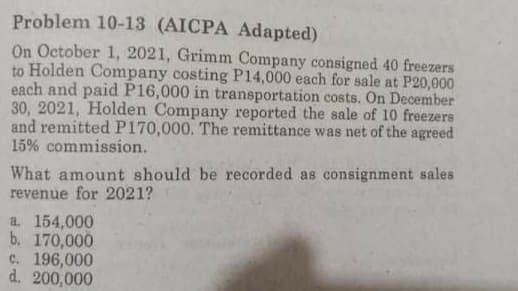

Problem 10-13 (AICPA Adapted) On October 1, 2021, Grimm Company consigned 40 freezers to Holden Company costing P14,000 each for sale at P20,000 each and paid P16,000 in transportation costs. On December 30, 2021, Holden Company reported the sale of 10 freezers and remitted P170,000. The remittance was net of the agreed 15% commission. What amount should be recorded as consignment sales revenue for 2021? a. 154,000 b. 170,000 C. 196,000

Q: Wing Co. consigned eight printing machines to Wind Co. Each machine costs P1,000,000 and has a…

A: Introduction: The consignor's (Wing co.'s) machines are held by the consignee (Wind Co.) who sells…

Q: On January 1, 20x1, Pete Electrical Shop received from Marion Trading 300 pieces of bread toasters.…

A: Consignment is a commercial agreement in which a company, also known as a consignee, agrees to pay a…

Q: 19. ABC Company sells appliance service contracts agreeing to repair appliances for a two-year…

A: In the given case, ABC Company spends 40% during year 1, and 60% during year 2 Hence, the revenue…

Q: On January 1, 2030, KKK consigned 300 units of gaming keyboards to SSS Each keyboard costs P400 and…

A: Consignment means where consignor send goods to consignee to be sold by later on the behalf of…

Q: On August, 2019, HBO consigned to GEO 10 laptops costing $15,000 each, paying freight charge of…

A: Consignment Account: It is made to calculate the profit earned or loss incurred by the consignor…

Q: Newmarket's revenue as shown in its draft statement of profit or loss for the year ended 31 December…

A: International Financial Reporting Standard (IFRS) 15, revenue from contracts with customers…

Q: 58. During 2021, Tartarus Company signed a noncancellable contract to purchase 500 sacks of rice at…

A: Purchase commitment is a form of agreement or contract with company and their suppliers, which says…

Q: ABC Co., consigned 5 dozen of stainless chairs to DEF Co on April 1. 2021. Each chair cost P120 and…

A:

Q: . On April 1, 2020, Waleed company entered into a cost-plus fixed-fee contract to construct a power…

A: Formula: Total estimated project cost = Estimated project cost + Fixed fee in the contract. Sum of…

Q: Kikiam Company sells equipment service contracts that cover a two-year period. The sales price of…

A: Warranty means where the company is undertaking to make good the loss which has been incurred due to…

Q: On January 1, 2021, VVV received from ABC 300 pieces of bread toaster. VV was to sell these on…

A: Inventory value is the total cost associated with that stock on acquiring or storing of acquiring…

Q: On May 3, 2020, Flint Company consigned 80 freezers, costing $450 each, to Remmers Company. The cost…

A: Given information is: Goods consigned 80 freezers costing $450 each

Q: Shrek Company consigned 100 freezers costing P50,000 each to Disney Company on January 2, 2020. The…

A: Consignment seems to be an agreement between a distributor (consignee) and their provider…

Q: 7. On April 1, 2020, Waleed company entered into a cost- plus fixed-fee contract to construct a…

A: Formula: Total estimated project cost = Estimated project cost + Fixed fee in the contract. Sum of…

Q: How much is the net profit of Spider related to the seven bikes sold?

A: Net profit on sale of bikes is calculated as sales value minus commission minus purchase cost minus…

Q: On October 1, consignment. P20,000 each. P10,000. The consignor agreed to absorb the consignee's…

A: Consignment means where consignor send goods to consignee to be sold by later on the behalf of…

Q: NAPAPALUNOK AKO AS OF THE MOMENT INC. sells 3-year service contracts for air conditioning units for…

A: Revenue means the amount earned by selling the goods or services. Unearned revenue means the amount…

Q: On January 1, 20x1, Pete Electrical Shop received from Marion Trading 300 pieces of bread toasters.…

A: Sales value = (amount remitted + repair cost + deliver expense) / (1 - commission rate) =…

Q: On 1 July 20X7 The Qtakamiro Company handed over to a client a new computer system. The contract…

A: IFRS 15: an entity recognises revenue to depict the transfer of promised goods or services to the…

Q: Spider Inc. consigned ten electric bikes costing P30,000 per bike to Web Company. Spider incurred…

A: Commission on sale = (50,000 x 7) x 15% = 52,500

Q: 40. On January 1, 2017, Prague Company sold its goods costing P400,000 to Budapest Company. Prague,…

A:

Q: On July 2, 2022, Honesty Co. consigned 3,200 books costing P60 and retailing for P100 each to…

A: Let assume number of books sold by integrity co. Is X . Selling price of book = P100 Sale value…

Q: On July 2, 2022, Howard Co. consigned 3,200 books costing P60 and retailing for P100 each to Ines…

A: The actual books sold by Ines Co. will be total sales divided by sales price after deducting…

Q: Kikiam Company sells equipment service contracts that cover a two-year period. The sales price of…

A: The question is based on the concept of Finacial Accounting.

Q: Corner Company puchased a van with a list price of P3,000,000. The dealer granted a 15% reduction in…

A: List price = P3,000, 000 Net price = List price - reduction in list price

Q: Dunne Co. sells equipment service contracts that cover a twoyear period. The sales price of each…

A: Ans. As given in the question, the service contract is spread over 2 years. And so the revenue will…

Q: INTEGRITY, Inc. consigned 1,000 units of ordinary printer, costing P700 each to PUP Co. to be sold…

A: Net income is calculated by deducting all expenses related to consignment from sales and adding…

Q: Assume the following scenarios.Scenario 1: During 2021, The Hubbard Group provides services of…

A: Revenue recognition principle: Revenue recognition principle states that even- business organization…

Q: On July 1, 20x1, Lala Home Store shipped 150 ovens, costing P9,000 each on consignment basis to SM…

A: Consignment sales is a type of sales agreement in which one party, that is known as consignor sends…

Q: Dec 31 Purchased new equipment for P750,000, paying P150,000 cash and signing a 3-year, 7% note for…

A: Warranty expense refers to the expenses which is to be incurred by a business entity in case their…

Q: In 2021, ABC Corporation which is subject to MCIT has the following records: Sales: net of…

A: The MCIT is 2% of the gross income of the corporation at the end of the taxable year. Computation…

Q: Peterson, Inc. purchased a machine under a deferred payment contract on December 31, 2001. Under the…

A: Given a specified rate of return, Present Value (PV) is the current value of a future sum of money.…

Q: ABC Co. sells equipment service contracts that cover a two-year period. The sales price of each…

A: Introduction:- Calculation of total sales value as follows:- Total sales value = No. of contracts…

Q: On July 1, 20x1, Lala Home Store shipped 150 ovens, costing P9,000 each on consignment basis to SM…

A: Consignment sales is a type of sales agreement in which one party, that is known as consignor sends…

Q: A company received 505 pairs of slippers on consignment from C Company. C company’s cost for each…

A: Consignment is the facility available to the consignor by transferring the goods to the consignee on…

Q: Ines Company consigned twenty five (25) calculators, with cost of P800 each, to Hola Company for a…

A: Under consignment sales one party gives their goods to another party for selling. The one who gives…

Q: 10. On March 1, 2020 ABC Company sold a machine to XYZ Company. XYZ made a cash down payment of…

A: Non- current assets (NCA) - Assets which are not expected to be sold within 1 year and whose…

Q: During 2021, Tartarus Company signed a noncancellable contract to purchase 500 sacks of rice at P900…

A: Solution: Amount of loss on purchase commitment should be recognized on Dec 31, 2021 = (contract…

Q: 11. PEANUTS Company, a grocery retailer operates a customer loyalty program. It grants program…

A: • In the case of accounting for a customer loyalty programme, a portion of sales from the total…

Q: BC Company sells equipment service contracts that cover a two-year period. The sales price of each…

A: Total sales value = No. of contracts sold x sales price per contract = 1,000 x P600 = P600,000

Q: Gross sales of components for the first six months of 2021. were: Month Amount Month Amount January…

A: Sales Return - A sales return is merchandise sent back by a purchaser to the vendor. The return is…

Q: During the first quarter of 2021, a company sold on credit, 2,000 truck tires at $85 each plus…

A: The harmonized sales tax (HST) is a five-province mix of federal and provincial taxes on goods and…

Q: Mary Corporation has a branch in Caloocan. During 2021, the home office shipped to the branch…

A: Information given in the question Home office supplied goods to branch at cost 156,000 plus…

Q: Big Company consigned 1,000 units of ordinary printer, costing P700 each to a consignee to be sold…

A: “Since you have posted a question with multiple sub-parts, we will solve first three sub-parts for…

Q: On March 1, 2022, ABC Co. was contracted to construct a building for a customer at a total contract…

A: solution: Under percentage of completion method of revenue recognition, revenue is recognized based…

Q: 7. On April 1, 2020, Waleed company entered into a cost-plus fixed-fee contract to construct a power…

A: Formula: Total estimated cost = Cost incurred + Estimated cost

Q: On January 1, 20x1, Pete Electrical Shop received from Marion Trading 300 pieces of bread toasters.…

A: Under Consignment, consignee sells the goods and remits back the money to the consignor after…

Q: Anemic Inc. manufactures and sells specialized equipment normally at P1,000,000 for the medical…

A:

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- A company received 505 pairs of slippers on consignment from C Company. C company’s cost for each pair of slippers was P800 each, and they were priced to sell at P1,000. A Company’s commission on consigned goods is 10%. On December 31, 2021, 5 pairs remained. On December 31, 2021, what amount should be reported as payable for the consigned goods? a. 454,000 b. 404,000 c. 490,000 d. 450,000Problem 11 The following consignment-related transactions were made by Juno Company in December 2020: Consigned to Atlan Company 10,000 units of tools at P500 each and paid freight ofP50,000. Each unit costs P200. They agreed that Atlan’s commission is P10 per unit. Bythe end of the year, only 2,000 units remained unsold by Atlan. Consigned 5,000 units of tools to Skye at P600 each and paid freight of P50,000. Totalcost of the consigned items was P1,500,000. Skye agreed to undertake the consignmentif she will get a commission of 10% per unit sold. By the end of the year, only 2,000 unitswere sold by Skye. Assuming that Juno Company maintains its inventory records using the perpetual inventorysystem, prepare the journal entry to record the sales when Atlan and Skye remitted their sales.Prepare separate entry for each consigneeRegal Appliances consigned 60 television sets to Gal Company on January 1, 2020 for sale at P10,800 each and paid P10,000 transportation costs. At the end of the month, Gal reported sale of 25 television sets and remitted P243,000 which is net of ten percent commission. What amount of consignment sales revenue should be reported by Regal?

- On October 1, 2020, Win Company consigned 240 posters to JAA Inc. with original cost of P1,000 each. Win policy in setting its selling price is 160% mark-up on cost. Freight on shipment was paid by JAA Company for P12,000. Any costs incurred by the consignee in relation to the consigned goods are all reimbursable. On December 17, JAA Inc. submitted an account sales and remitted P230,400 after deducting 12% commissions, selling expense of P10,000 and any reimbursable cost. Assume further that 50% of the remaining posters were returned to Win incurring freight of P5,000. Half of the returned goods were lost during the shipment. How much is the total loss and/or expenses accounted by Win in relation to the consignment other than the Cost of Goods Sold? Determine the cost of ending inventoryOn October 1, 2020, Win Company consigned 240 posters to JAA Inc. with original cost of P1,000 each. Win policy in setting its selling price is 160% mark-up on cost. Freight on shipment was paid by JAA Company for P12,000. Any costs incurred by the consignee in relation to the consigned goods are all reimbursable. On December 17, JAA Inc. submitted an account sales and remitted P230,400 after deducting 12% commissions, selling expense of P10,000 and any reimbursable cost. How much is the net income?62 In August 2021, Commonlo Corp. commits to selling 100 of its merchandise to M&H Co. for P30,000 (P300 per product). The merchandise is to be delivered to M&H over the next 6 months. After 60 merchandises were delivered, the contract is modified and Commonlo promises to deliver 80 more products for an additional P21,600 (P270 per station). At year-end, Commonlo delivered an additional 90 products. All sales are cash on delivery. How much revenue will be recognized on the contract for the year 2021?

- On November 30, 20x1, Northup Co. consigned 90 freezers to Watson Co. for sale at ₱1,600 each and paid ₱1,200in transportation costs. A report of sales was received on December 30, 20x1 from Watson reporting the sale of 20 freezers, together with a remittance that was net of the agreed 15% commission. How much, should Northup receive as remittance from Watson Co.11. In 2021, ABC Corporation which is subject to MCIT has the following records: Sales: net of discounts and allowances 9,500,000 Cost of sales 5,000,000 Gain on sale of building 150,000 Allowable deductions 4,420,000 Compute the MCIT of ABC Corporation. P46,000 P46,500 P93,000 P95,000On May 2, 2019 PIONEER, PHILS INC. Ships ten (10) Compact Disc Stereo to KALIDAD Appliance Center. Each Stereo system costs P10,000 and is to be sold at an advertised price of P14,000. PIONEER Paid freight in the amount of P1,200 while KALIDAD incurred a cartage of P500, which is reimbursable. The consignee is entitled to a commission of 20% of the authorized selling price. The Consignee sold all the units and remitted the balance due to the consignor along with the account sales. Required: 1. Prepare the account sales

- On May 2, 2019 PIONEER, PHILS INC. Ships ten (10) Compact Disc Stereo to KALIDAD Appliance Center. Each Stereo system costs P10,000 and is to be sold at an advertised price of P14,000. PIONEER Paid freight in the amount of P1,200 while KALIDAD incurred a cartage of P500, which is reimbursable. The consignee is entitled to a commission of 20% of the authorized selling price. The Consignee sold all the units and remitted the balance due to the consignor along with the account sales. Required: 1. Prepare the journal entries in the books of hte consignee 2. Prepare the account salesOn May 2, 2019 PIONEER, PHILS INC. Ships ten (10) Compact Disc Stereo to KALIDAD Appliance Center. Each Stereo system costs P10,000 and is to be sold at an advertised price of P14,000. PIONEER Paid freight in the amount of P1,200 while KALIDAD incurred a cartage of P500, which is reimbursable. The consignee is entitled to a commission of 20% of the authorized selling price. The Consignee sold all the units and remitted the balance due to the consignor along with the account sales. Required: 1. Prepare the journal entries in the books of the consigneeABC Co., consigned 5 dozen of stainless chairs to DEF Co. on April 1, 2021. Each chair cost P120 and the consignor paid P600 for the shipment to the consignee. On August 15, 2021, 36 chairs were already sold and the consignee rendered an account sale, and remitted the balance due the consignor in the amount of P5,580 after deducting the following: Commission at 15% of the selling price Selling expenses P360Delivery and installation 180Compute for the cost of inventory on consignment in the hand of DEF Co.