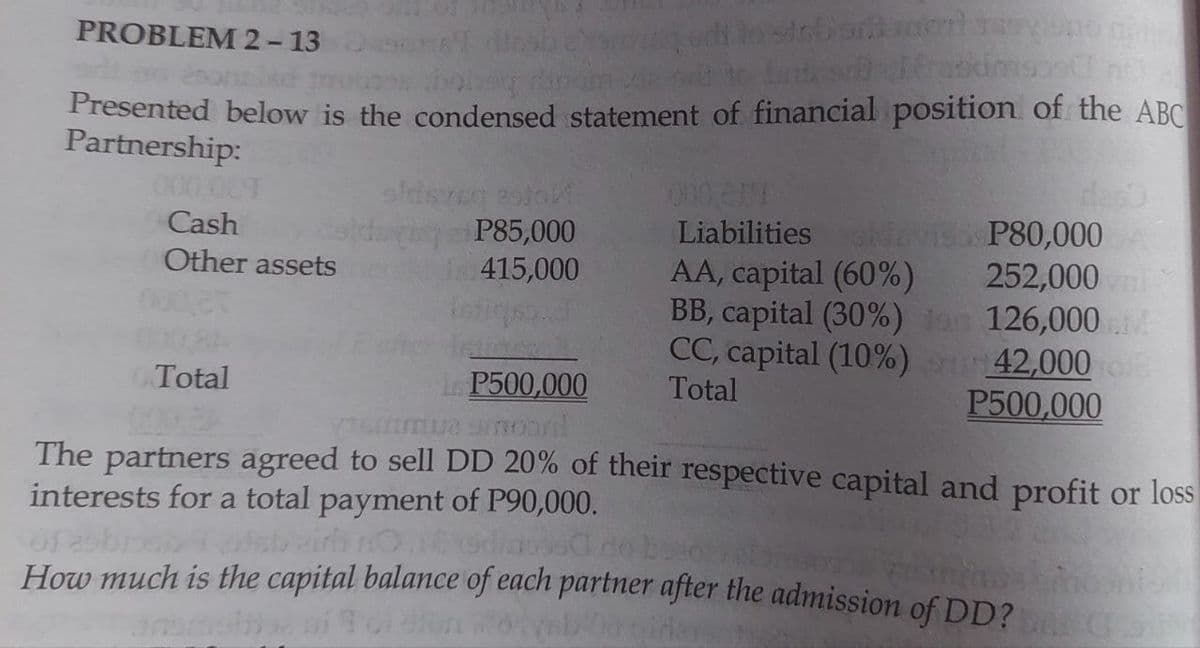

PROBLEM 2- 13 abe odi losiobo e no Presented below is the condensed statement of financial position of the ABC Partnership: 00006 000 Liabilities NNS P80,000 AA, capital (60%) BB, capital (30%)on 126,000 M CC, capital (10%) 42,000e Total Cash P85,000 415,000 252,000i Other assets Total P500,000 P500,000 The partners agreed to sell DD 20% of their respective capital and profit or los- interests for a total payment of P90,000. How much is the capital balance of each partner after the admission of DD2

Q: Based on the following, calculate the costs of buying versus leasing a motor vehicle.

A: Solution:- Given, Down payment = $1,500 Security deposit = $500 Estimated value at end of loan =…

Q: Polo Bond is the sole owner and operator of Fun Polo Shop. The following is information as of the…

A: amount of net (profit)/loss during Year 2 = opening capital + Additional capital - withdrawal-…

Q: + 10 Primary income (investment income earned abroad) 72 Imports of goods and services 98 Augusta…

A: Capital account indicates a country's balance of payments. Over the course of a year, the capital…

Q: Sapphire Computer Company has been purchasing carrying cases for its portable comput-ers at a…

A: Differential analysis is a decision-making approach that analyses the net effects of two…

Q: Miracle Car Wash located in Nashville, Tennessee has been providing Interior and exterior car washes…

A: A flexible budget is prepared on the basis of the budgeted rate and on the basis of different…

Q: A taxpayer exchanged land held for investment for another parcel of land. The transfer qualifies as…

A: Land Basis: $330,000 Mortgage Amount: $50,000 Taxpayer will be receiving a parcel of land whose fair…

Q: Georgio owns a 20 percent profits and capital interest in Rain Tree LLC. For the current year, Rain…

A: Regular income is defined as any sort of income earned by a business or individual that is taxed at…

Q: 1.Equipment Capital 1. The owner invests equipment in the business. 2. The company receives cash…

A: The business transactions affects two or more accounts of the business where one account is credited…

Q: How much money will you have available to you after five years if you put aside $100.00 a month in…

A: Compound Interest- Compound interest is interest that is added to the principal amount each year,…

Q: Your company declared $13,800 cash dividends on stock. There were $6,400 in dividends payable at the…

A: Amount of dividends paid during Year = Dividends payable at beginning of the year + dividends…

Q: Using the following information, prepare a bank reconciliation. Bank balance: $6,988 Book balance:…

A: Bank reconciliation statement: It is a statement drawn up by the business to verify the cash book…

Q: 14. Zelgius, Ike, and Greil are partners in an accounting firm. Their ending capital balances were:…

A: Answer) Calculation of Greil’s Share in Total Profits Greil’s share in Total Profits = Greil’s…

Q: The Lakers Corporation uses a joint manufacturing process that produces three products. The process…

A:

Q: With respect to its new product launch, Ernst and Anderson Manufacturing Ltd has gathered the…

A: Variable cost are the costs that changes with the change in the output level. Like direct material…

Q: At financial year end, Mathew had accrued expenses totaling $22,300 and prepaid income totaling…

A: Lets understand the basics Accrued expense is a expense which is already accrued but not paid. For…

Q: Calculate the missing values and express the answers rounded to two decimal places. Rate of Amount…

A: Markup on Cost = Profit/Cost x 100 Markup on Sales = Profit/Sales x 100 Profit = Sales - Cost

Q: n equity/capital O D.

A: To find the correct option as,

Q: The following transactions and adjusting entries were completed by Robinson Furniture Co. during a…

A: A journal entry is a form of accounting entry that is used to report a business transaction in a…

Q: Question 7: Which of these taxes is NOT remitted with Form 941? Answer: A. O Federal income tax В. O…

A: Note: “Hi There, Thanks for posting the questions. As per our Q&A guidelines, must be answered…

Q: Question 6: Form 941 shares the same due date as Answer: A. Form 940 В. O FUTA payments C. O Form…

A: Lets understand the basics. In united states, form 941 is for reporting tax withhold from the…

Q: MULTIPLE the number of the question or statement being answered. BLEM. Write the letter of the best…

A: EBITDA stands for earnings before interest, tax, depreciation and amortization.

Q: Exercise 10-6 (Algo) Goodwill [LO10-1] On March 31, 2021, Wolfson Corporation acquired all of the…

A: In accounting, goodwill is usually defined as the worth of a company that surpasses its assets less…

Q: oe and Sunny intend to enter into a business venture together and decided that an S corporation…

A: Basis in property: The amount of investment made by an individual in acquiring a property is called…

Q: Five Measures of Solvency or Profitability The balance sheet for Quigg Inc. at the end ofr the…

A: "Since we only answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit the question and…

Q: On June 30, 2019, New Company granted compensatory share option for 30,000 P20 par value ordinary…

A: Share Option For the employees share option which can be prevailed for retain the employees into the…

Q: The funds of a county government report the following noncurrent asset acquisitions during the year:…

A: Under statement of net position, there are two column to report asset, one is the governmental…

Q: luded merchandise purchased from N Company amounting to P39,000 which was sold to them by

A: Equity shareholder's net income is the net income of the parent adjusted for the intercompany…

Q: Cammie received 100 NQOs (each option provides a right to purchase 10 shares of MNL stock for $10…

A: b. Tax savings on grant date = $0 (No tax can be deducted on the grant date as the option cannot be…

Q: ith narrations) for the following three transactions (voucher and are not required): on 1 t of one…

A: Basic Accounting Journal Entry

Q: The Sales Journal for March 2017 was destroyed, but Washeed was able to provide the following…

A: The Sales Ledger Control Account is a summarized account that validates the Sales Ledger's…

Q: Phi Phi Furniture produced 1,500 television stands in March. These stands are sold for RM300 each.…

A: Schedule of Cost of Goods Manufactured Amount (In RM) Amount (In RM) Direct Materials…

Q: Nivea Company is planning to introduce a new product. Market research information suggests that the…

A: Introduction: A product is a tangible object that is placed on the market for purchase, attention,…

Q: Equipment for immersion cooling of electronic components has an installed value of P 819,000 with an…

A: Introduction:- It is one of the depreciation method It is accelerated depreciation method. The…

Q: The equity section of the December 31", 2025, balance sheet for BOOYA Inc. showed the following:…

A: The equity portion, in the balance sheet, reflects the ownership section which shows the funds…

Q: Question 3: In 2022, Johnson Company's first year of operations, the following transactions…

A: Journal entries are the transaction we posted in our books, to keep records of our receivables and…

Q: a 21 cu ft refrigerator is priced at 46,795 the seller is willing to give it in installment for a…

A: Given information Price of refrigerator = 46,795 Down payment = 15% 2 year term and 8% interest.…

Q: s at P21 per sh

A: Memo entry is a function that does not contain items posted in the general manual. These entries are…

Q: Melvin Indecision has difficulty deciding whether to put his savings in Mystic Bank or Four Rivers…

A: Computation of the interest earned at the end of Melvin's investment period at each bank are as…

Q: old from P old from others

A: Net income attributable to p corporation is the total net income after taxes which belongs to the p…

Q: Accounting 29-5. Which of the following is the most appropriate asset for Colleen to give to her…

A: An IRA is a saving for the purpose of retirement which ultimately gives tax benefits.

Q: Salamano Co. is a profitable company based in Malambo Constituency of Mambwe District of Zambia and…

A: Note: Hi! Thank you for the question, As per the honor code, we are allowed to answer three…

Q: Question 14 of 36 Fill in the blanks: The accountant was tasked to reconstruct the books of Refresh…

A: Every business needs goods and services to be used in its business. These may be on cash basis or on…

Q: (c) Suppose you had a choice between owning a US government treasury bond paying 2% coupon and a…

A: Here discuss about the advantages of while using the US government Treasury Bond compare with the…

Q: What is the effective annual rate for an APR of 15.70 percent compounded monthly?

A: The effective annual Rate will be computed according to the formula..... i=(1+rm)m−1.. Where rm…

Q: The Converting Department of Worley Company had 920 units in work in process at the beginning of the…

A: Formulas: Number of Equivalent Units of Production = Inventory in process, beginning + Units Started…

Q: DATE PARTICULARS DEBIT CREDIT P 200,000 40,000 Dec-01 Cash Equipment Candelaria Maugat, Capital To…

A: Journal Entries are posted into T-accounts. The balance of T-accounts are presented in the trial…

Q: Analyzing changes in unit costs The costs of materials consumed in producing good units in the…

A: Energy cost per ton = Cost of materials Consumed/nu.ber of tons produced

Q: Jacques Ltd purchased a truck for $45,000 on 1 July 2018. It had an estimated useful life of three…

A: Depreciation means the reduction in the value of an asset over the life of the assets due to wear…

Q: Cozy Corporation purchased supplies at a cost of S24,000 during the current year. At January1,…

A: Formula: Supplies expense = Beginning supplies + Purchases - Ending supplies

Q: Rocky Mountain Bus Tours needs an additional bus for three years. It can lease a bus for $2100…

A: Present value of annuity due (payment due at the beginning of each month) = Payment x [1 - (1 +…

The problem and question are in the attached photo. Thank you

Step by step

Solved in 3 steps

- Question 2The following Trial Balance is extracted from the books of FW Sdn Bhd as at31 December 20X1:Trial Balance as at 31 December 20X1 Dr CrRM RM20,000 non-redeemable Preference share capital 20,00070,000 Ordinary share capital 70,00010% debentures (repayable 20X8) 30,000Building at cost 110,500Equipment at cost 8,000Motor vehicles at cost 17,200Accumulated depreciation : equipment 1.1.20X1 2,400Accumulated depreciation : motors 1.1.20X1 5,160Inventories 22,690Sales 98,200Purchases 53,910Carriage inwards 1,620Salaries & wages 9,240Directors’ remuneration 6,300Motor expenses 8,120Rates & insurances 2,930General expenses 560Debenture interest 1,500Trade Receivables 18,610Trade Payables 11,370Cash at Bank 8,390General reserve 19,000Interim ordinary dividend paid 3,500Retained earnings: 31.12.20X0 16,940273,070 273,070 The following adjustments are needed:(i) Inventories at 31.12.20X1 were RM27,220.(ii) Depreciation of motor vehicles RM3,000 and equipment RM1,200.(iii)Accrued…Question 3 On 1 July 2024, it was agreed that Dancer Ltd would take over Runner Ltd, after which Runner Ltd will liquidate. The statement of financial position of Runner Ltd on that day was as follows: Cash $ 40 000 Accounts receivable 112 000 Inventory 58 000 Plant and equipment 334 000 Accumulated depreciation — plant and equipment (80 000) Shares in Harry Ltd 52 000 $516 000 Accounts payable 62 000 Mortgage loan 43 000 10% Debentures 60 000 Share Capital ($4 ordinary shares) 200 000 Retained earnings 151 000 $516 000 Dancer Ltd is to acquire all the assets of Runner Ltd (except for cash) and assume the accounts payable. The assets of Runner Ltd are recorded at their fair values except for: Fair Value Inventory $ 78 400 Plant and equipment 280 000 Shares in Harry Ltd 45 000 In exchange, Dancer Ltd will transfer the…14 Amal and Aman are partners of a firm sharing profit and loss in the ratio of 4:3. Their Balance Sheet Shows OMR 14,000 as Profit and Loss A/c in the Assets side. Pass the necessary journal entry in the books of accounts? a. Profit and Loss A/c 14,000 To Amal Capital A/c 8,000 Aman Capital A/c 6,000 b. None of the options c. Amal Capital A/c 8,000 Aman Capital A/c 6,000 To Profit and Loss Appropriation A/c 14,000 d. Amal Capital A/c 8,000 Aman Capital A/c 6,000 To Profit and Loss A/c 14,000

- Case 2: the Investment Held for Trading Securities account in the book of Tatay (acquired in 2020) represents 30% ownership interest in Walanay, Inc. Walanay subsequently reacquires 50% of its outstanding shares from other investors. The previously held equity of Tatay have a fair value of three times its book value now. Tatay elected to measure NCI at ‘proportionate share’.With the stated facts, answer the following:1.How much is the Consideration Transferred?a. P 1,350,000.00b. P 1,900,000.00c. P 1,750,000.00d. P 1,800,000.002.How much is the Non-Controlling Interest in the acquiree?a. P 0.00b. P 150,000.00c. P 684,000.00d. P 1,200,000.003.How much is the Fair Value of the previously held equity interest in the acquiree?a. P 0.00b. P 540,000.00c. P 450,000.00d. P 500,000.0029. the assets and liabilities of R were stated at their fair values when A acquired it's 80% interest and the fair value method was used to initially measure the NCI. A uses the cost method to account for its investment in R. Net income and dividends for 2021 for the affiliated companies were: A Corp. R Corp. Net Income P105,000 P31,500 Dividends paid 63,000 17,500 Dividends Payable, 1/1 20,000 9,250 Dividends Payable 12/31 31,500 8,750 Retained Earnings of A Corp. in the separate FS at the beginning of the year is P420,000. End of the year evaluation indicates P3,000 impairment in goodwill. The consolidated retained earnings at December 31, 2021 is:38. ABC partnership engaged in steel manufacturing business had the following condensed financial position prior to liquidation: (in the picture) Assuming assets with a book value of P700,000 were sold for P500,000 and that all available cash was distributed. For what amount would the remaining assets have to be sold in order for Partner BBB to receive a total of P790,000 cash after liquidation. A. P1,550,000B. P1,600,000C. P1,500,000D. P1,650,000

- Ma3. Investor owns 10% of Investee shares and has the ability to exert significant influence. In 2022 Investee reported net income of $800,000 and paid cash dividends of $120,000. 1.. If Investor uses the indirect method to present the activities operational: a. It will add $80,000 b. It will add $12,000 c. Will subtract $68,000 d. It will add $68,000 2. If Investor uses the direct method to present the activities operational: a. It will add $80,000 b. It will add $12,000 c. Will subtract $68,000 d. It will add $68,0005. Use the following information for the next three (3) questions: On July 1, 2021 Captain Universe Company declared as property dividends 10,000 shares held as investment in associate with carrying amount of P4,000,000. Cost of disposal is immaterial. Information on fair values is shown below: Date Fair Value July 1, 2021 P3,200,000 December 31, 2021 4,400,000 February 1, 2022 3,800,000 Questions: The entries on July 1, 2021 include all of the following except Group of answer choices A debit to retained earnings for P3,200,000 A debit to impairment loss for P800,000 A debit to non current asset held for disposal to owners for P4,000,000 A credit to property dividends payable for P3,200,000Problem 1-16 Humility Inc. acquired 70% interest of Forgiveness Company, a printing business. The sale and purchase agreement specify the amount payable as: Cash of P12 million to be paid on acquisition date, and b. Additional 2,000 shares of its P100 par value ordinary shares to be issued after two (2) years if specified product receives the target market share. The fair value of Forgiveness Company's net assets is P11 million and estimated fair value of the contingent consideration is P300,000. NCI is measured using the proportionate method. Required 1. Assuming the target was met and shares was issued to the former shareholders of Forgiveness, the estimated fair value of contingent consideration is P400,000, how much goodwill will be presented in the consolidated financial statements two years after the acquisition? 2. Journal entry in the books of Humility Inc. (a) on the date of business combination and (b) on the issuance of 2,000 shares, in relation to #1. 3. Assuming the target…

- aj.4 Matthews, Mitchell, and Michaels are partners in BG Land Development Company and share losses in a 5:41 ratio, respectively. The balance sheet on June 30, 20X1, when they decide to liquidate the business, is as follows: Cash Noncash Assets Total Assets Assets $ 19,000 167,000 $ 186,000 The noncash assets are sold for $120,000 Liabilities and Capital Accounts Payable Mitchell, Loan Matthews, Capital Mitchell, Capital Michaels, Capital Total Liabilities and Equities $ 31,000 9,000 85,500 48,800 11,700 $ 186,000 Required: a. Prepare a statement of partnership realization and liquidation. b. Prepare the required journal entries to account for the liquidation of BG Land Development CompanynEED IN 10 MINUTES 9. On January 1, 20x1, an entity purchased marketable equity securities for P2,500,000. The entity paid commission and taxes of P190,000. The equity securities do not qualify as financial asset held for trading. The entity made irrevocable election to present unrealized gain and loss in other comprehensive income. The securities have a market value of P2,600,000, and P2,750,000 on December 31, 20x1 and December 31, 20x2. On July 1, 2022, half of the securities are sold for P1,400,000. On July 1, 2022, the net increase/ decrease in retained earnings account is (sample answer: 10,500 increase or 10,500 decrease)PROBLEM 31Cobarrubias Corporation had the following investment at FVTPL at the beginning of the current year: Fair ValueABC Corporation, 10,000 shares (originally cost P1,000,000) - P1,200,000JKL Company, 20,000 shares (originally cost P500,000) - 450,000 During the current year, the following transactions occurred: Feb. 28 ABC Corporation declared a 3-for-2 share split. Apr 31 JKL Company declared a 20% share dividend. The market value of JKL Company on this date is P3.00. June 30 Sold 5,000 shares of JKL Company for P100,000, less brokers fee of P1,000. July 31 Sold 5,000 shares of ABC Corporation for P135. Sept 30 Received share rights to purchase one share of ABC Corporation for P100 per share. The company should tender five rights for every share acquired. The market price of ABC Corporation shares on this date is P140. Oct. 31 Exercise all the share rights from ABC…