Press Esc to exit full screen Import Ltd imports raw materials from a supplier in the United states for an amount of $40 000. Transport costs on the raw materials amounted to $2 500. These transport costs were paid on 31 May 2016. Payment for the raw materials was made on 31 august 2016. The raw materials were ordered on 30 November 2015. The raw materials were delivered and taken into stock on 31 January 2016 and import limited was invoiced on the same date, i.e. 31 January 2016. The year end of the company is 30 June 2016. 20% of the raw materials bought from the united states was still on hand at year end. The following exchange rates are applicable: REQUIRED: Date 30 November 2015 31 January 2016 31 May 2016 30 June 2016 31 August 2016 R/$ exchange rate Rg.80 R10.20 R10.40 R10.15 R10.30 2.1 Prepare all the journal entries in the accounting records of the Import Ltd for the period 20

Press Esc to exit full screen Import Ltd imports raw materials from a supplier in the United states for an amount of $40 000. Transport costs on the raw materials amounted to $2 500. These transport costs were paid on 31 May 2016. Payment for the raw materials was made on 31 august 2016. The raw materials were ordered on 30 November 2015. The raw materials were delivered and taken into stock on 31 January 2016 and import limited was invoiced on the same date, i.e. 31 January 2016. The year end of the company is 30 June 2016. 20% of the raw materials bought from the united states was still on hand at year end. The following exchange rates are applicable: REQUIRED: Date 30 November 2015 31 January 2016 31 May 2016 30 June 2016 31 August 2016 R/$ exchange rate Rg.80 R10.20 R10.40 R10.15 R10.30 2.1 Prepare all the journal entries in the accounting records of the Import Ltd for the period 20

Chapter2: The Domestic And International Financial Marketplace

Section: Chapter Questions

Problem 11P

Related questions

Question

Transcribed Image Text:Press Esc to exit full screen

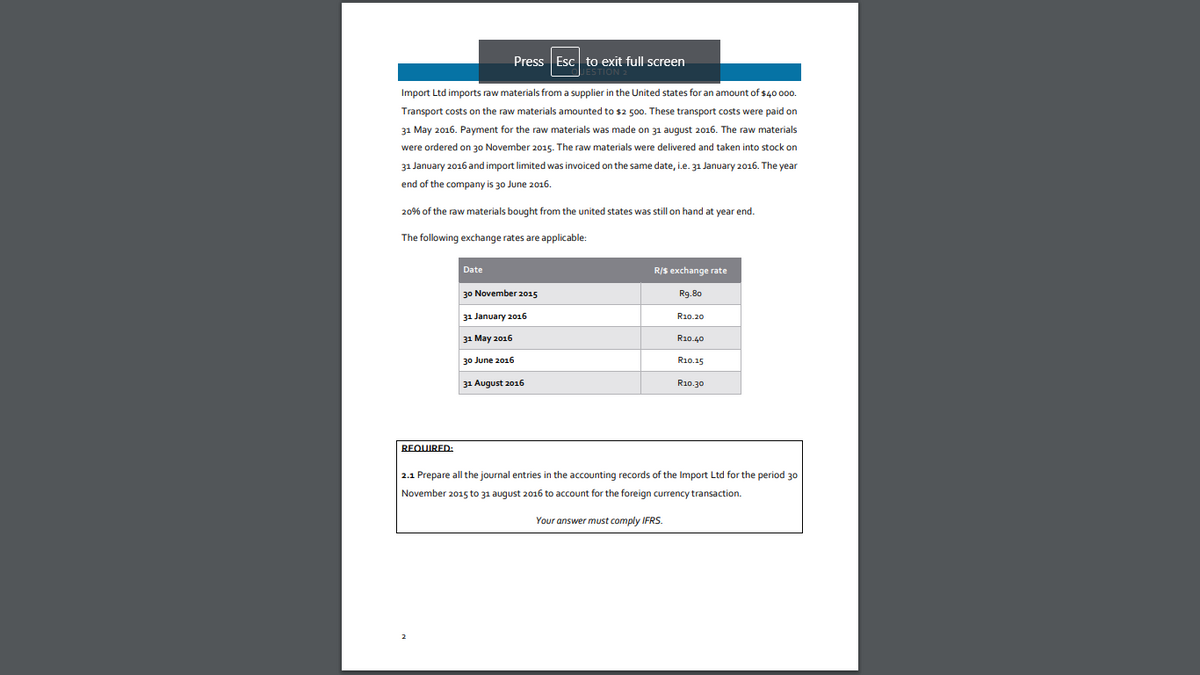

Import Ltd imports raw materials from a supplier in the United states for an amount of $40 000.

Transport costs on the raw materials amounted to $2 500. These transport costs were paid on

31 May 2016. Payment for the raw materials was made on 31 august 2016. The raw materials

were ordered on 30 November 2015. The raw materials were delivered and taken into stock on

31 January 2016 and import limited was invoiced on the same date, i.e. 31 January 2016. The year

end of the company is 30 June 2016.

20% of the raw materials bought from the united states was still on hand at year end.

The following exchange rates are applicable:

REQUIRED:

Date

30 November 2015

31 January 2016

31 May 2016

30 June 2016

31 August 2016

R/$ exchange rate

Rg.80

R10.20

R10.40

R10.15

R10.30

2.1 Prepare all the journal entries in the accounting records of the Import Ltd for the period 30

November 2015 to 31 august 2016 to account for the foreign currency transaction.

Your answer must comply IFRS.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub