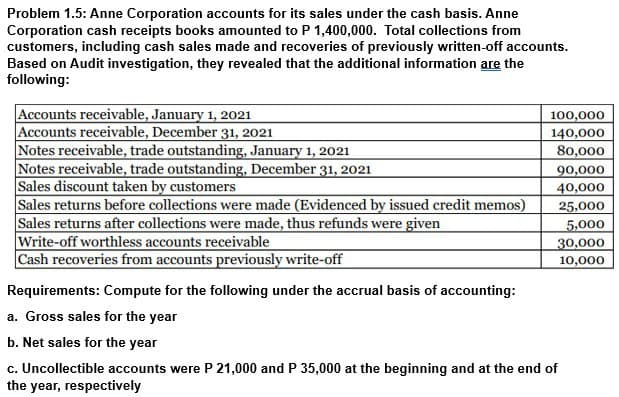

Problem 1.5: Anne Corporation accounts for its sales under the cash basis. Anne Corporation cash receipts books amounted to P 1,400,000. Total collections from customers, including cash sales made and recoveries of previously written-off accounts. Based on Audit investigation, they revealed that the additional information are the following: Accounts receivable, January 1, 2021 Accounts receivable, December 31, 2021 Notes receivable, trade outstanding, January 1, 2021 Notes receivable, trade outstanding, December 31, 2021 Sales discount taken by customers Sales returns before collections were made (Evidenced by issued credit memos) Sales returns after collections were made, thus refunds were given Write-off worthless accounts receivable Cash recoveries from accounts previously write-off Requirements: Compute for the following under the accrual basis of accounting: a. Gross sales for the year b. Net sales for the year 100,000 140,000 80,000 90,000 40,000 25,000 5,000 30,000 10,000 c. Uncollectible accounts were P 21,000 and P 35,000 at the beginning and at the end of the year, respectively

Problem 1.5: Anne Corporation accounts for its sales under the cash basis. Anne Corporation cash receipts books amounted to P 1,400,000. Total collections from customers, including cash sales made and recoveries of previously written-off accounts. Based on Audit investigation, they revealed that the additional information are the following: Accounts receivable, January 1, 2021 Accounts receivable, December 31, 2021 Notes receivable, trade outstanding, January 1, 2021 Notes receivable, trade outstanding, December 31, 2021 Sales discount taken by customers Sales returns before collections were made (Evidenced by issued credit memos) Sales returns after collections were made, thus refunds were given Write-off worthless accounts receivable Cash recoveries from accounts previously write-off Requirements: Compute for the following under the accrual basis of accounting: a. Gross sales for the year b. Net sales for the year 100,000 140,000 80,000 90,000 40,000 25,000 5,000 30,000 10,000 c. Uncollectible accounts were P 21,000 and P 35,000 at the beginning and at the end of the year, respectively

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter6: Cash And Receivables

Section: Chapter Questions

Problem 15P: Comprehensive Receivables Problem Blackmon Corporations December 31, 2018, balance sheet disclosed...

Related questions

Question

Transcribed Image Text:Problem 1.5: Anne Corporation accounts for its sales under the cash basis. Anne

Corporation cash receipts books amounted to P 1,400,000. Total collections from

customers, including cash sales made and recoveries of previously written-off accounts.

Based on Audit investigation, they revealed that the additional information are the

following:

Accounts receivable, January 1, 2021

Accounts receivable, December 31, 2021

Notes receivable, trade outstanding, January 1, 2021

Notes receivable, trade outstanding, December 31, 2021

Sales discount taken by customers

Sales returns before collections were made (Evidenced by issued credit memos)

Sales returns after collections were made, thus refunds were given

Write-off worthless accounts receivable

Cash recoveries from accounts previously write-off

100,000

140,000

80,000

90,000

40,000

25,000

5,000

30,000

10,000

Requirements: Compute for the following under the accrual basis of accounting:

a. Gross sales for the year

b. Net sales for the year

c. Uncollectible accounts were P 21,000 and P 35,000 at the beginning and at the end of

the year, respectively

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning