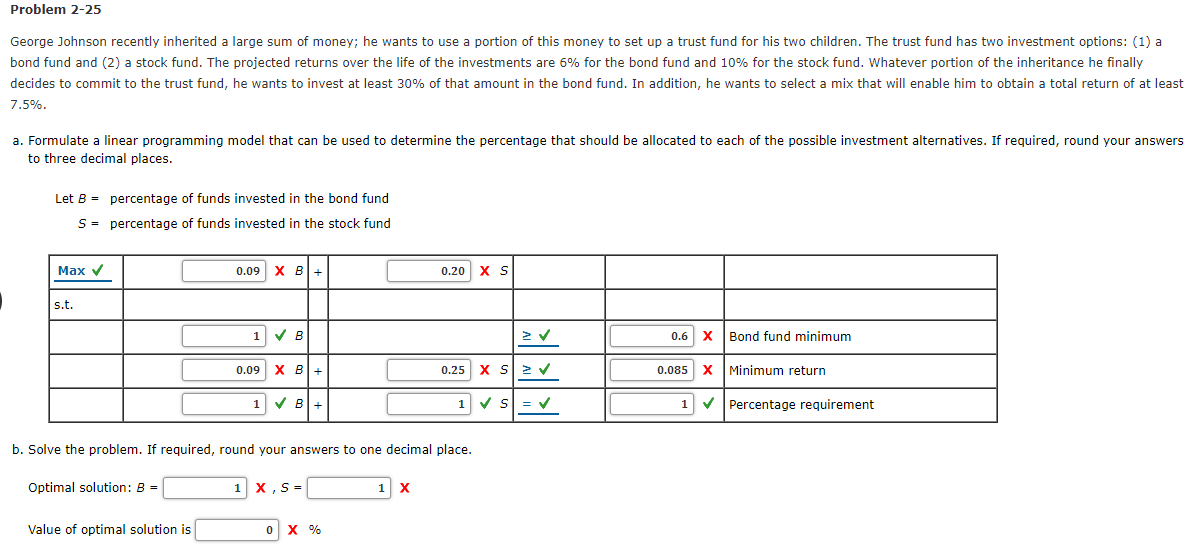

Problem 2-25 George Johnson recently inherited a large sum of money; he wants to use a portion of this money to set up a trust fund for his two children. The trust fund has two investment options: (1) a bond fund and (2) a stock fund. The projected returns over the life of the investments are 6% for the bond fund and 10% for the stock fund. Whatever portion of the inheritance he finally decides to commit to the trust fund, he wants to invest at least 30% of that amount in the bond fund. In addition, he wants to select a mix that will enable him to obtain a total return of at least 7.5%. a. Formulate a linear programming model that can be used to determine the percentage that should be allocated to each of the possible investment alternatives. If required, round your answers to three decimal places. Let B = percentage of funds invested in the bond fund S = percentage of funds invested in the stock fund Маx у 0.09 х в+ 0.20 X S s.t. V B 0.6 x Bond fund minimum 0.09 х в+ 0.25 x S > V 0.085 X Minimum return 1 V B 1 V s = v Percentage requirement b. Solve the problem. If required, round your answers to one decimal place. Optimal solution: B = 1 x, S = 1 X Value of optimal solution is X %

Problem 2-25 George Johnson recently inherited a large sum of money; he wants to use a portion of this money to set up a trust fund for his two children. The trust fund has two investment options: (1) a bond fund and (2) a stock fund. The projected returns over the life of the investments are 6% for the bond fund and 10% for the stock fund. Whatever portion of the inheritance he finally decides to commit to the trust fund, he wants to invest at least 30% of that amount in the bond fund. In addition, he wants to select a mix that will enable him to obtain a total return of at least 7.5%. a. Formulate a linear programming model that can be used to determine the percentage that should be allocated to each of the possible investment alternatives. If required, round your answers to three decimal places. Let B = percentage of funds invested in the bond fund S = percentage of funds invested in the stock fund Маx у 0.09 х в+ 0.20 X S s.t. V B 0.6 x Bond fund minimum 0.09 х в+ 0.25 x S > V 0.085 X Minimum return 1 V B 1 V s = v Percentage requirement b. Solve the problem. If required, round your answers to one decimal place. Optimal solution: B = 1 x, S = 1 X Value of optimal solution is X %

Algebra and Trigonometry (MindTap Course List)

4th Edition

ISBN:9781305071742

Author:James Stewart, Lothar Redlin, Saleem Watson

Publisher:James Stewart, Lothar Redlin, Saleem Watson

Chapter10: Systems Of Equations And Inequalities

Section10.FOM: Focus On Modeling: Linear Programming

Problem 14P

Related questions

Topic Video

Question

100%

Please help me to answer the questions that are incorrect.

Transcribed Image Text:Problem 2-25

George Johnson recently inherited a large sum of money; he wants to use a portion of this money to set up a trust fund for his two children. The trust fund has two investment options: (1) a

bond fund and (2) a stock fund. The projected returns over the life of the investments are 6% for the bond fund and 10% for the stock fund. Whatever portion of the inheritance he finally

decides to commit to the trust fund, he wants to invest at least 30% of that amount in the bond fund. In addition, he wants to select a mix that will enable him to obtain a total return of at least

7.5%.

a. Formulate a linear programming model that can be used to determine the percentage that should be allocated to each of the possible investment alternatives. If required, round your answers

to three decimal places.

Let B = percentage of funds invested in the bond fund

S = percentage of funds invested in the stock fund

Маx у

0.09

х в+

0.20

X S

s.t.

V B

0.6

x Bond fund minimum

0.09

х в+

0.25 x S > V

0.085

X

Minimum return

1 V B

1 V s = v

Percentage requirement

b. Solve the problem. If required, round your answers to one decimal place.

Optimal solution: B =

1 x, S =

1 X

Value of optimal solution is

X %

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, advanced-math and related others by exploring similar questions and additional content below.Recommended textbooks for you

Algebra and Trigonometry (MindTap Course List)

Algebra

ISBN:

9781305071742

Author:

James Stewart, Lothar Redlin, Saleem Watson

Publisher:

Cengage Learning

Algebra and Trigonometry (MindTap Course List)

Algebra

ISBN:

9781305071742

Author:

James Stewart, Lothar Redlin, Saleem Watson

Publisher:

Cengage Learning