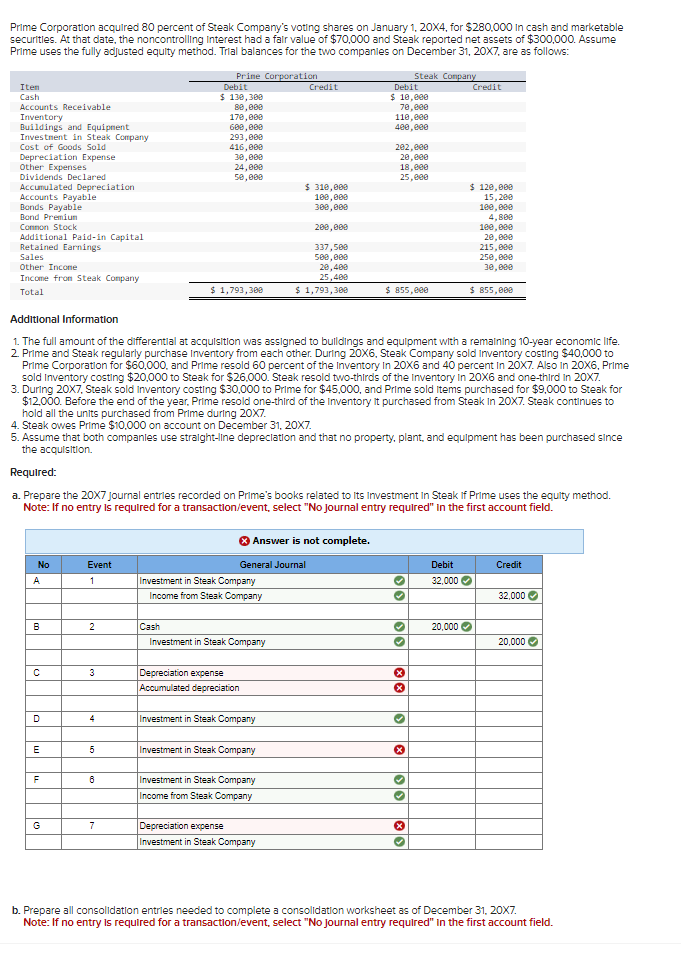

Prime Corporation acquired 80 percent of Steak Company's voting shares on January 1, 20X4, for $280,000 in cash and marketable securities. At that date, the noncontrolling Interest had a fair value of $70,000 and Steak reported net assets of $300,000. Assume Prime uses the fully adjusted equity method. Trial balances for the two companies on December 31, 20X7, are as follows: Steak Company Iten Cash Accounts Receivable Inventory Buildings and Equipment Investment in Steak Company Cost of Goods Sold Depreciation Expense Other Expenses Dividends Declared Accumulated Depreciation Accounts Payable Bonds Payable Bond Premium Connon Stock Prime Corporation Debit $ 130,300 80,000 170,000 600,000 293,000 416,000 30,000 24,000 50,000 Credit $ 310,000 100,000 300,000 200 000 Debit $ 10,000 70,000 110,000 400,000 202,000 20,000 18,000 25,000 Credit $ 120,000 15,200 100,000 4,800 100 000

Prime Corporation acquired 80 percent of Steak Company's voting shares on January 1, 20X4, for $280,000 in cash and marketable securities. At that date, the noncontrolling Interest had a fair value of $70,000 and Steak reported net assets of $300,000. Assume Prime uses the fully adjusted equity method. Trial balances for the two companies on December 31, 20X7, are as follows: Steak Company Iten Cash Accounts Receivable Inventory Buildings and Equipment Investment in Steak Company Cost of Goods Sold Depreciation Expense Other Expenses Dividends Declared Accumulated Depreciation Accounts Payable Bonds Payable Bond Premium Connon Stock Prime Corporation Debit $ 130,300 80,000 170,000 600,000 293,000 416,000 30,000 24,000 50,000 Credit $ 310,000 100,000 300,000 200 000 Debit $ 10,000 70,000 110,000 400,000 202,000 20,000 18,000 25,000 Credit $ 120,000 15,200 100,000 4,800 100 000

Chapter20: Corporations: Distributions In Complete Liquidation And An Overview Of Reorganizations

Section: Chapter Questions

Problem 35P

Related questions

Question

Transcribed Image Text:Prime Corporation acquired 80 percent of Steak Company's voting shares on January 1, 20X4, for $280,000 in cash and marketable

securities. At that date, the noncontrolling Interest had a fair value of $70,000 and Steak reported net assets of $300,000. Assume

Prime uses the fully adjusted equity method. Trial balances for the two companies on December 31, 20X7, are as follows:

Steak Company

Iten

Cash

Accounts Receivable

Inventory

Buildings and Equipment

Investment in Steak Company

Cost of Goods Sold

Depreciation Expense

Other Expenses

Dividends Declared

Accumulated Depreciation

Accounts Payable

Bonds Payable

Bond Premium

Connon Stock

Additional Paid-in Capital

Retained Earnings

Sales

Other Income

Income from Steak Company

Total

No

A

B

C

D

E

LL

F

G

Event

1

Additional Information

1. The full amount of the differential at acquisition was assigned to buildings and equipment with a remaining 10-year economic life.

2. Prime and Steak regularly purchase Inventory from each other. During 20X6, Steak Company sold Inventory costing $40,000 to

Prime Corporation for $60,000, and Prime resold 60 percent of the Inventory In 20X6 and 40 percent In 20X7. Also in 20X6, Prime

sold Inventory costing $20,000 to Steak for $26,000. Steak resold two-thirds of the Inventory in 20X6 and one-third In 20x7.

3. During 20X7, Steak sold Inventory costing $30,000 to Prime for $45,000, and Prime sold Items purchased for $9,000 to Steak for

$12,000. Before the end of the year, Prime resold one-third of the Inventory it purchased from Steak in 20X7. Steak continues to

hold all the units purchased from Prime during 20X7.

4. Steak owes Prime $10,000 on account on December 31, 20X7.

2

5. Assume that both companies use straight-line depreciation and that no property, plant, and equipment has be purchased since

the acquisition.

Required:

3

a. Prepare the 20X7 journal entries recorded on Prime's books related to its Investment in Steak if Prime uses the equity method.

Note: If no entry is required for a transaction/event, select "No Journal entry required" in the first account field.

5

Prime Corporation

6

Debit

$ 130,300

80,000

170,000

7

600,000

293,000

416,000

30,000

24,000

50,000

$ 1,793,300

Cash

Investment in Steak Company

Income from Steak Company

Depreciation expense

Accumulated depreciation

Answer is not complete.

General Journal

Investment in Steak Company

Credit

$ 310,000

100,000

300,000

200,000

337,500

500,000

20,400

25,400

$ 1,793,300

Investment in Steak Company

Investment in Steak Company

Investment in Steak Company

Income from Steak Company

Debit

$ 10,000

70,000

110,000

400,000

Depreciation expense

Investment in Steak Company

202,000

20,000

18,000

25,000

$ 855,000

33

X

X

3

X

››

3*

Credit

$120,000

15,200

100,000

X

4,888

100,000

20,000

215,000

250,000

30,000

$ 855,000

20,000

Debit

32,000 ✓

Credit

32,000✔

20,000✔

b. Prepare all consolidation entries needed to complete a consolidation worksheet as of December 31, 20X7.

Note: If no entry is required for a transaction/event, select "No Journal entry required" in the first account field.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 8 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning