Problem 13-74 (a) (LO. 6) Rodriquez owns real estate (adjusted basis of $57,000 and fair market value of $65,000), which he uses in his business. Rodriquez sells the real estate for $65,000 to Jones (a dealer) and then purchases a new parcel of land for $65,000 from Franklin (also a dealer). The new parcel of land would normally qualify as like-kind property. a. What are Rodriquez's realized and recognized gain on the sale of the land he sold to Jones? On the sale of real estate, Rodriquez's realized gain is $ and recognized gain is $ b. Rodriquez's basis for the land he purchased from Franklin is $ c. Indicate whether the following statements are "True" or "False" regarding what would motivate Rodriquez to sell his land to Jones and purchase the land from Franklin rather than exchange one parcel of land for the other. If Rodriquez sells the parcel of land, the sale would have resulted in the realized gain being postponed. • If Rodriquez sells the parcel of land, the recognition of gain permits him to have a higher basis for the new parcel of land. • If Rodriquez sells the parcel of land, he may have some losses with which he can offset the recognized gain. • If Rodriquez exchanges the parcel of land instead of selling it, the exchange would result in a nondeductible loss.

Problem 13-74 (a) (LO. 6) Rodriquez owns real estate (adjusted basis of $57,000 and fair market value of $65,000), which he uses in his business. Rodriquez sells the real estate for $65,000 to Jones (a dealer) and then purchases a new parcel of land for $65,000 from Franklin (also a dealer). The new parcel of land would normally qualify as like-kind property. a. What are Rodriquez's realized and recognized gain on the sale of the land he sold to Jones? On the sale of real estate, Rodriquez's realized gain is $ and recognized gain is $ b. Rodriquez's basis for the land he purchased from Franklin is $ c. Indicate whether the following statements are "True" or "False" regarding what would motivate Rodriquez to sell his land to Jones and purchase the land from Franklin rather than exchange one parcel of land for the other. If Rodriquez sells the parcel of land, the sale would have resulted in the realized gain being postponed. • If Rodriquez sells the parcel of land, the recognition of gain permits him to have a higher basis for the new parcel of land. • If Rodriquez sells the parcel of land, he may have some losses with which he can offset the recognized gain. • If Rodriquez exchanges the parcel of land instead of selling it, the exchange would result in a nondeductible loss.

Chapter15: Property Transactions: Nontaxable Exchanges

Section: Chapter Questions

Problem 36P

Related questions

Question

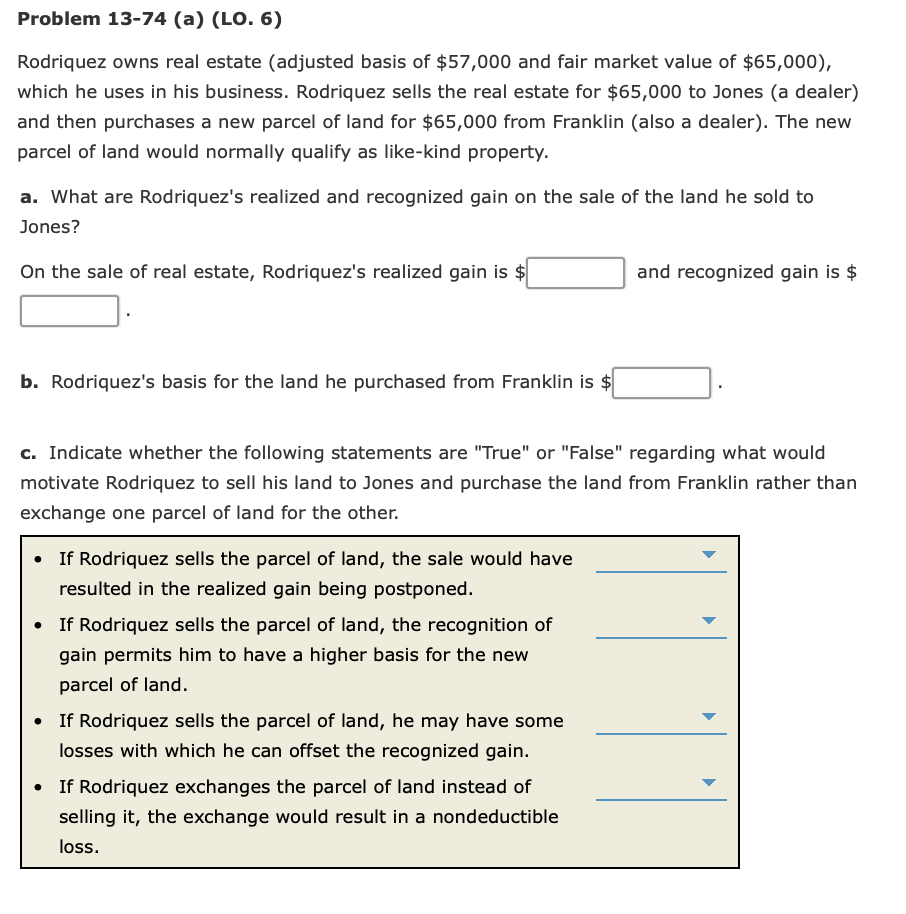

Transcribed Image Text:Problem 13-74 (a) (LO. 6)

Rodriquez owns real estate (adjusted basis of $57,000 and fair market value of $65,000),

which he uses in his business. Rodriquez sells the real estate for $65,000 to Jones (a dealer)

and then purchases a new parcel of land for $65,000 from Franklin (also a dealer). The new

parcel of land would normally qualify as like-kind property.

a. What are Rodriquez's realized and recognized gain on the sale of the land he sold to

Jones?

On the sale of real estate, Rodriquez's realized gain is $

and recognized gain is $

b. Rodriquez's basis for the land he purchased from Franklin is $

c. Indicate whether the following statements are "True" or "False" regarding what would

motivate Rodriquez to sell his land to Jones and purchase the land from Franklin rather than

exchange one parcel of land for the other.

• If Rodriquez sells the parcel of land, the sale would have

resulted in the realized gain being postponed.

• If Rodriquez sells the parcel of land, the recognition of

gain permits him to have a higher basis for the new

parcel of land.

• If Rodriquez sells the parcel of land, he may have some

losses with which he can offset the recognized gain.

• If Rodriquez exchanges the parcel of land instead of

selling it, the exchange would result in a nondeductible

loss.

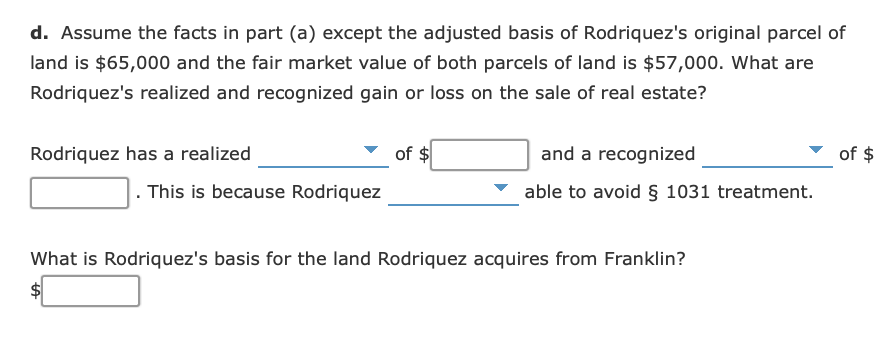

Transcribed Image Text:d. Assume the facts in part (a) except the adjusted basis of Rodriquez's original parcel of

land is $65,000 and the fair market value of both parcels of land is $57,000. What are

Rodriquez's realized and recognized gain or loss on the sale of real estate?

of $

Rodriquez has a realized

of $

and a recognized

This is because Rodriquez

able to avoid § 1031 treatment.

What is Rodriquez's basis for the land Rodriquez acquires from Franklin?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT