Principal value What principal value must be invested today so that it's value grows to 2500 in 4 years at 5.5% interest and compounded semi annually

Principal value What principal value must be invested today so that it's value grows to 2500 in 4 years at 5.5% interest and compounded semi annually

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

ChapterA3: Time Value Of Money

Section: Chapter Questions

Problem 19E: Present Values Krista Kellman has an opportunity to purchase a government security that will pay...

Related questions

Question

100%

can you please show me all the steps how to solve these questions ie. addition or division or subtraction etc.

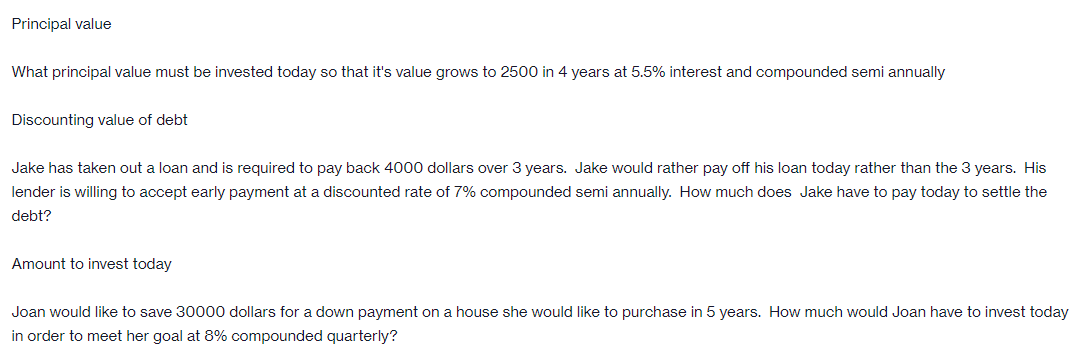

Transcribed Image Text:Principal value

What principal value must be invested today so that it's value grows to 2500 in 4 years at 5.5% interest and compounded semi annually

Discounting value of debt

Jake has taken out a loan and is required to pay back 4000 dollars over 3 years. Jake would rather pay off his loan today rather than the 3 years. His

lender is willing to accept early payment at a discounted rate of 7% compounded semi annually. How much does Jake have to pay today to settle the

debt?

Amount to invest today

Joan would like to save 30000 dollars for a down payment on a house she would like to purchase in 5 years. How much would Joan have to invest today

in order to meet her goal at 8% compounded quarterly?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT