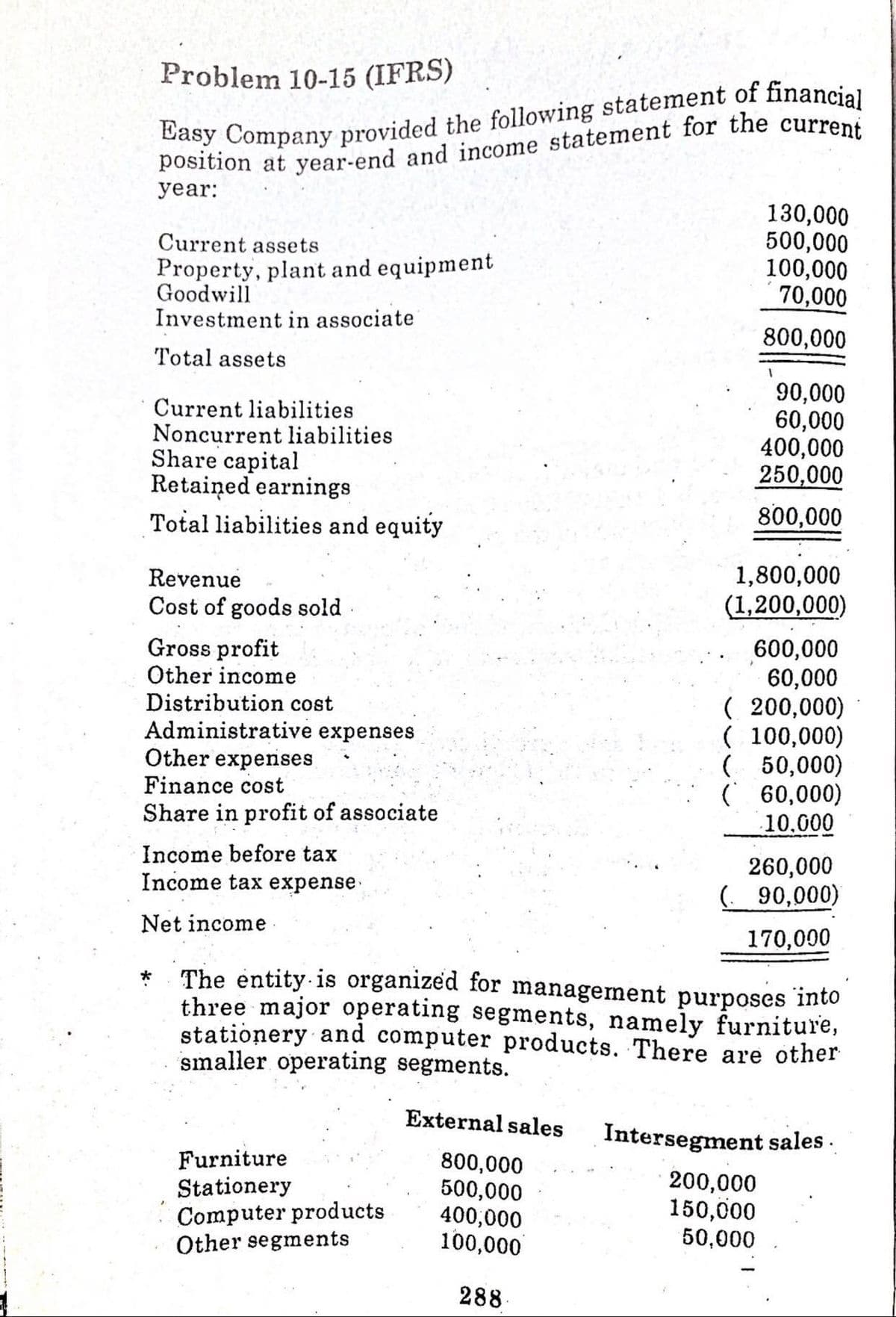

Problem 10-15 (IFRS) basy Company provided the following statement of financial year: 130,000 500,000 100,000 70,000 Current assets Property, plant and equipment Goodwill Investment in associate 800,000 Total assets Current liabilities Noncurrent liabilities Share capital Retaiņed earnings Total liabilities and equity 90,000 60,000 400,000 250,000 800,000 Revenue 1,800,000 Cost of goods sold (1,200,000) Gross profit Other income Distribution cost Administrative expenses Other expenses Finance cost Share in profit of associate 600,000 60,000 ( 200,000) ( 100,000) ( 50,000) ( 60,000) 10.000 Income before tax Income tax expense. 260,000 (. 90,000) Net income 170,000 The entity is organized for management purposes into three major operating segments, namely furniture, stationery and computer products. There are other smaller operating segments. External sales Intersegment sales . Furniture Stationery Computer products Other segments 800,000 500,000 400,000 100,000 200,000 150,000 50,000 288-

Problem 10-15 (IFRS) basy Company provided the following statement of financial year: 130,000 500,000 100,000 70,000 Current assets Property, plant and equipment Goodwill Investment in associate 800,000 Total assets Current liabilities Noncurrent liabilities Share capital Retaiņed earnings Total liabilities and equity 90,000 60,000 400,000 250,000 800,000 Revenue 1,800,000 Cost of goods sold (1,200,000) Gross profit Other income Distribution cost Administrative expenses Other expenses Finance cost Share in profit of associate 600,000 60,000 ( 200,000) ( 100,000) ( 50,000) ( 60,000) 10.000 Income before tax Income tax expense. 260,000 (. 90,000) Net income 170,000 The entity is organized for management purposes into three major operating segments, namely furniture, stationery and computer products. There are other smaller operating segments. External sales Intersegment sales . Furniture Stationery Computer products Other segments 800,000 500,000 400,000 100,000 200,000 150,000 50,000 288-

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter9: Metric-analysis Of Financial Statements

Section: Chapter Questions

Problem 9.4.10P: Twenty metrics of liquidity, solvency, and profitability The comparative financial statements of...

Related questions

Question

REQUIRED:

1. Prepare the disclosures required for operating segments.

Transcribed Image Text:Problem 10-15 (IFRS)

Dasy Company provided the following statement of financial

year:

130,000

500,000

100,000

70,000

Current assets

Property, plant and equipment

Goodwill

Investment in associate

800,000

Total assets

Current liabilities

Noncurrent liabilities

Share capital

Retaiņed earnings

Total liabilities and equity

90,000

60,000

400,000

250,000

800,000

1,800,000

(1,200,000)

Revenue

Cost of goods sold.

Gross profit

Other income

Distribution cost

Administrative expenses

Other expenses

Finance cost

600,000

60,000

( 200,000)

( 100,000)

( 50,000)

( 60,000)

10.000

Share in profit of associate

Income before tax

260,000

Income tax expense.

( 90,000)

Net income

170,000

The entity is organized for management purposes into

three major operating segments, namely furniture,

stationery and computer products. There are other

smaller operating segments.

External sales

Intersegment sales.

Furniture

Stationery

Computer products

Other segments

800,000

500,000

400,000

100,000

200,000

150,000

50,000

288

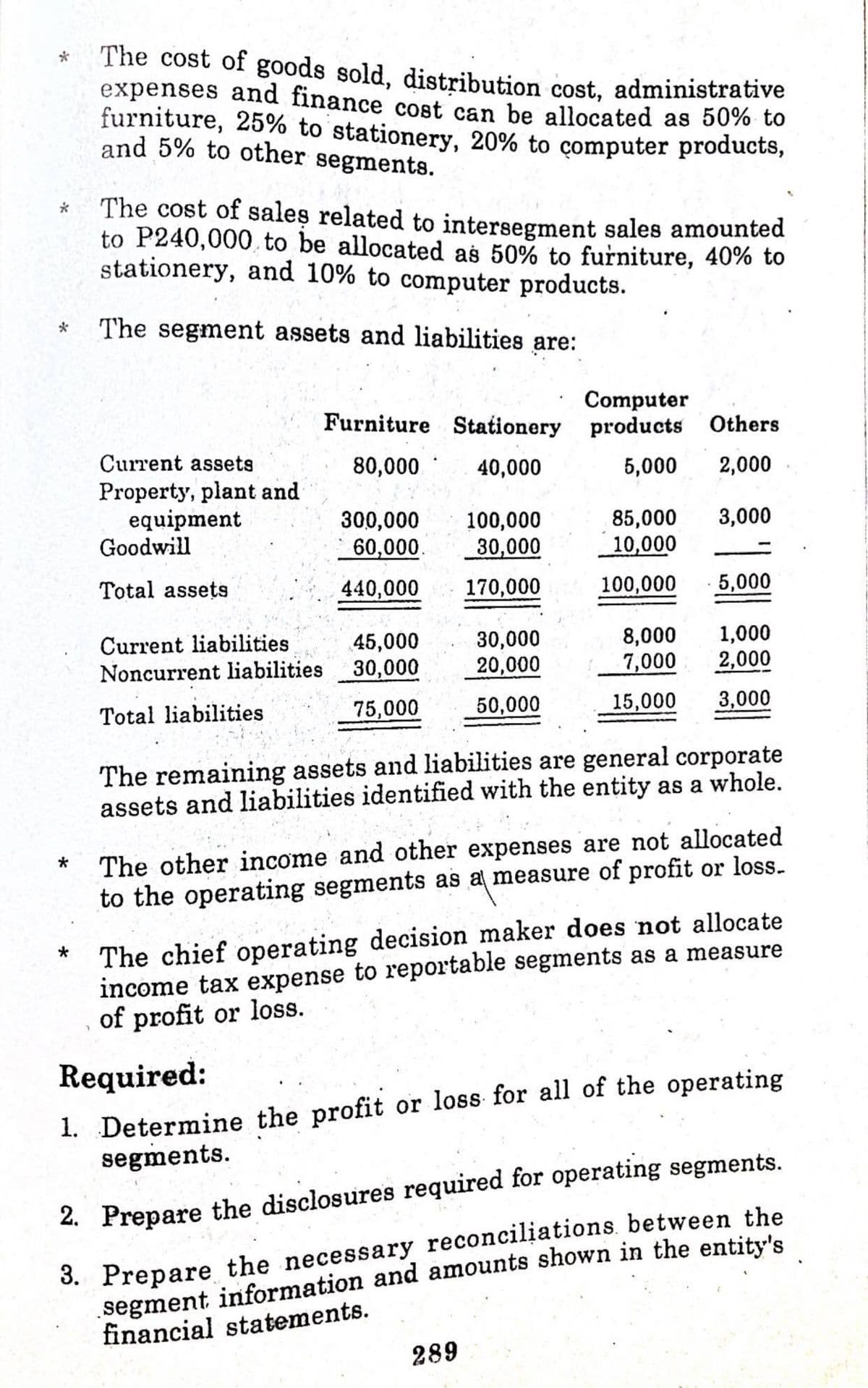

Transcribed Image Text:The cost of goods sold, distribution cost, administrative

expenses and finance cost can be allocated as 50% to

furniture, 25% to stationery, 20% to computer products,

and 5% to other segments.

The cost of sales related to intersegment sales amounted

to P240,000, to be allocated as 50% to furniture, 40% to

stationery, and 10% to computer products.

The segment assets and liabilities are:

Computer

Furniture Stationery products Others

Current assets

80,000

40,000

5,000

2,000

Property, plant and

equipment

Goodwill

3,000

300,000

60,000.

100,000

30,000

85,000

10,000

Total assets

440,000

170,000

100,000

5,000

1,000

Current liabilities

Noncurrent liabilities

30,000

20,000

8,000

7,000

45,000

30,000

2,000

75,000

50,000

15,000

3,000

Total liabilities

The remaining assets and liabilities are general corporate

assets and liabilities identified with the entity as a whole.

The other income and other expenses are not allocated

to the operating segments as a measure of profit or loss.

The chief operating decision maker does not allocate

income tax expense to reportable segments as a measure

of profit or loss.

1. Determine the profit or loss for all of the operating

segments.

Required:

3. Prepare the necessary reconciliations between the

segment information and amounts shown in the entity's

financial statements.

2. Prepare the disclosures required for operating segments.

289

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning