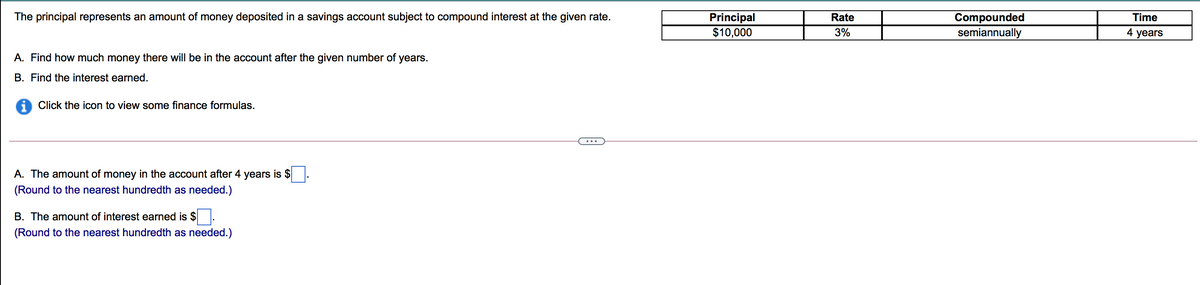

Principal $10,000 Compounded semiannually The principal represents an amount money deposited in a savings account subject to compound interest at the given rate. Rate Time 3% 4 years A. Find how much money there will be in the account after the given number of years. B. Find the interest earned. Click the icon to view some finance formulas. A. The amount of money in the account after 4 years is $. (Round to the nearest hundredth as needed.) B. The amount of interest earned is $. (Round to the nearest hundredth as needed.)

Principal $10,000 Compounded semiannually The principal represents an amount money deposited in a savings account subject to compound interest at the given rate. Rate Time 3% 4 years A. Find how much money there will be in the account after the given number of years. B. Find the interest earned. Click the icon to view some finance formulas. A. The amount of money in the account after 4 years is $. (Round to the nearest hundredth as needed.) B. The amount of interest earned is $. (Round to the nearest hundredth as needed.)

Chapter9: Sequences, Probability And Counting Theory

Section9.4: Series And Their Notations

Problem 62SE: Rachael deposits $1500 into a retirement fund each year. The fund earns 8.2% annual interest,...

Related questions

Question

Transcribed Image Text:The principal represents an amount of money deposited in a savings account subject to compound interest at the given rate.

Principal

$10,000

Compounded

semiannually

Rate

Time

3%

4 years

A. Find how much money there will be in the account after the given number of years.

B. Find the interest earned.

A Click the icon to view some finance formulas.

A. The amount of money in the account after 4 years is $

(Round to the nearest hundredth as needed.)

B. The amount of interest earned is $.

(Round to the nearest hundredth as needed.)

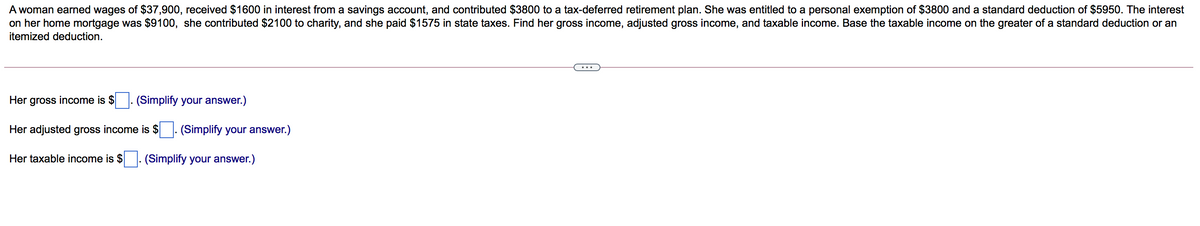

Transcribed Image Text:A woman earned wages of $37,900, received $1600 in interest from a savings account, and contributed $3800 to a tax-deferred retirement plan. She was entitled to a personal exemption of $3800 and a standard deduction of $5950. The interest

on her home mortgage was $9100, she contributed $2100 to charity, and she paid $1575 in state taxes. Find her gross income, adjusted gross income, and taxable income. Base the taxable income on the greater of a standard deduction or an

itemized deduction.

Her

gross

income is $

(Simplify your answer.)

Her adjusted gross income is $

(Simplify your answer.)

Her taxable income is $. (Simplify your answer.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Holt Mcdougal Larson Pre-algebra: Student Edition…

Algebra

ISBN:

9780547587776

Author:

HOLT MCDOUGAL

Publisher:

HOLT MCDOUGAL

Holt Mcdougal Larson Pre-algebra: Student Edition…

Algebra

ISBN:

9780547587776

Author:

HOLT MCDOUGAL

Publisher:

HOLT MCDOUGAL