Problem 08-10 (LO2) On January 1, Year 5, Pic Company acquired 7,500 ordinary shares of Sic Company for $825,000. On January 1, Year 6, Pic Company acquired an additional 2,000 ordinary shares of Sic Company for $207000. On January 1, Year 5, the shareholders' equity of Sic was as follows: Ordinary shares (10,000 no par value shares issued) Ketained earnings $200, 000 309, 000 $509, 000 The following are the statements of retained earmings for the two companies for Years 5 and 6: Pie Year 5 $ S18,000 141,500 (100,000) $ 559,500 Sie Year S $ 309,000 139,000 (90,000) Retained earnings, beginning of year Year 6 Year 6 $ 559, 500 149, 500 (120, 000) $ 589,000 $ 358, 000 Profit 201,000 Dividends Retained earnings, end of year (00, 000) $ 358,000 $ 469, 000 Additional Information • Pic uses the cost method to account for its Investment in Sic. • Any acquisition differential is allocated to customer contracts, which are expected to provide future benefits until December 31, Year 7. Neither company has any customer contracts recorded on their separate-entity records. • There were no unrealized profits from intercompany transactions since the date of acquisition. Required: (n) Calculate consolidated profit attributable to Pic's shareholders for Year 6. (Omit S sign in your response.)

Problem 08-10 (LO2) On January 1, Year 5, Pic Company acquired 7,500 ordinary shares of Sic Company for $825,000. On January 1, Year 6, Pic Company acquired an additional 2,000 ordinary shares of Sic Company for $207000. On January 1, Year 5, the shareholders' equity of Sic was as follows: Ordinary shares (10,000 no par value shares issued) Ketained earnings $200, 000 309, 000 $509, 000 The following are the statements of retained earmings for the two companies for Years 5 and 6: Pie Year 5 $ S18,000 141,500 (100,000) $ 559,500 Sie Year S $ 309,000 139,000 (90,000) Retained earnings, beginning of year Year 6 Year 6 $ 559, 500 149, 500 (120, 000) $ 589,000 $ 358, 000 Profit 201,000 Dividends Retained earnings, end of year (00, 000) $ 358,000 $ 469, 000 Additional Information • Pic uses the cost method to account for its Investment in Sic. • Any acquisition differential is allocated to customer contracts, which are expected to provide future benefits until December 31, Year 7. Neither company has any customer contracts recorded on their separate-entity records. • There were no unrealized profits from intercompany transactions since the date of acquisition. Required: (n) Calculate consolidated profit attributable to Pic's shareholders for Year 6. (Omit S sign in your response.)

Chapter14: Corporation Accounting

Section: Chapter Questions

Problem 8PB: Tent Tarp Corporation is a manufacturer of outdoor camping equipment. The company was incorporated...

Related questions

Question

Please explain how you get the answer.

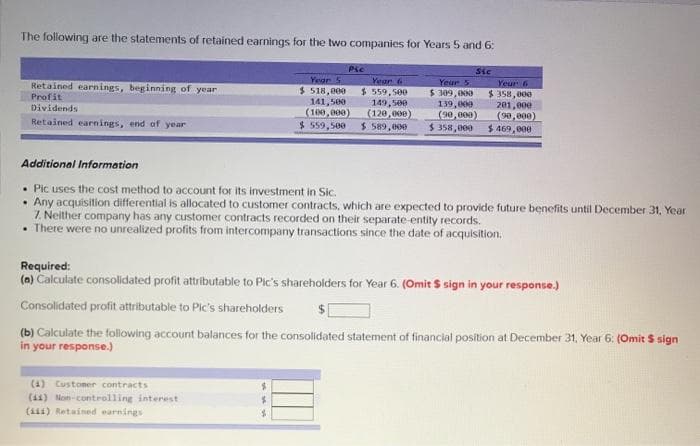

Transcribed Image Text:The following are the statements of retained earnings for the two companies for Years 5 and 6:

Pic

Sic

Retained earnings, beginning of year

Profit

Dividends

Year S

$ 518,000

141,500

(100,000)

$ 559,500

Year 6

$ 559, 500

149,500

(120, 00e)

$ 589,000

Yeur 5

Yeur 6

$ 309, 00

$ 358,000

201,000

(90, 000)

$ 469,000

139, 000

(98, 000)

$ 358,000

Retained earnings, end of year

Additional Information

• Pic uses the cost method to account for its investment in Sic.

• Any acquisition differential is allocated to customer contracts, which are expected to provide future benefits until December 31, Year

Z. Neither company has any customer contracts recorded on their separate entity records.

• There were no unrealized profits from intercompany transactions since the date of acquisition.

Required:

(a) Calculate consolidated profit attributable to Pic's shareholders for Year 6. (Omit $ sign in your response.)

Consolidated profit attributable to Pic's shareholders

(b) Calculate the following account balances for the consolidated statement of financial position at December 31, Year 6: (Omit $ sign

in your response.)

(4) Customer contracts

(41) Mon-controlling interest

(ii4) Retained earnings

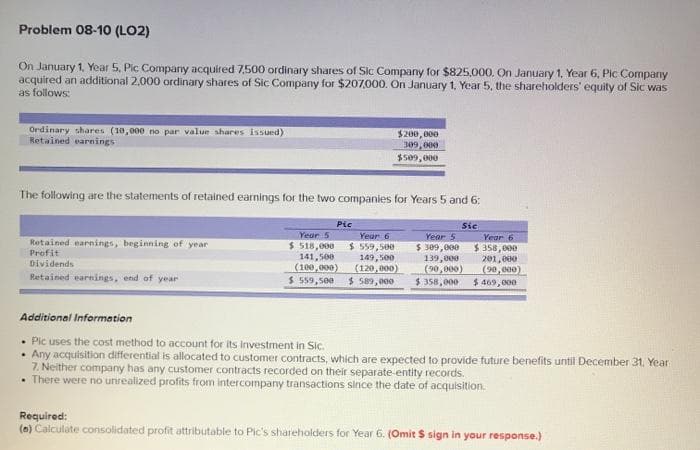

Transcribed Image Text:Problem 08-10 (LO2)

On January 1, Year 5, Pic Company acquired 7,500 ordinary shares of Sic Company for $825,000. On January 1, Year 6, Pic Company

acquired an additional 2,000 ordinary shares of Sic Company for $207000. On January 1, Year 5, the shareholders' equity of Sic was

as follows:

Ordinary shares (10,000 no par value shares issued)

Retained earnings

$200, 800

309, 000

$s09, 000

The following are the statements of retained earnings for the two companies for Years 5 and 6:

Pic

Sic

Year 5

Year 6

Year 5

Year 6

Retained earnings, beginning of year

Profit

$ 518,000

141,500

(100,000)

$ 559,500

$ 559,500

149, 500

(120, 000)

$ 589, 000

$ 309,000

139,800

(90,000)

$ 358,000

$ 358, 000

201,000

(90, 000)

$ 469,000

Dividends

Retained earnings, end of year

Additional Information

• Pic uses the cost method to account for its Investment in Sic.

Any acquisition differential is allocated to customer contracts, which are expected to provide future benefits until December 31, Year

7. Neither company has any customer contracts recorded on their separate-entity records.

• There were no unrealized profits from intercompany transactions since the date of acquisition.

Required:

(n) Calculate consolidated profit attributable to Pic's shareholders for Year 6. (Omit $ sign in your response.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning