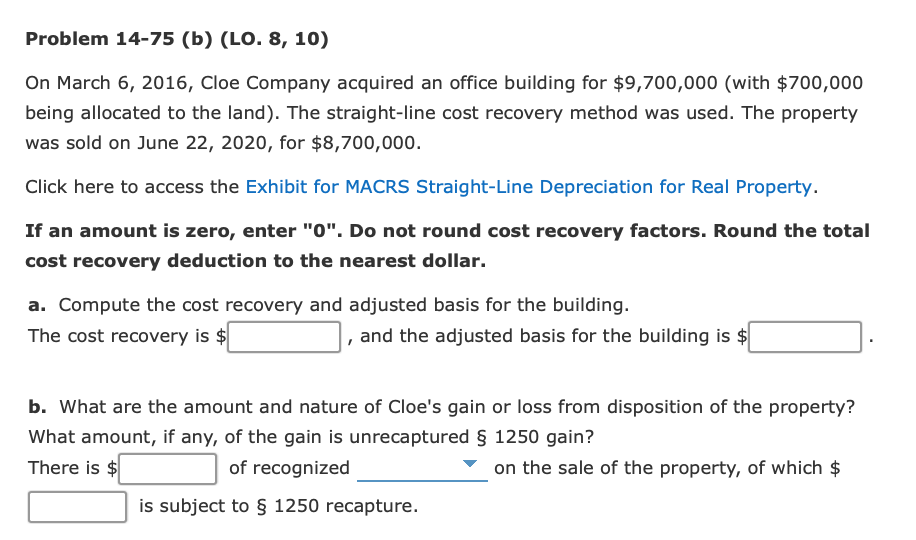

Problem 14-75 (b) (LO. 8, 10) On March 6, 2016, Cloe Company acquired an office building for $9,700,000 (with $700,000 being allocated to the land). The straight-line cost recovery method was used. The property was sold on June 22, 2020, for $8,700,000. Click here to access the Exhibit for MACRS Straight-Line Depreciation for Real Property. If an amount is zero, enter "0". Do not round cost recovery factors. Round the total cost recovery deduction to the nearest dollar. a. Compute the cost recovery and adjusted basis for the building. The cost recovery is $ and the adjusted basis for the building is $ b. What are the amount and nature of Cloe's gain or loss from disposition of the property? What amount, if any, of the gain is unrecaptured § 1250 gain? There is $ of recognized on the sale of the property, of which $ is subject to § 1250 recapture.

Problem 14-75 (b) (LO. 8, 10) On March 6, 2016, Cloe Company acquired an office building for $9,700,000 (with $700,000 being allocated to the land). The straight-line cost recovery method was used. The property was sold on June 22, 2020, for $8,700,000. Click here to access the Exhibit for MACRS Straight-Line Depreciation for Real Property. If an amount is zero, enter "0". Do not round cost recovery factors. Round the total cost recovery deduction to the nearest dollar. a. Compute the cost recovery and adjusted basis for the building. The cost recovery is $ and the adjusted basis for the building is $ b. What are the amount and nature of Cloe's gain or loss from disposition of the property? What amount, if any, of the gain is unrecaptured § 1250 gain? There is $ of recognized on the sale of the property, of which $ is subject to § 1250 recapture.

Chapter8: Depreciation, Cost Recovery, Amortization, And Depletion

Section: Chapter Questions

Problem 7BCRQ

Related questions

Question

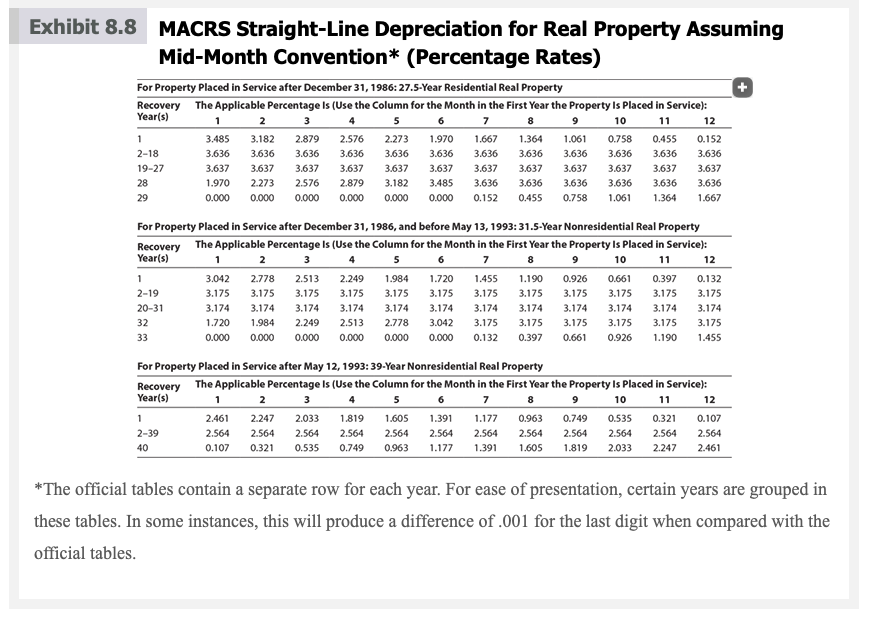

Transcribed Image Text:Exhibit 8.8 MACRS Straight-Line Depreciation for Real Property Assuming

Mid-Month Convention* (Percentage Rates)

For Property Placed in Service after December 31, 1986: 27.5-Year Residential Real Property

Recovery The Applicable Percentage Is (Use the Column for the Month in the First Year the Property Is Placed in Service):

Year(s)

1

2

3

4

5

6

8

9

10

11

12

1

3.485

3.182

2.879

2.576

2.273

1.970

1.667

1.364

1.061

0.758

0.455

0.152

2-18

3.636

3.636

3.636

3.636

3.636

3.636

3.636

3.636

3.636

3.636

3.636

3.636

19-27

3.637

3.637

3.637

3.637

3.637

3.637

3.637

3.637

3.637

3.637

3.637

3.637

28

1.970

2.273

2.576

2.879

3.182

3.485

3.636

3.636

3.636

3.636

3.636

3.636

29

0.000

0.000

0.000

0.000

0.000

0.000

0.152

0.455

0.758

1.061

1.364

1.667

For Property Placed in Service after December 31, 1986, and before May 13, 1993: 31.5-Year Nonresidential Real Property

The Applicable Percentage Is (Use the Column for the Month in the First Year the Property Is Placed in Service):

Recovery

Year(s)

1

2

3

6.

7

8

10

11

12

3.042

2.778

2.513

2.249

1.984

1.720

1.455

1.190

0.926

0.661

0.397

0.132

2-19

3.175

3.175

3.175

3.175

3.175

3.175

3.175

3.175

3.175

3.175

3.175

3.175

20-31

3.174

3.174

3.174

3.174

3.174

3.174

3.174

3.174

3.174

3.174

3.174

3.174

32

1.720

1.984

2.249

2.513

2.778

3.042

3.175

3.175

3.175

3.175

3.175

3.175

33

0.000

0.000

0.000

0.000

0.000

0.000

0.132

0.397

0.661

0.926

1.190

1.455

For Property Placed in Service after May 12, 1993: 39-Year Nonresidential Real Property

Recovery The Applicable Percentage Is (Use the Column for the Month in the First Year the Property Is Placed in Service):

Year(s)

1

2

3

4

5

6

7

8

9

10

11

12

1

2.461

2.247

2.033

1.819

1.605

1.391

1.177

0.963

0.749

0.535

0.321

0.107

2-39

2.564

2.564

2.564

2.564

2.564

2.564

2.564

2.564

2.564

2.564

2.564

2.564

40

0.107

0.321

0.535

0.749

0.963

1.177

1.391

1.605

1.819

2.033

2.247

2.461

*The official tables contain a separate row for each year. For ease of presentation, certain years are grouped in

these tables. In some instances, this will produce a difference of .001 for the last digit when compared with the

official tables.

Transcribed Image Text:Problem 14-75 (b) (LO. 8, 10)

On March 6, 2016, Cloe Company acquired an office building for $9,700,000 (with $700,000

being allocated to the land). The straight-line cost recovery method was used. The property

was sold on June 22, 2020, for $8,700,000.

Click here to access the Exhibit for MACRS Straight-Line Depreciation for Real Property.

If an amount is zero, enter "0". Do not round cost recovery factors. Round the total

cost recovery deduction to the nearest dollar.

a. Compute the cost recovery and adjusted basis for the building.

The cost recovery is $

and the adjusted basis for the building is $

b. What are the amount and nature of Cloe's gain or loss from disposition of the property?

What amount, if any, of the gain is unrecaptured § 1250 gain?

There is $

of recognized

on the sale of the property, of which $

is subject to § 1250 recapture.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning