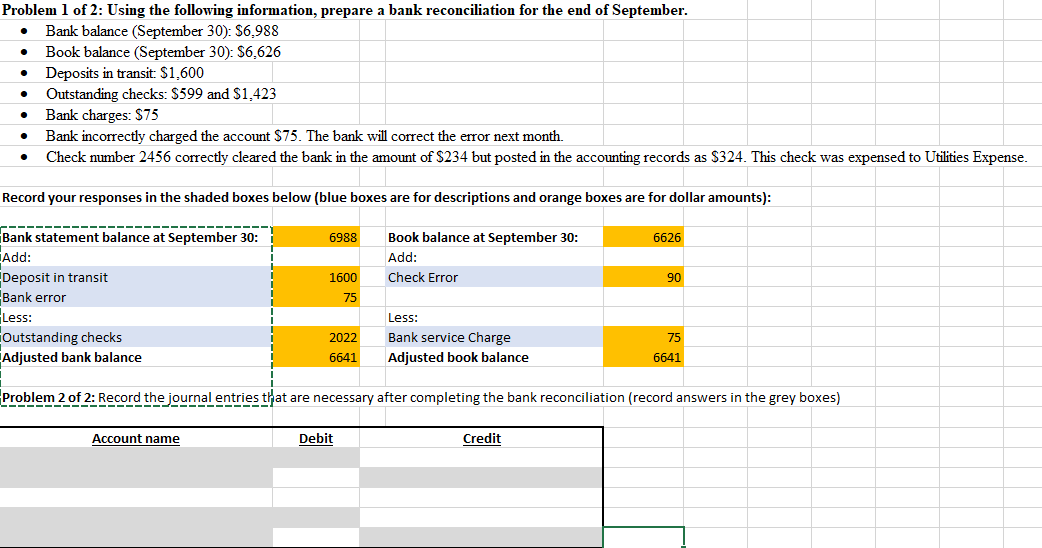

Problem 1 of 2: Using the following information, prepare a bank reconciliation for the end of September. Bank balance (September 30): $6,988 Book balance (September 30): S6,626 Deposits in transit: $1,600 Outstanding checks: $599 and $1,423 Bank charges: $75 Bank incorrectly charged the account $75. The bank will correct the error next month. Check number 2456 correctly cleared the bank in the amount of $234 but posted in the accounting records as $324. This check was expensed to Utilities Expense. Record your responses in the shaded boxes below (blue boxes are for descriptions and orange boxes are for dollar amounts): ----- Bank statement balance at September 30: 6988 Book balance at September 30: 6626 Add: Deposit in transit Bank error Less: Add: 1600 Check Error 90 75 Less: Outstanding checks Adjusted bank balance 2022 Bank service Charge 75 6641 Adjusted book balance 6641 Problem 2 of 2: Record the journal entries that are necessary after completing the bank reconciliation (record answers in the grey boxes)

Problem 1 of 2: Using the following information, prepare a bank reconciliation for the end of September. Bank balance (September 30): $6,988 Book balance (September 30): S6,626 Deposits in transit: $1,600 Outstanding checks: $599 and $1,423 Bank charges: $75 Bank incorrectly charged the account $75. The bank will correct the error next month. Check number 2456 correctly cleared the bank in the amount of $234 but posted in the accounting records as $324. This check was expensed to Utilities Expense. Record your responses in the shaded boxes below (blue boxes are for descriptions and orange boxes are for dollar amounts): ----- Bank statement balance at September 30: 6988 Book balance at September 30: 6626 Add: Deposit in transit Bank error Less: Add: 1600 Check Error 90 75 Less: Outstanding checks Adjusted bank balance 2022 Bank service Charge 75 6641 Adjusted book balance 6641 Problem 2 of 2: Record the journal entries that are necessary after completing the bank reconciliation (record answers in the grey boxes)

Chapter8: Fraud, Internal Controls, And Cash

Section: Chapter Questions

Problem 11EB: Using the following information, prepare a bank reconciliation. Bank balance: $12,565. Book...

Related questions

Question

Transcribed Image Text:Problem 1 of 2: Using the following information, prepare a bank reconciliation for the end of September.

Bank balance (September 30): $6,988

Book balance (September 30): $6,626

• Deposits in transit: $1,600

Outstanding checks: $599 and $1,423

Bank charges: $75

Bank incorrectly charged the account $75. The bank will correct the error next month.

Check number 2456 correctly cleared the bank in the amount of $234 but posted in the accounting records as $324. This check was expensed to Utilities Expense.

Record your responses in the shaded boxes below (blue boxes are for descriptions and orange boxes are for dollar amounts):

-----

Bank statement balance at September 30:

Add:

Deposit in transit

Bank error

Book balance at September 30:

Add:

6988

6626

1600

Check Error

90

75

Less:

Less:

Outstanding checks

Adjusted bank balance

2022

Bank service Charge

75

6641

Adjusted book balance

6641

Problem 2 of 2: Record the journal entries that are necessary after completing the bank reconciliation (record answers in the grey boxes)

----- ----- %D

:=3DD ----- --

Account name

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning