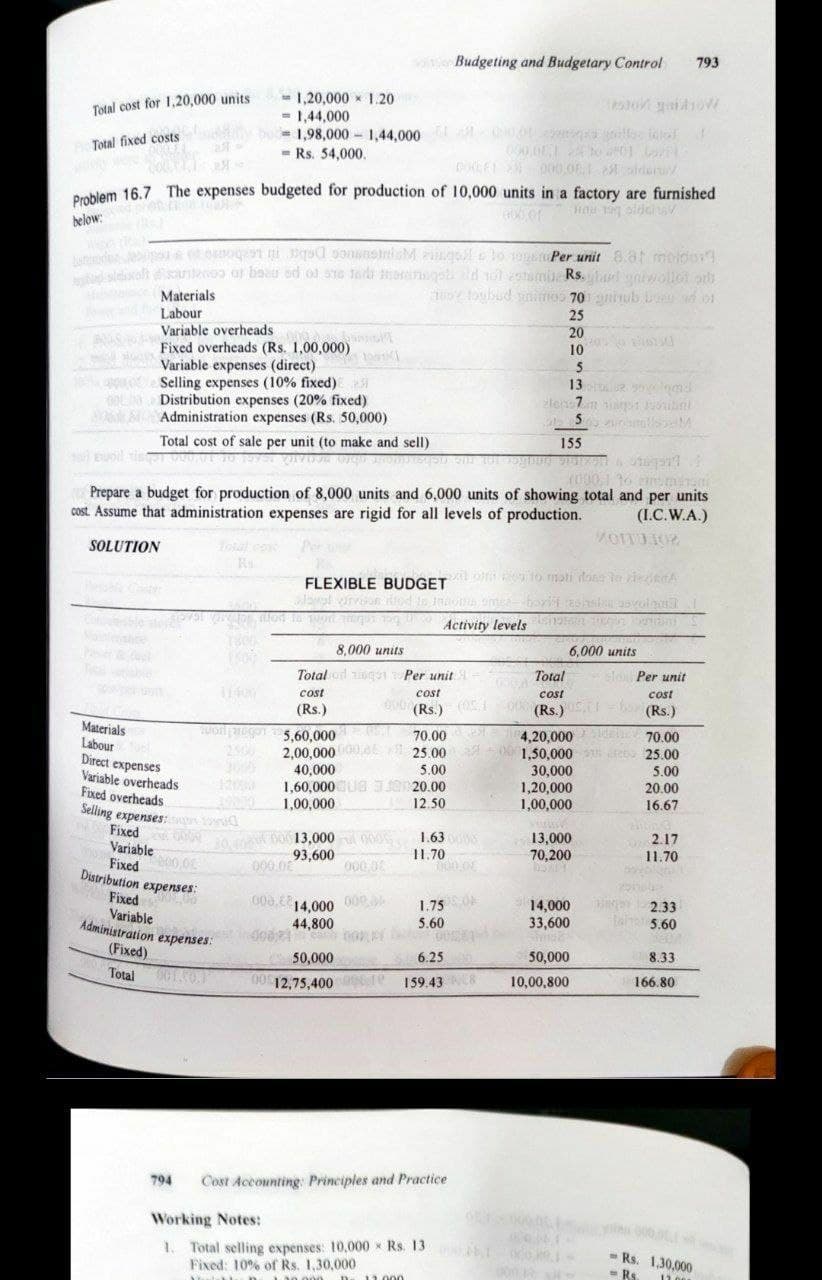

Problem 16.7 The expenses budgeted for production of 10,000 units in a factory are furnished below: Bo 1ogan Per unit 8.at moldo 00 ot boau od ol ste tadi ongot ald tol stami Rs.b wollo ars togbud nimos 70niub boeu d on Materials Labour Variable overheads Fixed overheads (Rs. 1,00,000) Variable expenses (direct) Selling expenses (10% fixed) Distribution expenses (20% fixed) Administration expenses (Rs. 50,000) 25 20 10 13 teno Tamen sch Total cost of sale per unit (to make and sell) 155 euoil Prepare a budget for production of 8,000 units and 6,000 units of showing total and per units cost. Assume that administration expenses are rigid for all levels of production. (I.C.W.A.)

Problem 16.7 The expenses budgeted for production of 10,000 units in a factory are furnished below: Bo 1ogan Per unit 8.at moldo 00 ot boau od ol ste tadi ongot ald tol stami Rs.b wollo ars togbud nimos 70niub boeu d on Materials Labour Variable overheads Fixed overheads (Rs. 1,00,000) Variable expenses (direct) Selling expenses (10% fixed) Distribution expenses (20% fixed) Administration expenses (Rs. 50,000) 25 20 10 13 teno Tamen sch Total cost of sale per unit (to make and sell) 155 euoil Prepare a budget for production of 8,000 units and 6,000 units of showing total and per units cost. Assume that administration expenses are rigid for all levels of production. (I.C.W.A.)

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter13: Budgeting And Standard Costs

Section: Chapter Questions

Problem 13.17E: Capital expenditures budget On August 1, 20Y4. the controller of Handy Dan Tools Inc. is planning...

Related questions

Concept explainers

Variance Analysis

In layman's terms, variance analysis is an analysis of a difference between planned and actual behavior. Variance analysis is mainly used by the companies to maintain a control over a business. After analyzing differences, companies find the reasons for the variance so that the necessary steps should be taken to correct that variance.

Standard Costing

The standard cost system is the expected cost per unit product manufactured and it helps in estimating the deviations and controlling them as well as fixing the selling price of the product. For example, it helps to plan the cost for the coming year on the various expenses.

Topic Video

Question

Transcribed Image Text:Budgeting and Budgetary Control

793

- 1,20,000 x 1.20

= 1,44,000

= 1,98,000 1,44,000 00 ille talor

- Rs. 54,000.

Total cost for 1,20,000 units

to yaidiov

Total fixed costs

DEI O00.08.1 aldert

Droblem 16.7 The expenses budgeted for production of 10,000 units in a factory are furnished

below:

Numindus non i 1qsd oonanotrisM znq e lo 19pen Per unit 8.at moldo

olelicolt suntenoo of bau od ol ste tada oningoli zld tol cotamiu Rs.nbud nwolloi or

togbud imoo 70ninub boeu nd o

Materials

Labour

Variable overheads

Fixed overheads (Rs. 1,00,000)

Variable expenses (direct)

25

20

10

Selling expenses (10% fixed)

0OLa Distribution expenses (20% fixed)

SOBAdministration expenses (Rs. 50,000)

13 nmd

5

Total cost of sale per unit (to make and sell)

155

euoil tis 00

(000,1 1o amerani

Prepare a budget for production of 8,000 units and 6,000 units of showing total and per units

(I.C.W.A.)

cost. Assume that administration expenses are rigid for all levels of production.

SOLUTION

Total cos

Rs

xil o oto moti dona to ziedeaA

FLEXIBLE BUDGET

A lapl rvn ilod n Inaoms omea bovit asal avolna

lehce

1500

8,000 units

6.000 units

T ble

Total od ingi Per unit - Total

cost

000RS.) (0S

sldn Per unit

cost

cost

cost

(Rs.)

(Rs.)I (Rs.)

Materials

Labour

TUonljagon 5.60.000

2500

4.20.000 dalie 70.00

2.00.000 00.06 25.00 00 1,50,000 Se 25.00

70.00

Direct expenses

Variable overheads

Fixed overheads

40.000

5.00

1,60,000 US 3an20.00

12.50

30,000

1,20,000

1,00,000

5.00

12000

O000 1,00,000

20.00

16.67

Selling expenses:n tod

Fixed 00

30.10 00 13,000 00 1.63 S

I1.70

000.00

13,000

70,200

2.17

Variable

Fixed

Distribution

93,600

000.0

00,06

000,00

11.70

expenses:

Fixed

Variable

Administration expenses.

000,E14.000 000.

14,000

33,600

1.75O

2.33

Tana5.60

44,800

5.60

(Fixed)

50,000

6.25

50,000

8.33

Total

00 12,75,400 0Te

159.43 8

10,00,800

166.80

794

Cost Accounting Principles and Practice

Working Notes:

1. Total selling expenses: 10.000 x Rs. 13 e

- Rs. 1,30,000

- Rs

Fixed: 10% of Rs. 1,30,000

1.000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning