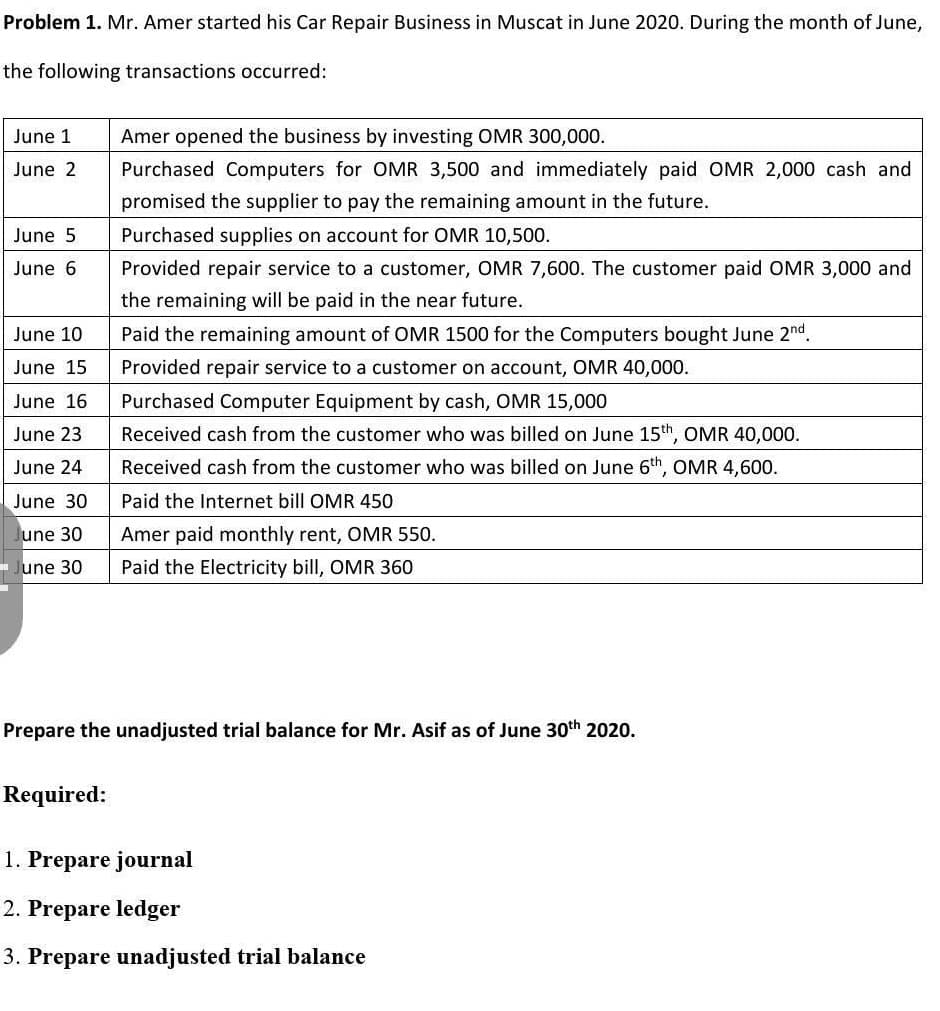

Problem 1. Mr. Amer started his Car Repair Business in Muscat in June 2020. During the month of June, che following transactions occurred: June 1 Amer opened the business by investing OMR 300,000. June 2 Purchased Computers for OMR 3,500 and immediately paid OMR 2,000 cash and promised the supplier to pay the remaining amount in the future. June 5 Purchased supplies on account for OMR 10,500. June 6 Provided repair service to a customer, OMR 7,600. The customer paid OMR 3,000 and the remaining will be paid in the near future. June 10 Paid the remaining amount of OMR 1500 for the Computers bought June 2nd. June 15 Provided renair service to a customer on account OMR 40 000

Q: Assertions: A. A Cutoff B. Accuracy C. Completene D. Existence E. Valuation

A: a. Decisional roles- The managers oversee and initiate new tasks or projects in order to enhance t...

Q: If a broker quotes a price of 111.25 for a bond on September 10, what amount will a client pay per $...

A: Broker Quotes price 111.25 for a bond on Sep ,10 Face Value = $1000 Coupon Rate = 7% Coupon Rate is...

Q: A company had the following unadjusted balances on specific accounts for the year ended December 31,...

A: Current Liabilities: Current liabilities are financial commitments owed by a corporation that are du...

Q: Prepare the journal entries, that Whispering should record on December 31, 2021. (Credit account tit...

A: Accounting for Leases There are mainly two types of lease system are there one is operating leases a...

Q: Consider the following information items as you respond to the question: i. Customer master file ii...

A: The five basic elements of AIS system are: 1. Output 2. Input 3. Storage 4. Internal control 5. Proc...

Q: ABC Juice Limited manufactures and sells juice locally in Trinidad and in the Caribbean. The busines...

A: Value-added tax: Value-added tax is one type of indirect tax which is levied on the goods and servic...

Q: Zach contributed land with an FMV of $44,000 and a basis of $23,500 to a partnership on April 5, 201...

A: When a partner contributes property, their basis is increased by the partner's tax basis in the co...

Q: Oslo Company prepared the following contribution format income statement based on a sales volume of ...

A: Given That : Variable cost per unit increase by $1 Unit sale increase by 140 units...

Q: CBA Corporation was incorporated on January 1, 2020. The following equity-related transactions occur...

A: Stockholders' Equity Statement For the Year Ended December 31, 2020 Common Stock P 1 par Pa...

Q: Lampport Industries GHT. is dedicated to the manufacture of games for children from 2 years of age, ...

A: In variable costing we calculate contributio margin by deducting variable costs f...

Q: On January 1, 2019, Osgood Film Studios reported the following alphabetical list of shareholders’ eq...

A: Shareholders equity is the total amount attributable to the owners and shareholders of the company. ...

Q: Days' cash on hand

A: Days cash on hands means number of days any company can continue to pay its operating expenses with ...

Q: Item Nő. 22 I5 formation: Kung and Fu are partners whose average capitals during 200B wer P 500,000 ...

A: The partnership comes into existence when two or more persons agree to do the business and share pro...

Q: On March 2, Cullumber Company sold $835,000 of merchandise on account to Bramble Company, terms 2/10...

A: Sales = $835,000 Cost of goods sold = $585,000

Q: 28 February 2021 Vehicles R300000, Accumulated depreciation R50000. Depreciation is calculated at 1...

A: Business organizations are required to charge the depreciation expense on their assets so that the a...

Q: Susan is looking for a method of how she could calculate and interpret the financial ratio so as to ...

A: Benchmarking: Under this method, some benchmarks are set and the actual results are evaluated by com...

Q: of Of 10 years, an estimated residual value of $50,000, and were depreciated using straight-line dep...

A: The depreciation expense is charged on fixed assets as reduced value of the fixed asset with usage a...

Q: In 2018, Kardashian Inc. reported pretax accounting income of $240,000. In 2019, the company had a p...

A: Carry back of losses is an option for the company to set off the current ...

Q: Purchases $250,000 Cost of goods sold 250,000 Beginning balance 30,000 Ending balance ?

A: Formula: Cost of Goods Sold = Beginning Inventory + Purchases – Ending Inventory Ending Inventory = ...

Q: Using Declining Balance Method, a machine with an initial cost of $200,000 and a life of 10 years.

A: The value of the specific machinery or asset after its effective or expected life of usage is regard...

Q: An auditor's preliminary control risk assessment is at a high level. Which of the following are poss...

A: An auditor, during the preliminary assessment of control risk, evaluates the effectiveness of that c...

Q: How much withholding tax on compensation will Near Eastern University. withhold on the salary of Nic...

A: Withholding tax is the amount of tax which has been deducted by the company during the period and wh...

Q: p. expects to sell 620 sun visors in May and 380 in June. Each visor sells for $22 Shadee's beginnin...

A: Calculation of Budgeted Cost of Closures Purchased May June Total Number of Sun visors to b...

Q: The following is a trail balance of ACC Limited for the year ended 31 December 2014: R BALANCE SHE...

A:

Q: Olivia Company began 2019 with a Retained Earings account balance of $180,000. During 2019, the foll...

A: Retained Earnings statement- A retained earnings statement is a financial statement that accounts fo...

Q: a. Return on equity b. Total assets turnover c. Return on assets d. Current ratio e. Receivables tur...

A: a. Return on equity = Net Income / Shareholders' Equityb. Total assets turnover = Sales / Total Asse...

Q: Entries for Bank Reconciliation

A: These are the accounting transactions that are having a monetary impact on the financial statement o...

Q: Carla Vista Co. accepts from Gates Stores a $4,400, 4-month, 9% note dated May 31 in settlement of G...

A: Journal entries are used to keep record of the financial transactions. Your entries are entered into...

Q: property at P 20,000,000. If Nicanor utilized P 8,000,000 of the proceeds of the sale in acquiring a...

A: Nicanor sold his rest house in Pangasinan for P 80,00,000. Now sale of property will attract a capit...

Q: ollute y mu

A: If MAC = 228 - 1.5Eand tax is 72 than optimal emission ----> 72 = 228 - 1.5E ----> E = 104 uni...

Q: Required information [The following information applies to the questions displayed below.] Kubin Com...

A: "Since we only answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit the question and ...

Q: Jacob Machine Technology Ltd. makes a tool for sharpening the blades of pruning shears and glass cl...

A: In order to determine the contribution margin per unit, the variable cost per unit is required to be...

Q: There are no changes in the company's cost structure. Assume that the units produced were also the b...

A: Absorption costing, often known as "full costing," is a managerial accounting technique for collecti...

Q: Corp. grants its employees 20 days' vacation leave for the whole year. Such vacat leave may be conve...

A: Taxable income means the base income upon which the system of income tax levy tax, in short, the inc...

Q: An item of p- O True O False

A: Real property means any item which may be factored into the property value.

Q: S1: In indirect tax, the impact of taxation and incidence of taxation lie on the same subject. S2: I...

A: S1 is false as in indirect tax, the impact of taxation lies on one person while the incidence of tax...

Q: The income summary account has a debit balance of P45,000. The agreement between Emo and Ted include...

A: A partnership is a kind of business structure in which two or more people agree to carry out commerc...

Q: Willow Construction Company is a partnership with three equal partners. On April 4, 2020, one of the...

A: Partnership Dissolution

Q: Which of the following are assets? (Select all that apply.) O Land Supplies Expense Wages Payable

A: Introduction: Balance sheet: All Assets and liabilities are shown in Balance sheet. It tells the net...

Q: A, B and C form a general partnership. A contributes Land, a capital asset A acquired several years...

A:

Q: Consider the following situation for Junkee Corporation for the prior year. The company produced 1,0...

A: Under variable costing Sales( 900x 100) 90000 Less: variable cost Direct Material (30...

Q: 6. Inventory turnover times times 7. Days sales in inventory days days Return on common shareholders...

A: Lets understand the basics. Inventory turnover ratio indicates how many times business is able to se...

Q: The commencement date of the l

A: Introduction A lease is recorded in the books of the lessee as the right to use asset and a lease ...

Q: 0 year vs 20 year mortgage How much money you save altogether by taking out 20 year mortgage rather ...

A: Option -I Purchase Price of House $ 1,90,000 Down Payment @10% $ 19,000 ...

Q: $320 m $280 m $300 m

A: Given : The Initial cost of the machine is $300,000. The New machine depreciates in 5 years MACRS ra...

Q: On March 1, 2022, a company issued a four-year, P3,000,000 face value, 11% term bonds for P3,197,87...

A: Bond is issued by the company for raising finance for the business working. It is considered a cheap...

Q: What amount should be reported as accrued liability on December 31, 2023? What amount should b...

A: 1. As the Grapes Company became aware in December 2023 that Engineering flaw in the product poses a ...

Q: The finance director of the Bethandy Independent School District is making preliminary estimates of ...

A:

Q: Which statements are true? 1. Perpetual system keeps only costs of inventories up-to-date, whereas ...

A: Perpetual Inventory system :- It is method of inventory control in which every inflow and outflow of...

Step by step

Solved in 2 steps

- The transactions completed by PS Music during June 2019 were described at the end of Chapter 1. The following transactions were completed during July, the second month of the business's operations: July 1. Peyton Smith made an additional investment in PS Music by depositing 5,000 in PS Music's checking account. 1. Instead of continuing to share office space with a local real estate agency, Peyton decided to rent office space near a local music: store. Paid rent for July, 1,750. 1. Paid a premium of 2,700 for a comprehensive insurance policy covering liability, theft, and fire. The policy covers a one-year period. 2. Received 1,000 cash from customers on account. 3. On behalf of PS Music, Peyton signed a contract with a local radio station, KXMD, to provide guest spots for the next three months. The contract requires PS Music to provide a guest disc jockey for SO hours per month for a monthly fee of 3,600. Any additional hours beyond SO will be billed to KXMD at 40 per hour. In accordance with the contract, Peyton received 7,200 from KXMD as an advance payment for the first two months. 3. Paid 250 to creditors on account. 4. Paid an attorney 900 for reviewing the July 3 contract with KXMD. (Record as Miscellaneous Expense.) 5. Purchased office equipment on account from Office Mart, 7,500. 8. Paid for a newspaper advertisement, 200. 11. Received 1,000 for serving as a disc jockey for a party. 13. Paid 700 to a local audio electronics store for rental of digital recording equipment. 11. Paid wages of 1,200 to receptionist and part-time assistant. Enter the following transactions on Page 2 of the two-column journal: 16. Received 2,000 for serving as a disc jockey for a wedding reception. 18. Purchased supplies on account, 850. July 21. Paid 620 to Upload Music for use of its current music demos in making various music sets. 22. Paid 800 to a local radio station to advertise the services of PS Music twice daily for the remainder of July. 23. Served as disc jockey for a party for 2,500. Received 750, with the remainder due August 4, 2019. 27. Paid electric bill, 915. 28. Paid wages of 1,200 to receptionist and part-time assistant. 29. Paid miscellaneous expenses, 540. 30. Served as a disc jockey for a charity ball for 1,500. Received 500, with the remainder due on August 9, 2019. 31. Received 3,000 for serving as a disc jockey for a party. 31. Paid 1,400 royalties (music expense) to National Music Clearing for use of various artists' music during July. 31. Withdrew l,250 cash from PS Music for personal use. PS Music's chart of accounts and the balance of accounts as of July 1, 2019 (all normal balances), are as follows: 11 Cash 3,920 12 Accounts receivable 1,000 14 Supplies 170 15 Prepaid insurance 17 Office Equipment 21 Accounts payable 250 23 Unearned Revenue 31 Peyton smith, Drawing 4,000 32 Fees Earned 500 41 Wages Expense 6,200 50 Office Rent Expense 400 51 Equipment Rent Expense 800 52 Utilities Expense 675 53 Supplies Expense 300 54 music Expense 1,590 55 Advertising Expense 500 56 Supplies Expense 180 59 Miscellaneous Expense 415 Instructions 1.Enter the July 1, 2019, account balances in the appropriate balance column of a four-column account. Write Balance in the Item column and place a check mark () in the Posting Reference column. (Hint: Verify the equality of the debit and credit balances in the ledger before proceeding with the next instruction.) 2.Analyze and journalize each transaction in a two-column journal beginning on Page 1, omitting journal entry explanations. 3.Post the journal to the ledger, extending the account balance to the appropriate balance column after each posting. 4.Prepare an unadjusted trial balance as of July 31, 2019.On October 1, 2019, Jay Pryor established an interior decorating business, Pioneer Designs. During the month, Jay completed the following transactions related to the business: Oct. 1. Jay transferred cash from a personal bank account to an account to be used for the business, 18,000. 4.Paid rent for period of October 4 to end of month, 3,000. 10.Purchased a used truck for 23,750, paying 3,750 cash and giving a note payable for the remainder. 13.Purchased equipment on account, 10,500. 14.Purchased supplies for cash, 2,100. 15.Paid annual premiums on property and casualty insurance, 3,600. 15.Received cash for job completed, 8,950. Enter the following transactions on Page 2 of the two-column journal: 21.Paid creditor a portion of the amount owed for equipment purchased on October 13, 2,000. 24.Recorded jobs completed on account and sent invoices to customers, 14,150. 26.Received an invoice for truck expenses, to be paid in November, 700. 27.Paid utilities expense, 2,240. 27.Paid miscellaneous expenses, 1,100. Oct. 29. Received cash from customers on account, 7,600. 30.Paid wages of employees, 4,800. 31.Withdrew cash for personal use, 3,500. Instructions 1. Journalize each transaction in a two-column journal beginning on Page 1, referring to the following chart of accounts in selecting the accounts to be debited and credited. (Do not insert the account numbers in the journal at this time.) Journal entry explanations may be omitted. 2. Post the journal to a ledger of four-column accounts, inserting appropriate posting references as each item is posted. Extend the balances to the appropriate balance columns after each transaction is posted. 3. Prepare an unadjusted trial balance for Pioneer Designs as of October 31, 2019. 4. Determine the excess of revenues over expenses for October. 5. Can you think of any reason why the amount determined in (4) might not be the net income for October?A business has the following transactions: A. The business is started by receiving cash from an investor in exchange for common stock $10,000. B. Rent of $1,250 is paid for the first month. C. Office supplies are purchased for $375. D. Services worth $3,450 are performed. Cash is received for half. E. Customers pay $1,250 for services to be performed next month. F. $6,000 is paid for a one year insurance policy. G. We receive 25% of the money owed by customers in D. H. A customer has placed an order for $475 of services to be done this coming week. How much total revenue does the company have?

- Domingo Company started its business on January 1, 2019. The following transactions occurred during the month of May. Prepare the journal entries in the journal on Page 1. A. The owners invested $10,000 from their personal account to the business account. B. Paid rent $500 with check #101. C. Initiated a petty cash fund $500 with check #102. D. Received $1,000 cash for services rendered. E. Purchased office supplies for $158 with check #103. F. Purchased computer equipment $2,500, paid $1,350 with check #104, and will pay the remainder in 30 days. G. Received $800 cash for services rendered. H. Paid wages $600, check #105. I. Petty cash reimbursement: office supplies $256, maintenance expense $108, postage expense $77, miscellaneous expense $55. Cash on hand $11. Check #106. J. Increased petty cash by $30, check #107.Hajun Company started its business on May 1, 2019. The following transactions occurred during the month of May. Prepare the journal entries in the journal on Page 1. A. The owners invested $5,000 from their personal account to the business account. B. Paid rent $400 with check #101. C. Initiated a petty cash fund $200 check #102. D. Received $400 cash for services rendered E. Purchased office supplies for $90 with check #103. F. Purchased computer equipment $1,000, paid $350 with check #104 and will pay the remainder in 30 days. G. Received $500 cash for services rendered. H. Paid wages $250, check #105. I. Petty cash reimbursement office supplies $25, Maintenance Expense $125, Miscellaneous Expense $35. Cash on hand $18. Check #106. J. Increased Petty Cash by $50, check #107.Taylor Company recently purchased a piece of equipment for $2,000 which will be paid within 30 days after delivery. At what point would the event be recorded in Taylors accounting system? When Taylor signs the agreement with the seller When Taylor receives an invoice (a bill) from the setter When Taylor receives the asset from the seller When Taylor pays $2.000 cash to the seller

- Lavender Company started its business on April 1, 2019. The following are the transactions that happened during the month of April. Prepare the journal entries in the journal on Page 1. A. The owners invested $7,500 from their personal account to the business account. B. Paid rent $600 with check #101. C. Initiated a petty cash fund $250 check #102. D. Received $350 cash for services rendered. E. Purchased office supplies for $125 with check #103. F. Purchased computer equipment $1,500, paid $500 with check #104, and will pay the remainder in 30 days. G. Received $750 cash for services rendered. H. Paid wages $375, check #105. I. Petty cash reimbursement Office Supplies $50, Maintenance Expense $80, Miscellaneous Expense $60. Cash on hand $8. Check #106. J. Increased Petty Cash by $70, check #107.Inner Resources Company started its business on April 1, 2019. The following transactions occurred during the month of April. Prepare the journal entries in the journal on Page 1. A. The owners invested $8,500 from their personal account to the business account. B. Paid rent $650 with check #101. C. Initiated a petty cash fund $550 check #102. D. Received $750 cash for services rendered. E. Purchased office supplies for $180 with check #103. F. Purchased computer equipment $8,500, paid $1,600 with check #104 and will pay the remainder in 30 days. G. Received $1,200 cash for services rendered. H. Paid wages $560, check #105. I. Petty cash reimbursement office supplies $200, Maintenance Expense $140, Miscellaneous Expense $65. Cash on Hand $93. Check #106. J. Increased Petty Cash by $100, check #107.Kelly Pitney began her consulting business, Kelly Consulting, on April 1, 2019. The accounting cycle for Kelly Consulting for April, including financial statements, was illustrated in this chapter. During May, Kelly Consulting entered into the following transactions: May 3. Received cash from clients as an advance payment for services to be provided and recorded it as unearned fees, 4,500. 5. Received cash from clients on account, 2,450. 9. Paid cash for a newspaper advertisement, 225. 13. Paid Office Station Co. for part of the debt incurred on April 5, 640. 15. Provided services on account for the period May 115, 9,180. 16. Paid part-time receptionist for two weeks' salary including the amount owed on April 30, 750. 17. Received cash from cash clients for fees earned during the period May 116, 8,360. Record the following transactions on Page 6 of the journal: 20. Purchased supplies on account, 735. 21. Provided services on account for the period May 1620, 4,820. 25. Received cash from cash clients for fees earned for the period May 1723, 7,900. 27. Received cash from clients on account, 9,520. 28. Paid part-time receptionist for two weeks' salary, 750. 30. Paid telephone bill for May, 260. 31. Paid electricity bill for May, 810. 31. Received cash from cash clients for fees earned for the period May 2631, 3,300. 31. Provided services on account for the remainder of May, 2,650. 31. Kelly withdrew 10,500 for personal use. Instructions 1.The chart of accounts for Kelly Consulting is shown in Exhibit 9, and the post-closing trial balance as of April 30, 2019, is shown in Exhibit 17. For each account in the post-closing trial balance, enter the balance in the appropriate Balance column of a four-column account. Date the balances May 1, 2019, and place a check mark () in the Posting Reference column Journalize each of the May transactions in a two column Journal starting on Page 5 of the journal and using Kelly Consulting's chart of accounts. (Do not insert the account numbers in the journal at this time.) 2.Post the journal to a ledger of four-column accounts. 3Prepare an unadjusted trial balance. 4.At the end of May, the following adjustment data were assembled. Analyze and use these data to complete parts (5) and (6). a.Insurance expired during May is 275. b.Supplies on hand on May 3 1 are 715. c.Depreciation of office equipment for May is 330. d.Accrued receptionist salary on May 31 is 325. e.Rent expired during May is 1,600. f.Unearned fees on May 31 are 3,210. 5.(Optional) Enter the unadjusted trial balance on an end-of-period spreadsheet and complete the spreadsheet. 6.Journalize and post the adjusting entries. Record the adjusting entries on Page 7 of the journal. 7.Prepare an adjusted trial balance. 8.Prepare an income statement, a statement of owner's equity, and a balance sheet. 9.Prepare and post the closing entries. Record the closing entries on Page 8 of the journal. Indicate closed accounts by inserting a line in both Balance columns opposite the closing entry. 10.Prepare a post-closing trial balance.

- In October, A. Nguyen established an apartment rental service. The account headings are presented below. Transactions completed during the month of October follow. a. Nguyen deposited 25,000 in a bank account in the name of the business. b. Paid the rent for the month, 1,200, Ck. No. 2015 (Rent Expense). c. Bought supplies on account, 225. d. Bought a truck for 18,000, paying 1,000 in cash and placing the remainder on account. e. Bought insurance for the truck for the year, 1,400, Ck. No. 2016. f. Sold services on account, 5,000 (Service Income). g. Bought office equipment on account from Henry Office Supply, 2,300. h. Sold services for cash for the first half of the month, 6,050 (Service Income). i. Received and paid the bill for utilities, 150, Ck. No. 2017 (Utilities Expense). j. Received a bill for gas and oil for the truck, 80 (Gas and Oil Expense). k. Paid wages to the employees, 1,400, Ck. Nos. 20182020 (Wages Expense). l. Sold services for cash for the remainder of the month, 4,200 (Service Income). m. Nguyen withdrew cash for personal use, 2,000, Ck. No. 2021. Required 1. In the equation, write the owners name above the terms Capital and Drawing. 2. Record the transactions and the balance after each transaction. Identify the account affected when the transaction involves revenues or expenses. 3. Write the account totals from the left side of the equals sign and add them. Write the account totals from the right side of the equals sign and add them. If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.In October, A. Nguyen established an apartment rental service. The account headings are presented below. Transactions completed during the month of October follow. a. Nguyen deposited 25,000 in a bank account in the name of the business. b. Paid the rent for the month, 1,200, Ck. No. 2015. c. Bought supplies on account, 225. d. Bought a truck for 18,000, paying 1,000 in cash and placing the remainder on account e. Bought Insurance for the truck for the yean 1,400, Ck. No. 2016. f. Sold services on account 5,000. g. Bought office equipment on account from Henry Office Supply, 2,300. h. Sold services for cash for the first half of the month, 6,050. i. Received and paid the bill for utilities, 150, Ck. No. 2017. j. Received a bill for gas and oil for the truck. 80. k. Paid wages to the employees, 1,400, Ck Nos. 20182020. l. Sold services for cash for the remainder of the month, 4,200. m. Nguyen withdrew cash for personal use, 2,000, Ck. No. 2021. Required 1. Record the transactions and the balance after each transaction. 2. Total the left side of the accounting equation (left side of the equal sign), then total the right side of the accounting equation (right side of the equal sign). If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, reanalyze each transaction.B. Kelso established Computer Wizards during November of this year. The accountant prepared the following chart of accounts: The following transactions occurred during the month: a. Kelso deposited 45,000 in a bank account in the name of the business. b. Paid the rent for the current month, 1,800, Ck. No. 2001. c. Bought office desks and filing cabinets for cash, 790, Ck. No. 2002. d. Bought a computer and printer from Cyber Center for use in the business, 2,700, paying 1,700 in cash and placing the balance on account, Ck. No. 2003. e. Bought a neon sign on account from Signage Co., 1,350. f. Kelso invested her personal computer software with a fair market value of 600 in the business. g. Received a bill from Country News for newspaper advertising, 365. h. Sold services for cash, 1,245. i. Received and paid the electric bill, 345, Ck. No. 2004. j. Paid on account to Country News, a creditor, 285, Ck. No. 2005. k. Sold services for cash, 1,450. l. Paid wages to an employee, 925, Ck. No. 2006. m. Received and paid the bill for the city business license, 75, Ck. No. 2007. n. Kelso withdrew cash for personal use, 850, Ck. No. 2008. o. Kelso withdrew cash for personal use, 850, Ck. No. 2008. Required 1. Record the owners name in the Capital and Drawing T accounts. 2. Correctly place the plus and minus signs for each T account and label the debit and credit sides of the accounts. 3. Record the transactions in T accounts. Write the letter of each entry to identify the transaction. 4. Foot the T accounts and show the balances. 5. Prepare a trial balance, with a three-line heading, dated November 30, 20--.