PROBLEM 1: TRUE OR FALS Jeases into a finance lease or an operating lease. control the use of an identified asset for a period of time in exchange for consideration. A lease that covers only the 1ª floor of a 10-storey building cannot qualify for accounting under PFRS 16 because the lessee does not have the right to obtain substantially all of the economic benefits of the entire building. nOenition and measurement approach

PROBLEM 1: TRUE OR FALS Jeases into a finance lease or an operating lease. control the use of an identified asset for a period of time in exchange for consideration. A lease that covers only the 1ª floor of a 10-storey building cannot qualify for accounting under PFRS 16 because the lessee does not have the right to obtain substantially all of the economic benefits of the entire building. nOenition and measurement approach

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter20: Accounting For Leases

Section: Chapter Questions

Problem 8RE: Use the following information to decide whether this equipment lease qualifies as an operating,...

Related questions

Question

Transcribed Image Text:under

reasonably

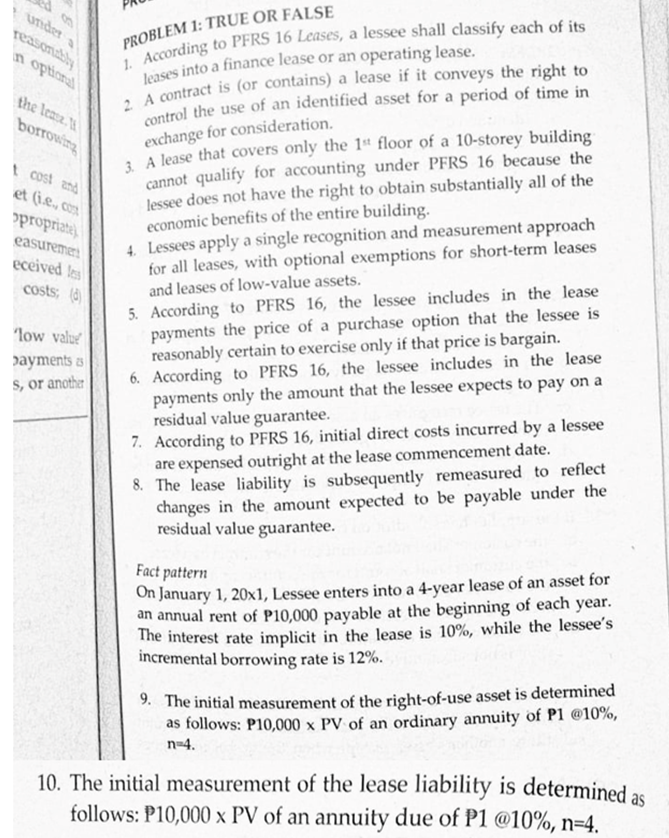

PROBLEM 1: TRUE OR FALSE

in

optional

the lease.

exchange for consideration.

L A lease that covers only the 1“ floor of a 10-storey building

cannot qualify for accounting under PFRS 16 because the

lessee does not have the right to obtain substantially all of the

economic benefits of the entire building.

4. Lessees apply a single recognition and measurement approach

for all leases, with optional exemptions for short-term leases

and leases of low-value assets.

borrowing

t cost znd

et (ie, co

opropriate)

easuremeri

eceived les

5. According to PFRS 16, the lessee includes in the lease

payments the price of a purchase option that the lessee is

reasonably certain to exercise only if that price is bargain.

6. According to PFRS 16, the lessee includes in the lease

payments only the amount that the lessee expects to pay on a

residual value guarantee.

7. According to PFRS 16, initial direct costs incurred by a lessee

are expensed outright at the lease commencement date.

8. The lease liability is subsequently remeasured to reflect

changes in the amount expected to be payable under the

residual value guarantee.

costs; (d)

"low valu

payments as

S, or another

On January 1, 20x1, Lessee enters into a 4-year lease of an asset for

an annual rent of P10,000 payable at the beginning of each year.

The interest rate implicit in the lease is 10%, while the lessee's

incremental borrowing rate is 12%.

Fact pattern

9. The initial measurement of the right-of-use asset is determined

as follows: P10,000 x PV of an ordinary annuity of P1 @10%,

n=4.

10. The initial measurement of the lease liability is determined as

follows: P10,000 x PV of an annuity due of P1 @10%, n=4.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning