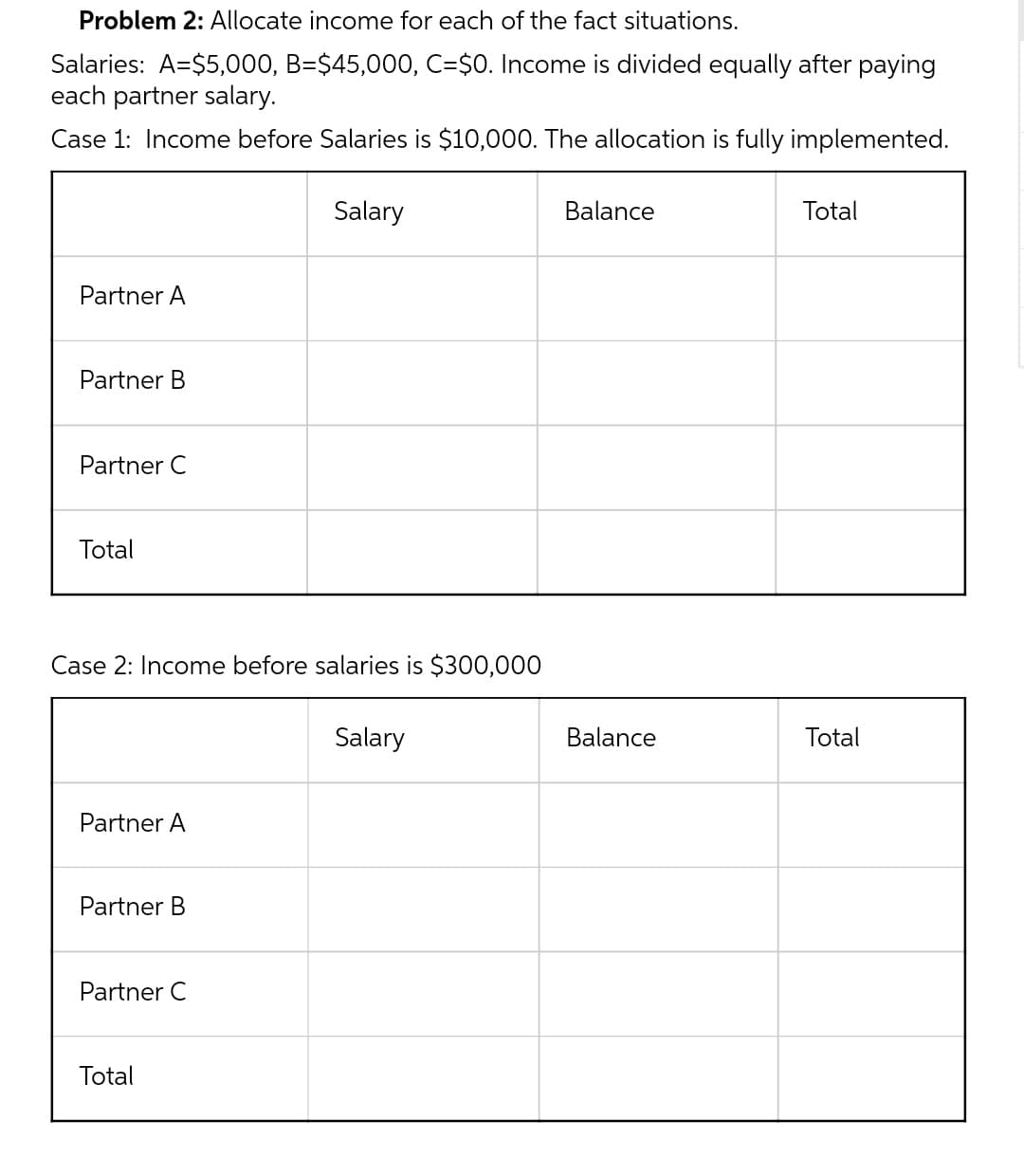

Problem 2: Allocate income for each of the fact situations. Salaries: A=$5,000, B=$45,000, C=$0. Income is divided equally after paying each partner salary. Case 1: Income before Salaries is $10,000. The allocation is fully implemented. Salary Partner A Partner B Balance Total

Q: Bugler Corp had the following transactions for 2021 related to bad debts. Bugler began 2021 with…

A: Since part a is already done, I'm providing only parts b and c. When a debtor of a company fails…

Q: Kingbird Corporation has the following information available concerning its postretirement benefit…

A: Many forms of costs that an employer provides to its retirees are known as postretirement costs.…

Q: Following is a table for the present value of $1 at compound interest: Year 6% 10% 12% 1 0.943…

A: Present value refers to the amount present today of an asset based on some future date. The money…

Q: Would unearned Revenue be included in post closing trial balance?

A: Unearned Revenue is the amount received from customers without rendering services. It is like an…

Q: Ziek Corp. acquired a 30% interest in ZKI Corporation on December 31, 2020 for $2,159,000. During…

A: Investment refers to the assets which are acquired or invested in building the wealth and also save…

Q: The following information is available for Integrity Corporation for 2020: 1) Materials inventory…

A: Direct Material Cost - Direct materials costs are the expenses incurred on the raw materials…

Q: Standard and actual costs for direct labor for the manufacture of 1,000 units of product were as…

A: Introduction: Variance analysis is the quantitative examination of the difference between actual and…

Q: 5. The equity sections for Atticus Group at the beginning of the year (January 1) and end…

A: Dividend - The dividend is the amount distributed to the shareholders of the company. It is…

Q: What is the threshold for reporting a major customer? 5 percent of revenues. 5 percent of profits.…

A: As per IRFS 8 Operating Segment Segment reporting is the reporting of the operating segments of a…

Q: Which of the following conditions would not indicate that two business segments should be classified…

A: Operating segments are the business components of an entity which earns revenue and incur expenses.…

Q: The following budgeted profit statement has been prepared using absorption costing principles. A…

A: Variable costs are those costs which changes along with change in activity level. Fixed costs are…

Q: May 1 Beginning inventory 150 units 5 Sale 100 units Purchase 50 units Purchase 200 units 200 units…

A: FIFO :— It is one of the method of inventory valuation, under this method it is assumed that first…

Q: QMW Company manufactures two models of microcassette recorders, VCH and MTV. Based on the following…

A: Introduction: The production budget, which is derived from a mixture of the sales forecast and the…

Q: Presently the Smiths invest $100,000 for A months in a certificate paying interest at the nominal…

A: Interest is the amount charged or received on total invested amount or amount borrowed. It can be…

Q: ACCT 540 Research Project 2 Facts Ken and Marilyn Hert started a business in 1998 in an S…

A: Tax Consequences of Redemption of Shares Unless it distributes valuable property, the redeeming…

Q: On January 1, 2022, Ivanhoe Company issued $322,500, 7%, 5-year bonds at face value. Interest is…

A: A bond is issued by the company for raising finance for the business working. The bonds are issued…

Q: es RTN hold any importan

A: In online transactions are done based on codes and codes are given for the name of bank and area of…

Q: Debt General Bonds Lease Bonds Revenue Bonds Loans Capital Leases Total Highest Debt Lowest Debt…

A: Debts are the obligations for an entity. These are just like creditors so the payment of the…

Q: 11. What is last year’s residual income? 12. What is the residual income of this year’s…

A: Residual Income :— Residual Income is income that one continues to receive after the completion of…

Q: Golden Corporation contemplates to market a new product. Estimated fixed costs is P1,000,000. The…

A: The contribution margin is calculated y deducting the variable cost from the net sales of the…

Q: On January 1, 2019, Peter Corporation purchased a debt instrument at its face value of P3,000,000.…

A: Reclassification of Debt Instrument As a result debt securities may be reclassified from the…

Q: What is the correct process for determining depreciation expense for partial periods? A: The…

A: Lets understand the basics. Depreciation is a reduction in value of asset due to wear and tear,…

Q: Storage Washing Average gallons on hand Number of batches a. Calculate the activity rates it b.…

A: Activity Based Costing :— Activity-based costing is a costing method that identifies activities in…

Q: Kit Kat Ltd is a company in the chemical industry, situated near the Murray River. Its year end is…

A: IAS 10 - Events After the Reporting Period provides the accounting and disclosure requirements…

Q: i) Explain three strengths identified within Unilever ltd purchasing transaction cycle based on the…

A: An organization must have good internal controls in place in order to reduce the risk of fraud.

Q: For the current year ending April 30, MJW Company expects fixed costs of $87,500; a unit variable…

A: Break Even Point - Break Even point is the point where the company recovered its cost. It is the not…

Q: Can a financial statement be manipulated? Why yes or why not? Critically discuss and evaluate it…

A: Financial statements manipulation is the manipulation of accounts which are reflected in the…

Q: Abigail lives in the UK and earns 40,000 pounds sterling per year. Her friend Barry lives in Japan…

A: In the context of the given question, we are required to solve this question. It can be considered a…

Q: Diluted earnings per share shows dilution resulting from additional shares that may be issued for…

A: Introduction:- Diluted Earnings Per Share indicates the residual net profits accountable to each…

Q: Please help me

A: Inventory - The things that a business keeps on hand in order to make money are referred to as…

Q: Determining Cost of Land On-Time Delivery Company acquired an adjacent lot to construct a new…

A: The value of a piece of property is its land value, which takes into account both the land's…

Q: (a) The depreciable cost (b) The straight-line rate (c) The annual straight-line depreciation %

A: Introduction:- Straight line depreciation is a common and simplest method of calculation…

Q: Cash and cash equivalents, December 31 prior year-end Cash and cash equivalents, December 31 current…

A: The cash flow statement (CFS), is a financial statement that summarizes the movement of cash and…

Q: 4. The equity sections for Atticus Group at the beginning of the year (January 1) and end…

A: Outstanding Shares - Outstanding Shares are those shares sold to the company's shareholders. It does…

Q: What professional conduct is outlined by the American Institute of Certified Public Accountants…

A: The American Institute of Certified Public Accounts (AICPA) The American Institute of Certified…

Q: Kinkaid Company was incorporated at the beginning of this year and had a number of transactions. The…

A: Introduction: A security that represents ownership of a company is common stock. The board of…

Q: Entries for notes payable Bennett Enterprises issues a $684,000, 30-day, 6%, note to Spectrum…

A: Note payable :— Note Payable is Liability in nature. It represent Under Current Liabilities in the…

Q: Upper Division of Lower Company acquired an asset with a cost of $620,000 and a four-year life. The…

A: Residual Income :— It is the difference between actual income and required income. Required income…

Q: 12. How is the matching principle related to the recording of depreciation on tangible operational…

A: Answer:- Matching principle meaning:- One of the fundamental principles that underlines accounting…

Q: thilaire Corporation is working on its direct labor budget for the next two months. Each unit of…

A: Answer : Total Direct Labor Cost = Direct Labor cost per hour * Total direct labor hours paid

Q: In 2020 the budget for a machine shop showed overheads of $60,000 and volume of activity of 12,000…

A: Overheads are the all type of indirect costs and expenses being incurred. These costs can not be…

Q: The susceptibility of an assertion about a class of transaction, account balance or disclosure to a…

A: Audit risk is the possibility that an auditor won't find fraud or errors while reviewing a client's…

Q: For each item listed, select the appropriate purpose of cost allocation from the list below. A…

A: Note: Hi, As of you have posted more than three sub parts, but as per the Bartleby policy we can…

Q: The Platter Valley factory of Bybee Industries manufactures field boots. The cost of each boot…

A: Variance is the variation or difference between the budgeted or actual costs. Here, the variance…

Q: Sebastian, Wyatt, and Mathew are close friends who graduated with master's degrees in accounting…

A: The legal identity of a Limited Liability Partnership (LLP) is distinct from that of its…

Q: If you deposit $100 monthly into a bank account that earns 4% interest per year compounded annually,…

A: Time Value of Money :— This concept says that value of money in present day is more than the value…

Q: Love for books bookstore expects sales of R10 000 000,00 next year. Each book sells for R200,00 and…

A: 1.Economic order quantity: Economic order quantity is the quantity that is most economical to order…

Q: Dawson Toys, Limited, produces a toy called the Maze. The company has recently created a standard…

A: Material variances arises when the estimated and actual cost incurred on the material costs is…

Q: An A-round investor got 20% of the shares of a startup (2 million shares, in return for a €2 million…

A: An A - round investor invested € 2 Million and got 20% shares of a startup. 20% shares is 2 Million…

Q: A company had a market price of $27.50 per share, earnings per share of $1.25, and dividends per…

A: The ratio analysis helps to analyze the statements of the business including balance sheet and…

Step by step

Solved in 2 steps

- Why is the salary figure in the income statement "600,000"? Is it the PAYE figure being used here? Just looking for some clarity as the following was noted: "Include in the income statement is $80,000 salary per month for each partner".Use the following information for the Exercises below. Skip to question [The following information applies to the questions displayed below.] BMX Company has one employee. FICA Social Security taxes are 6.2% of the first $128,400 paid to its employee, and FICA Medicare taxes are 1.45% of gross pay. For BMX, its FUTA taxes are 0.6% and SUTA taxes are 5.4% of the first $7,000 paid to its employee. Gross Pay throughAugust 31 Gross Pay forSeptember a. $ 6,400 $ 800 b. 2,000 2,100 c. 122,100 8,000 Exercise 11-6 Payroll-related journal entries LO P2 Assuming situation (a), prepare the employer’s September 30 journal entries to record salary expense and its related payroll liabilities for this employee. The employee’s federal income taxes withheld by the employer are $80 for this pay period.Use the following information for the Exercises below. Skip to question [The following information applies to the questions displayed below.] BMX Company has one employee. FICA Social Security taxes are 6.2% of the first $128,400 paid to its employee, and FICA Medicare taxes are 1.45% of gross pay. For BMX, its FUTA taxes are 0.6% and SUTA taxes are 5.4% of the first $7,000 paid to its employee. Gross Pay throughAugust 31 Gross Pay forSeptember a. $ 6,400 $ 800 b. 2,000 2,100 c. 122,100 8,000 Exercise 11-5 Computing payroll taxes LO P2, P3 Compute BMX’s amounts for each of these four taxes as applied to the employee’s gross earnings for September under each of three separate situations (a), (b), and (c). (Round your answers to 2 decimal places.)

- Use the following information for the Exercises below. Skip to question [The following information applies to the questions displayed below.] BMX Company has one employee. FICA Social Security taxes are 6.2% of the first $128,400 paid to its employee, and FICA Medicare taxes are 1.45% of gross pay. For BMX, its FUTA taxes are 0.6% and SUTA taxes are 5.4% of the first $7,000 paid to its employee. Gross Pay throughAugust 31 Gross Pay forSeptember a. $ 6,400 $ 800 b. 2,000 2,100 c. 122,100 8,000 Exercise 11-7 Payroll-related journal entries LO P3 Assuming situation (a), prepare the employer’s September 30 journal entries to record the employer’s payroll taxes expense and its related liabilities.Use the following information for the next two questions:The following relates to the transactions of GRIMACE FROWN Co. during 20x1:Directors' and officers' remuneration 8,000,000Post-employment benefits of officers 800,000Fringe benefits in the form of housing assistance to directors and officers 20,000,000Share options granted to officers 1,200,000Officers' expenses on travels, representation and entertainment subject to liquidation and reimbursement 400,000Loans to directors and officers 12,000,000Sales to related entities 40,000,000 A. How much is the amount of related party disclosures on GRIMACE’s separate financial statements?a. 30,000,000 b. 52,000,000 c. 82,000,000 d. 42,000,000 B. How much is the amount of related party disclosures on GRIMACE’s consolidated financial statements?a. 12,000,000 b. 30,000,000 c. 82,000,000 d. 42,000,000Use the following information for the Exercises below. [The following information applies to the questions displayed below. BMX Company has one employee. FICA Social Security taxes are 6.2% of the first $128,400 paid to its employee, and FICA Medicare taxes are 1.45% of gross payFor BMX , its FUTA taxes are 0.6% and SUTA taxes are 5.4% of the first $7,000 paid to its employee. Gross Pay through August 31 $ 6,400 2.000 122,100 Gross Pay for September $ 800 2.100 8,000 Exercise 9-7 Payroll-related journal entries LO P3 Assuming situation (a), prepare the employer's September 30 journal entries to record the employer's payroll taxes expense and its related iſabilities.

- Required information Use the following information for the Exercises below. (Algo) Skip to question [The following information applies to the questions displayed below.] BMX Company has one employee. FICA Social Security taxes are 6.2% of the first $137,700 paid to its employee, and FICA Medicare taxes are 1.45% of gross pay. For BMX, its FUTA taxes are 0.6% and SUTA taxes are 5.4% of the first $7,000 paid to its employee. Gross Pay through August 31 Gross Pay for September a. $ 6,400 $ 1,700 b. 2,700 2,800 c. 133,300 9,900 Exercise 11-8 (Algo) Payroll-related journal entries LO P2 Assuming situation (a), prepare the employer’s September 30 journal entry to record salary expense and its related payroll liabilities for this employee. The employee’s federal income taxes withheld by the employer are $60 for this pay period.Requirement: For each of the following independent income-sharing agreements, prepare an income distribution schedule. 1. Monthly salaries are P30,000 to AB, P50,000 to QR and P45,000 to XY AB receives a bonus of 5% of net income after deducting his bonus Interest is 12% of ending capital balances. Any remainder is divided by AB, QR and XY in a 25:40:35 ratio. The Income Summary account has a credit balance of P2,835,000 before closing. 2. Interest is 10% of weighted average capital balances. Annual salaries are P480,000 to AB, P630,000 to QR and P510,000 to XY. QR receives a bonus of 25% of net income after deducting the bonus and his salary, Any remainder is divided in a 2:3:4 ratio by AB, QR and XY, respectively. Net income was P1,050,000 before any allocations. 3. XY receives a bonus of 20% of net income after deducting the bonus and the salaries. Annual salaries are P600,000 to AB, P540,000 to QR and P750,000 to XY. Interest is 15% of the ending capital in excess of P140,000.…1. A salary allowance of RM20,000 to Kalmia and RM50,000 to Wardah.2. The remainder is to be divided equally.

- Gross Income Compute how much will be included and excluded in the gross income given the following scenarios. 1. A call center agent receiving a monthly salary of P21,000 with mandatory annual deductions of P15,166, which includes SSS, PhilHealth, and Pag-Ibig contributions. What will be the amount for his annual gross income?[The following information applies to the questions displayed below.] BMX Company has one employee. FICA Social Security taxes are 6.2% of the first $132,900 paid to its employee, and FICA Medicare taxes are 1.45% of gross pay. For BMX, its FUTA taxes are 0.6% and SUTA taxes are 5.4% of the first $7,000 paid to its employee. Gross Pay throughAugust 31 Gross Pay for September a. $ 5,200 $ 2,400 b. 2,700 2,800 c. 127,300 8,700 Assuming situation (a), prepare the employer’s September 30 journal entry to record the employer’s payroll taxes expense and its related liabilities.Required information Skip to question [The following information applies to the questions displayed below.] BMX Company has one employee. FICA Social Security taxes are 6.2% of the first $128,400 paid to its employee, and FICA Medicare taxes are 1.45% of gross pay. For BMX, its FUTA taxes are 0.6% and SUTA taxes are 5.4% of the first $7,000 paid to its employee. Gross Pay throughAugust 31 Gross Pay forSeptember a. $ 6,400 $ 800 b. 2,000 2,100 c. 122,100 8,000 Compute BMX’s amounts for each of these four taxes as applied to the employee’s gross earnings for September under each of three separate situations (a), (b), and (c). (Round your answers to 2 decimal places.) a) Tax September Earnings Subject to Tax Tax Rate Tax Amount FICA—Social Security FICA—Medicare FUTA SUTA b) Tax September Earnings Subject to Tax Tax Rate Tax Amount FICA—Social Security…