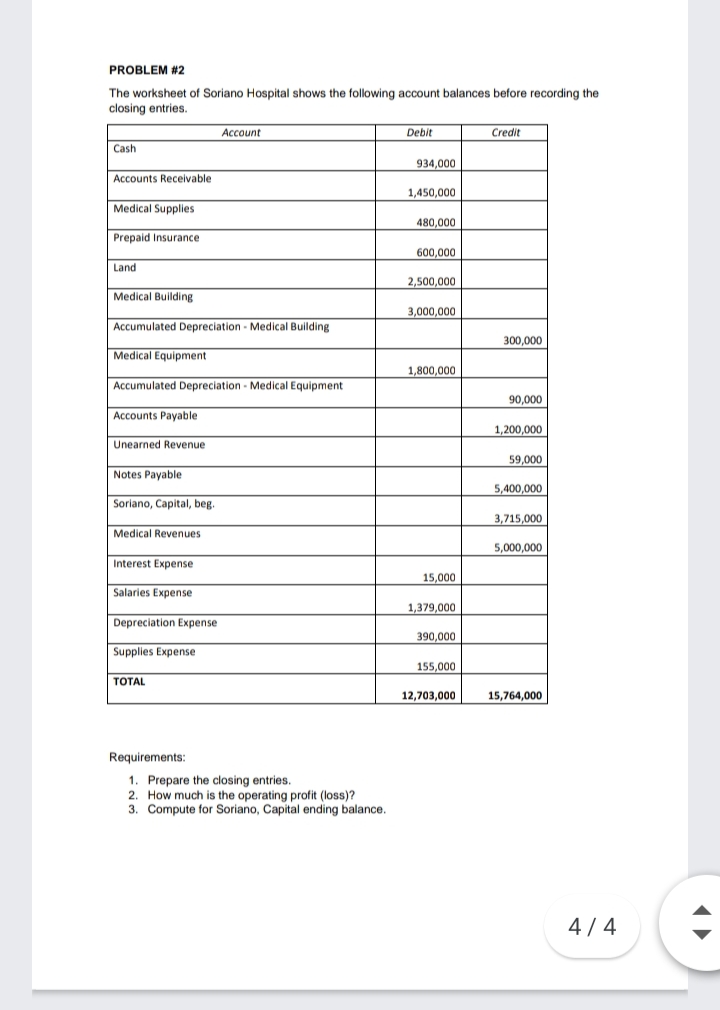

PROBLEM #2 The worksheet of Soriano Hospital shows the following account balances before recording the closing entries. Account Debit Credit Cash 934,000 Accounts Receivable 1,450,000 Medical Supplies 480,000 Prepaid Insurance 600,000 Land 2,500,000 Medical Building 3,000,000 Accumulated Depreciation - Medical Building 300,000 Medical Equipment 1,800,000 Accumulated Depreciation - Medical Equipment 90,000 Accounts Payable 1,200,000 Unearned Revenue 59,000 Notes Payable 5,400,000 Soriano, Capital, beg. 3,715,000 Medical Revenues 5,000,000 Interest Expense 15,000 Salaries Expense 1,379,000 Depreciation Expense 390,000 Supplies Expense 155,000 TOTAL 12,703,000 15,764,000 Requirements: 1. Prepare the closing entries. 2. How much is the operating profit (loss)? 3. Compute for Soriano, Capital ending balance.

PROBLEM #2 The worksheet of Soriano Hospital shows the following account balances before recording the closing entries. Account Debit Credit Cash 934,000 Accounts Receivable 1,450,000 Medical Supplies 480,000 Prepaid Insurance 600,000 Land 2,500,000 Medical Building 3,000,000 Accumulated Depreciation - Medical Building 300,000 Medical Equipment 1,800,000 Accumulated Depreciation - Medical Equipment 90,000 Accounts Payable 1,200,000 Unearned Revenue 59,000 Notes Payable 5,400,000 Soriano, Capital, beg. 3,715,000 Medical Revenues 5,000,000 Interest Expense 15,000 Salaries Expense 1,379,000 Depreciation Expense 390,000 Supplies Expense 155,000 TOTAL 12,703,000 15,764,000 Requirements: 1. Prepare the closing entries. 2. How much is the operating profit (loss)? 3. Compute for Soriano, Capital ending balance.

Chapter3: Setting Up A New Company

Section: Chapter Questions

Problem 3.3C

Related questions

Question

Transcribed Image Text:PROBLEM #2

The worksheet of Soriano Hospital shows the following account balances before recording the

closing entries.

Ассount

Debit

Credit

Cash

934,000

Accounts Receivable

1,450,000

Medical Supplies

480,000

Prepaid Insurance

600,000

Land

2,500,000

Medical Building

3,000,000

Accumulated Depreciation - Medical Building

300,000

Medical Equipment

1,800,000

Accumulated Depreciation - Medical Equipment

90,000

Accounts Payable

1,200,000

Unearned Revenue

59,000

Notes Payable

5,400,000

Soriano, Capital, beg.

3,715,000

Medical Revenues

5,000,000

Interest Expense

15,000

Salaries Expense

1,379,000

Depreciation Expense

390,000

Supplies Expense

155,000

TOTAL

ТОTAL

12,703,000

15,764,000

Requirements:

1. Prepare the closing entries.

2. How much is the operating profit (loss)?

3. Compute for Soriano, Capital ending balance.

4/4

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage