016, are...

Related questions

Question

answer quickly

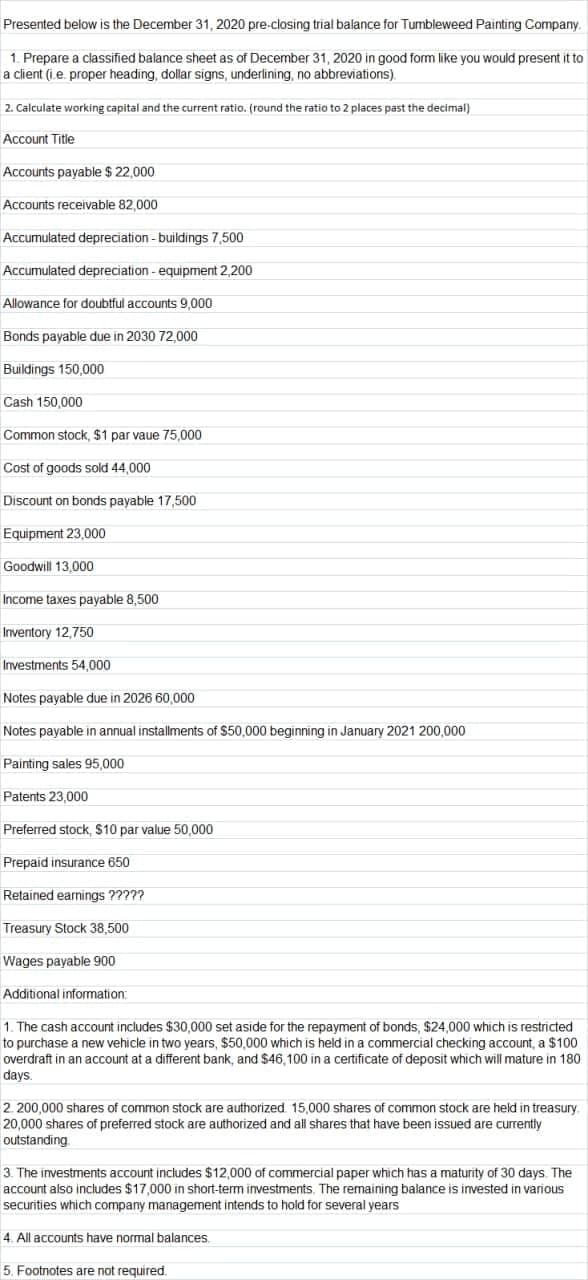

Transcribed Image Text:Presented below is the December 31, 2020 pre-closing trial balance for Tumbleweed Painting Company.

1. Prepare a classified balance sheet as of December 31, 2020 in good form like you would present it to

a client (i.e. proper heading, dollar signs, underlining, no abbreviations).

2. Calculate working capital and the current ratio. (round the ratio to 2 places past the decimal)

Account Title

Accounts payable $ 22,000

Accounts receivable 82,000

Accumulated depreciation - buildings 7,500

Accumulated depreciation - equipment 2,200

Allowance for doubtful accounts 9,000

Bonds payable due in 2030 72,000

Buildings 150,000

Cash 150,000

Common stock, $1 par vaue 75,000

Cost of goods sold 44,000

Discount on bonds payable 17,500

Equipment 23.000

Goodwill 13,000

Income taxes payable 8,500

Inventory 12,750

Investments 54.000

Notes payable due in 2026 60,000

Notes payable in annual installments of $50,000 beginning in January 2021 200,000

Painting sales 95,000

Patents 23,000

Preferred stock, $10 par value 50,000

Prepaid insurance 650

Retained earnings ?????

Treasury Stock 38,500

Wages payable 900

Additional infomation:

1. The cash account includes $30,000 set aside for the repayment of bonds, $24,000 which is restricted

to purchase a new vehicle in two years, $50,000 which is held in a commercial checking account, a $100

overdraft in an account at a different bank, and $46,100 in a certificate of deposit which will mature in 180

days.

2. 200,000 shares of common stock are authorized. 15,000 shares of common stock are held in treasury.

20,000 shares of preferred stock are authorized and all shares that have been issued are currently

outstanding

3. The investments account includes $12,000 of commercial paper which has a maturity of 30 days. The

account also includes $17,000 in short-term investments. The remaining balance is invested in various

securities which company management intends to hold for several years

4. All accounts have normal balances.

5. Footnotes are not required.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning