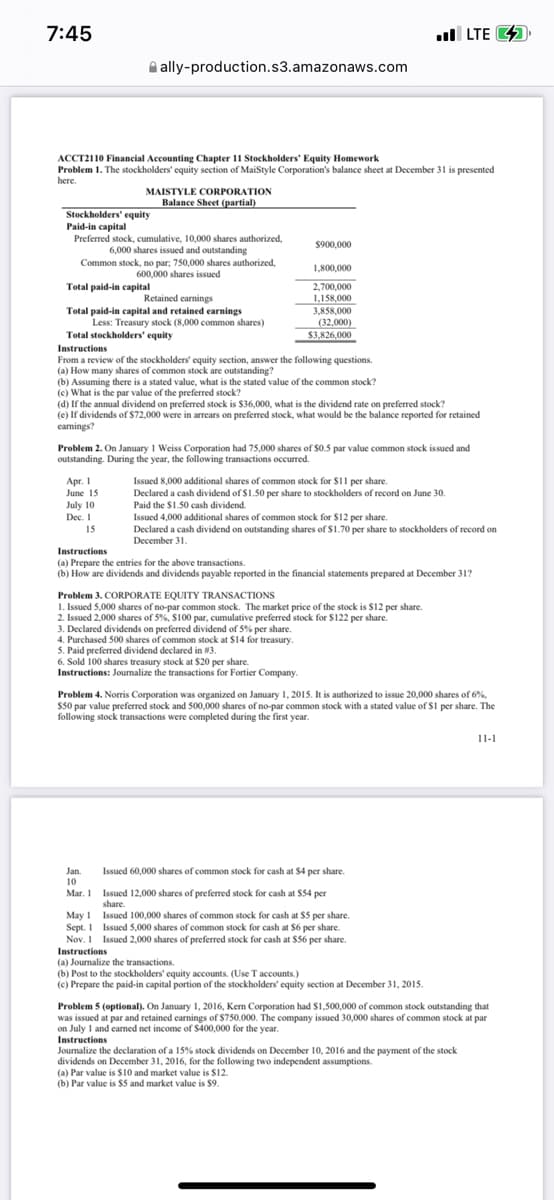

Problem 1. The stockholders' equity section of MaiStyle Corporation's balance sheet at December 31 is presented here. MAISTYLE CORPORATION Balance Sheet (partial) Stockholders' equity Paid-in capital Preferred stock, cumulative, 10,000 shares authorized, 6,000 shares issued and outstanding $900,000 Common stock, no par, 750,000 shares authorized, 600,000 shares issued 1,800,000 Total paid-in capital 2,700,000 Retained earnings 1,158,000 Total paid-in capital and retained earnings 3,858,000 Less: Treasury stock (8,000 common shares) (32,000) Total stockholders' equity $3,826,000 Instructions From a review of the stockholders' equity section, answer the following questions. (a) How many shares of common stock are outstanding? (b) Assuming there is a stated value, what is the stated value of the common stock? (c) What is the par value of the preferred stock? (d) If the annual dividend on preferred stock is $36,000, what is the dividend rate on preferred stock? (e) If dividends of $72,000 were in arrears on preferred stock, what would be the balance reported for retained earnings?

Problem 1. The stockholders' equity section of MaiStyle Corporation's balance sheet at December 31 is presented here. MAISTYLE CORPORATION Balance Sheet (partial) Stockholders' equity Paid-in capital Preferred stock, cumulative, 10,000 shares authorized, 6,000 shares issued and outstanding $900,000 Common stock, no par, 750,000 shares authorized, 600,000 shares issued 1,800,000 Total paid-in capital 2,700,000 Retained earnings 1,158,000 Total paid-in capital and retained earnings 3,858,000 Less: Treasury stock (8,000 common shares) (32,000) Total stockholders' equity $3,826,000 Instructions From a review of the stockholders' equity section, answer the following questions. (a) How many shares of common stock are outstanding? (b) Assuming there is a stated value, what is the stated value of the common stock? (c) What is the par value of the preferred stock? (d) If the annual dividend on preferred stock is $36,000, what is the dividend rate on preferred stock? (e) If dividends of $72,000 were in arrears on preferred stock, what would be the balance reported for retained earnings?

Century 21 Accounting General Journal

11th Edition

ISBN:9781337680059

Author:Gilbertson

Publisher:Gilbertson

Chapter16: Financial Statements And Closing Entries For A Corporation

Section16.2: Preparing A Statement Of Stockholders’ Equity

Problem 1OYO

Related questions

Question

Transcribed Image Text:7:45

LTE

ally-production.s3.amazonaws.com

ACCT2110 Financial Accounting Chapter 11 Stockholders' Equity Homework

Problem 1. The stockholders' equity section of MaiStyle Corporation's balance sheet at December 31 is presented

here.

MAISTYLE CORPORATION

Balance Sheet (partial)

Stockholders' equity

Paid-in capital

Preferred stock, cumulative, 10,000 shares authorized,

6,000 shares issued and outstanding

$900,000

Common stock, no par; 750,000 shares authorized,

600,000 shares issued

1,800,000

Total paid-in capital

2,700,000

Retained earnings

1,158,000

Total paid-in capital and retained earnings

3,858,000

Less: Treasury stock (8,000 common shares)

(32,000)

Total stockholders' equity

$3,826,000

Instructions

From a review of the stockholders' equity section, answer the following questions.

(a) How many shares of common stock are outstanding?

(b) Assuming there is a stated value, what is the stated value of the common stock?

(c) What is the par value of the preferred stock?

(d) If the annual dividend on preferred stock is $36,000, what is the dividend rate on preferred stock?

(e) If dividends of $72,000 were in arrears on preferred stock, what would be the balance reported for retained

earnings?

Problem 2. On January 1 Weiss Corporation had 75,000 shares of $0.5 par value common stock issued and

outstanding. During the year, the following transactions occurred.

Apr. 1

Issued 8,000 additional shares of common stock for $11 per share.

June 15

Declared a cash dividend of $1.50 per share to stockholders of record on June 30.

Paid the $1.50 cash dividend.

July 10

Dec. 1

Issued 4,000 additional shares of common stock for $12 per share.

15

Declared a cash dividend on outstanding shares of $1.70 per share to stockholders of record on

December 31.

Instructions

(a) Prepare the entries for the above transactions.

(b) How are dividends and dividends payable reported in the financial statements prepared at December 31?

Problem 3. CORPORATE EQUITY TRANSACTIONS

1. Issued 5,000 shares of no-par common stock. The market price of the stock is $12 per share.

2. Issued 2,000 shares of 5%, $100 par, cumulative preferred stock for $122 per share.

3. Declared dividends on preferred dividend of 5% per share.

4. Purchased 500 shares of common stock at $14 for treasury.

5. Paid preferred dividend declared in #3.

6. Sold 100 shares treasury stock at $20 per share.

Instructions: Journalize the transactions for Fortier Company.

Problem 4. Norris Corporation was organized on January 1, 2015. It is authorized to issue 20,000 shares of 6%,

$50 par value preferred stock and 500,000 shares of no-par common stock with a stated value of $1 per share. The

following stock transactions were completed during the first year.

11-1

Issued 60,000 shares of common stock for cash at $4 per share.

Jan.

10

Mar. 1

Issued 12,000 shares of preferred stock for cash at $54 per

share.

May 1

Sept. 1

Issued 100,000 shares of common stock for cash at $5 per share.

Issued 5,000 shares of common stock for cash at $6 per share.

Issued 2,000 shares of preferred stock for cash at $56 per share.

Nov. 1

Instructions

(a) Journalize the transactions.

(b) Post to the stockholders' equity accounts. (Use T accounts.)

(c) Prepare the paid-in capital portion of the stockholders' equity section at December 31, 2015.

Problem 5 (optional). On January 1, 2016, Kem Corporation had $1,500,000 of common stock outstanding that

was issued at par and retained earnings of $750.000. The company issued 30,000 shares of common stock at par

on July 1 and earned net income of $400,000 for the year.

Instructions

Journalize the declaration of a 15% stock dividends on December 10, 2016 and the payment of the stock

dividends on December 31, 2016, for the following two independent assumptions.

(a) Par value is $10 and market value is $12.

(b) Par value is $5 and market value is $9.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning