PRO Which of the 1. Financial assets in the form of investments in subsidiaries, associates and joint ventures. b. Contracts for the delivery or receipt of commodity and the scope of PAS 32? a. other non-financial items that can be settled net in cash or other financial assets. Physical assets, such as inventories and PPE. d. Liabilities arising from constructive obligations. 2 A contract that evidences a residual interest in the entity's rcets after deducting all of its liabilities is classified as a a financial liability. b. an equity instrument. C. a or b d. neither a nor b = Which of the following statements is incorrect? a. The PAS 32 definition of "equity" reflects the basic accounting equation of "Assets – Liabilities = Equity." b. According to PAS 32, a contract is an equity instrument if it may result in the receipt or delivery of the entity's own equity instruments. C Entity A issues a compound financial instrument for P1M. If the fair value of the liability component without the equity feature is P.8M, the value to be assigned to the equity component is P.2M. d. An intention to settle a financial asset and a financial nability on a net basis without the legal right to do so is not sufficient to justify offsetting because the rights and obligations associated with the individual financial asset

PRO Which of the 1. Financial assets in the form of investments in subsidiaries, associates and joint ventures. b. Contracts for the delivery or receipt of commodity and the scope of PAS 32? a. other non-financial items that can be settled net in cash or other financial assets. Physical assets, such as inventories and PPE. d. Liabilities arising from constructive obligations. 2 A contract that evidences a residual interest in the entity's rcets after deducting all of its liabilities is classified as a a financial liability. b. an equity instrument. C. a or b d. neither a nor b = Which of the following statements is incorrect? a. The PAS 32 definition of "equity" reflects the basic accounting equation of "Assets – Liabilities = Equity." b. According to PAS 32, a contract is an equity instrument if it may result in the receipt or delivery of the entity's own equity instruments. C Entity A issues a compound financial instrument for P1M. If the fair value of the liability component without the equity feature is P.8M, the value to be assigned to the equity component is P.2M. d. An intention to settle a financial asset and a financial nability on a net basis without the legal right to do so is not sufficient to justify offsetting because the rights and obligations associated with the individual financial asset

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter18: Comparative Forms Of Doing Business

Section: Chapter Questions

Problem 5P

Related questions

Question

Transcribed Image Text:PROBLE

other financial assets.

associates and joint ventures.

delivering cash or another financial asset. However, Entity A's

not sufficient to justify offsetting because the rights and

d. An intention to settle a financial asset and a financial

2 A contract that evidences a residual interest in the entity's

assets after deducting all of its liabilities is classified as

4. Entity A issues an instrument that is re-purchasable by

d. Liabilities arising from constructive obligations.

Physical assets, such as inventories and PPE.

and financial liability remain unaltered.

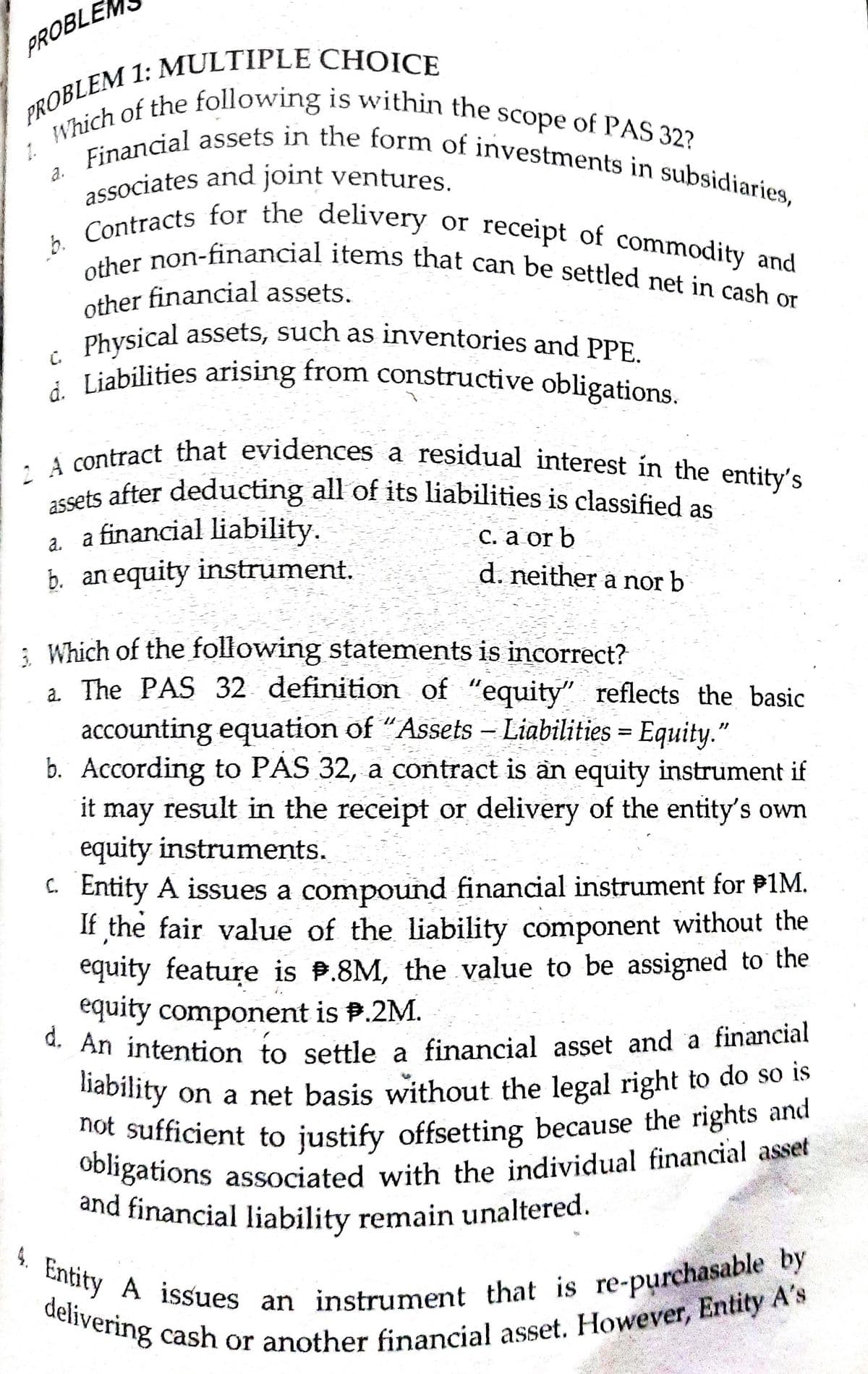

Which of the following is within the scope of PAS 32?

b. Contracts for the delivery or receipt of commodity and

other non-financial items that can be settled net in cash or

Financial assets in the form of investments in subsidiaries,

1.

a.

b.

Co non-financial items that can be settled net in cash or

Physical assets, such as inventories and PPE

C.

ssets after deducting all of its liabilities is classified as

a. a financial liability.

b. an equity instrument.

С. а or b

d. neither a nor b

: Which of the following statements is incorrect?

a. The PAS 32 definition of "equity" reflects the basic

accounting equation of "Assets – Liabilities = Equity."

b. According to PAS 32, a contract is an equity instrument if

|

it may result in the receipt or delivery of the entity's own

equity instruments.

C. Entity A issues a compound financial instrument for P1M.

If the fair value of the liability component without the

equity feature is P.8M, the value to be assigned to the

equity component is P.2M.

* An intention to settle a financial asset and a financial

nability on a net basis without the legal right to do so is

hot sufficient to justify offsetting because the rights and

Oongations associated with the individual financial asset

and financial liability remain unaltered.

Cntity A issues an instrument uhat

re-purchasable by

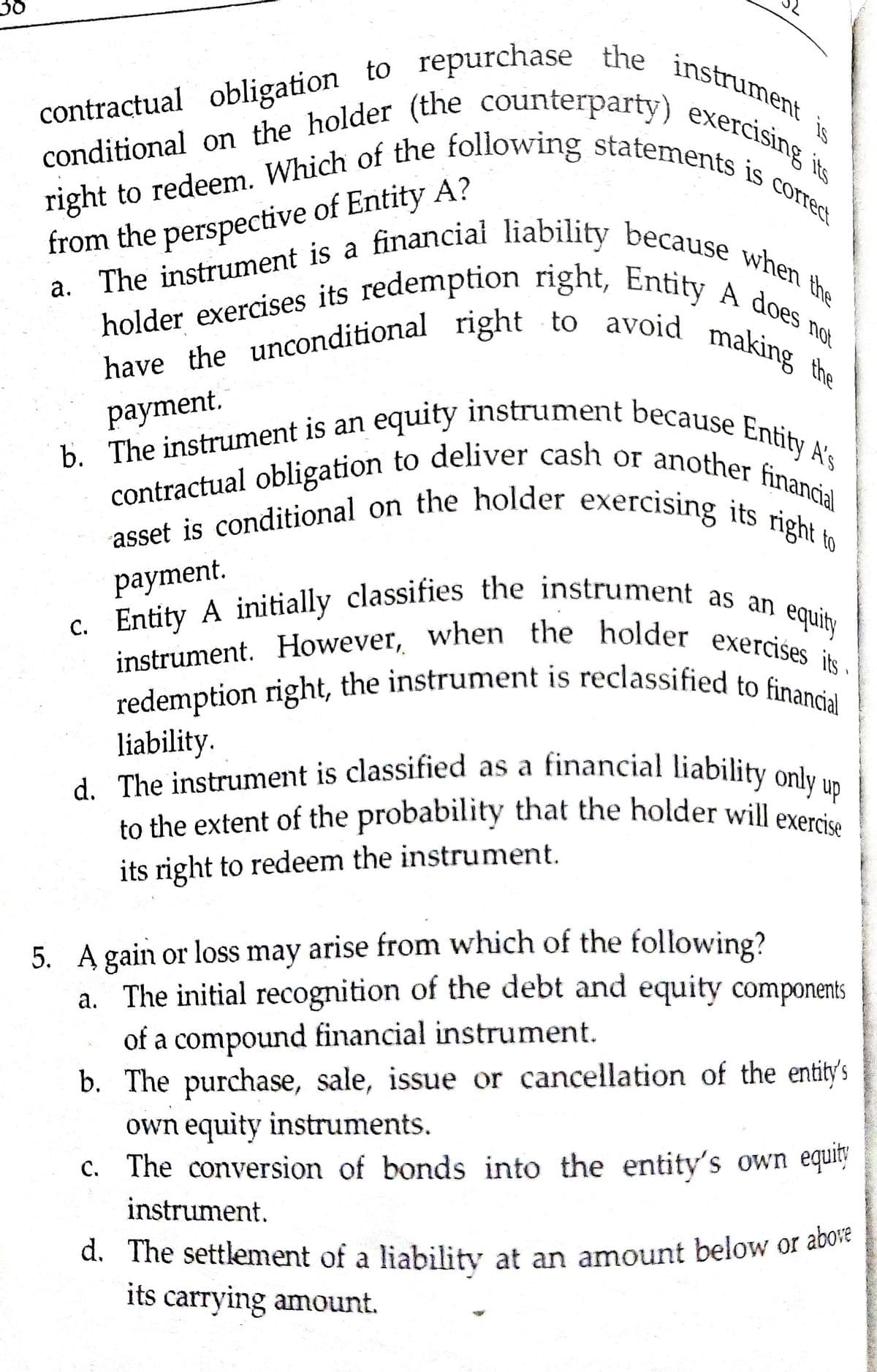

Transcribed Image Text:right to redeem. Which of the following statements is correct

c. Entity A initially classifies the instrument as an

d. The settlement of a liability at an amount below or above

holder exercises its redemption right, Entity A does not

conditional on the holder (the counterparty) exercising its

to the extent of the probability that the holder will exercise

contractual obligation to repurchase the instrument

redemption right, the instrument is reclassified to financial

instrument. However, when the holder exercises its

asset is conditional on the holder exercising its right to

contractual obligation to deliver cash or another financial

have the unconditional right to avoid making the

d. The instrument is classified as a financial liability only up

b. The instrument is an equity instrument because Entify A's

a. The instrument is a financiai liability because when the

contractual obligation to

is

holder exercises its redemption right, Entih. when

making

a. The instrument is a

not

the

payment.

b. The instrument is an

рayment.

C. Entity A initially classifies the instrument as

equity

redemption right, the instrument is reclassified to fi Is

liability.

d. The instrument is classified as a financial liability only.

to the extent of the probability that the holder will exers

its right to redeem the instrument.

5. A gain or loss may arise from which of the following?

a. The initial recognition of the debt and equity components

of a compound financial instrument.

b. The purchase, sale, issue or cancellation of the entity's

own equity instruments.

c. The conversion of bonds into the entity's own equity

instrument.

d. The settlement of a liability at an amount below or abo

its carrying amount.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning