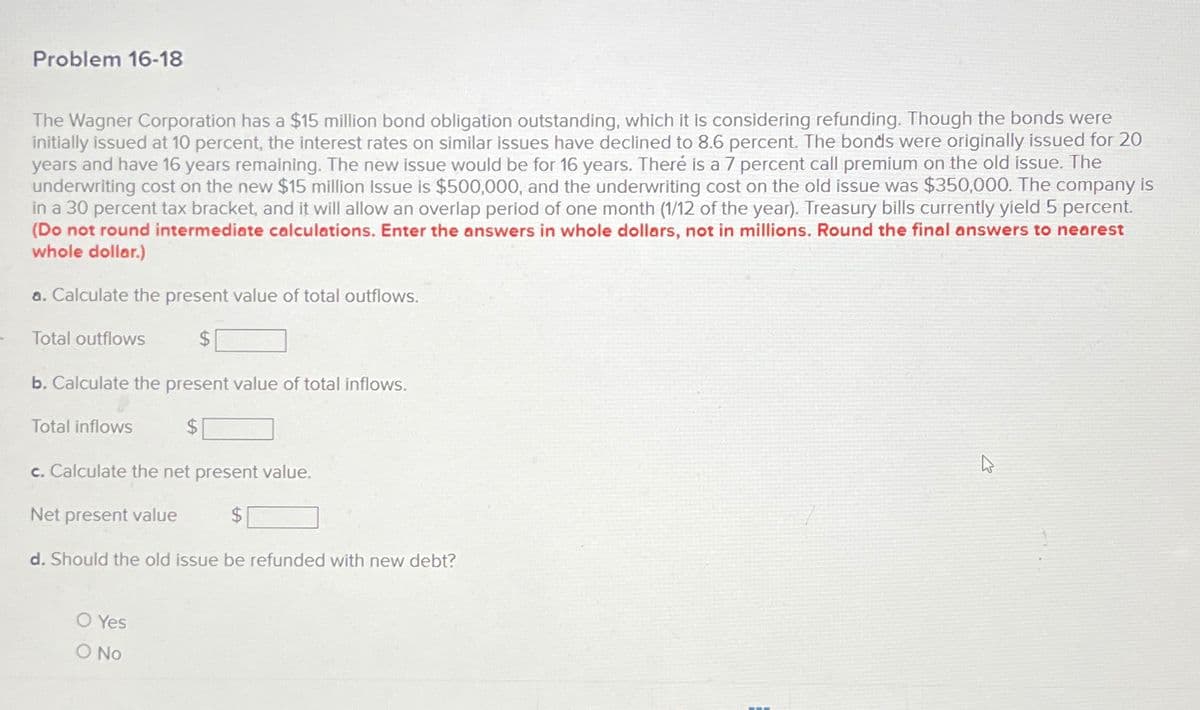

Problem 16-18 The Wagner Corporation has a $15 million bond obligation outstanding, which it is considering refunding. Though the bonds were initially issued at 10 percent, the interest rates on similar issues have declined to 8.6 percent. The bonds were originally issued for 20 years and have 16 years remaining. The new issue would be for 16 years. There is a 7 percent call premium on the old issue. The underwriting cost on the new $15 million Issue is $500,000, and the underwriting cost on the old issue was $350,000. The company is in a 30 percent tax bracket, and it will allow an overlap period of one month (1/12 of the year). Treasury bills currently yield 5 percent. (Do not round intermediate calculations. Enter the answers in whole dollars, not in millions. Round the final answers to nearest whole dollar.) a. Calculate the present value of total outflows. Total outflows $ b. Calculate the present value of total inflows. Total inflows $ c. Calculate the net present value. D Net present value $

Problem 16-18 The Wagner Corporation has a $15 million bond obligation outstanding, which it is considering refunding. Though the bonds were initially issued at 10 percent, the interest rates on similar issues have declined to 8.6 percent. The bonds were originally issued for 20 years and have 16 years remaining. The new issue would be for 16 years. There is a 7 percent call premium on the old issue. The underwriting cost on the new $15 million Issue is $500,000, and the underwriting cost on the old issue was $350,000. The company is in a 30 percent tax bracket, and it will allow an overlap period of one month (1/12 of the year). Treasury bills currently yield 5 percent. (Do not round intermediate calculations. Enter the answers in whole dollars, not in millions. Round the final answers to nearest whole dollar.) a. Calculate the present value of total outflows. Total outflows $ b. Calculate the present value of total inflows. Total inflows $ c. Calculate the net present value. D Net present value $

Algebra and Trigonometry (6th Edition)

6th Edition

ISBN:9780134463216

Author:Robert F. Blitzer

Publisher:Robert F. Blitzer

ChapterP: Prerequisites: Fundamental Concepts Of Algebra

Section: Chapter Questions

Problem 1MCCP: In Exercises 1-25, simplify the given expression or perform the indicated operation (and simplify,...

Related questions

Question

pm.8

Transcribed Image Text:Problem 16-18

The Wagner Corporation has a $15 million bond obligation outstanding, which it is considering refunding. Though the bonds were

initially issued at 10 percent, the interest rates on similar issues have declined to 8.6 percent. The bonds were originally issued for 20

years and have 16 years remaining. The new issue would be for 16 years. There is a 7 percent call premium on the old issue. The

underwriting cost on the new $15 million Issue is $500,000, and the underwriting cost on the old issue was $350,000. The company is

in a 30 percent tax bracket, and it will allow an overlap period of one month (1/12 of the year). Treasury bills currently yield 5 percent.

(Do not round intermediate calculations. Enter the answers in whole dollars, not in millions. Round the final answers to nearest

whole dollar.)

a. Calculate the present value of total outflows.

Total outflows

$

b. Calculate the present value of total inflows.

Total inflows

$

c. Calculate the net present value.

Net present value

$

d. Should the old issue be refunded with new debt?

O Yes

O No

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 14 images

Recommended textbooks for you

Algebra and Trigonometry (6th Edition)

Algebra

ISBN:

9780134463216

Author:

Robert F. Blitzer

Publisher:

PEARSON

Contemporary Abstract Algebra

Algebra

ISBN:

9781305657960

Author:

Joseph Gallian

Publisher:

Cengage Learning

Linear Algebra: A Modern Introduction

Algebra

ISBN:

9781285463247

Author:

David Poole

Publisher:

Cengage Learning

Algebra and Trigonometry (6th Edition)

Algebra

ISBN:

9780134463216

Author:

Robert F. Blitzer

Publisher:

PEARSON

Contemporary Abstract Algebra

Algebra

ISBN:

9781305657960

Author:

Joseph Gallian

Publisher:

Cengage Learning

Linear Algebra: A Modern Introduction

Algebra

ISBN:

9781285463247

Author:

David Poole

Publisher:

Cengage Learning

Algebra And Trigonometry (11th Edition)

Algebra

ISBN:

9780135163078

Author:

Michael Sullivan

Publisher:

PEARSON

Introduction to Linear Algebra, Fifth Edition

Algebra

ISBN:

9780980232776

Author:

Gilbert Strang

Publisher:

Wellesley-Cambridge Press

College Algebra (Collegiate Math)

Algebra

ISBN:

9780077836344

Author:

Julie Miller, Donna Gerken

Publisher:

McGraw-Hill Education