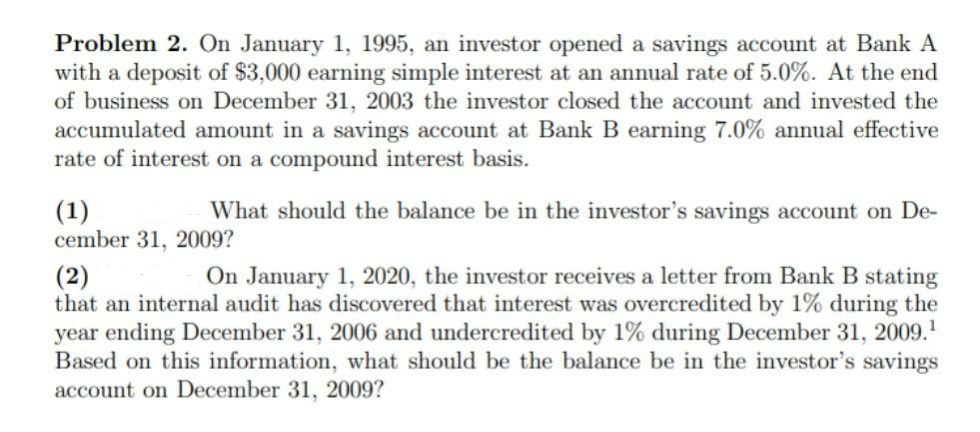

Problem 2. On January 1, 1995, an investor opened a savings account at Bank A with a deposit of $3,000 earning simple interest at an annual rate of 5.0%. At the end of business on December 31, 2003 the investor closed the account and invested the accumulated amount in a savings account at Bank B earning 7.0% annual effective rate of interest on a compound interest basis. (1) What should the balance be in the investor's savings account on De- cember 31, 2009? (2) On January 1, 2020, the investor receives a letter from Bank B stating that an internal audit has discovered that interest was overcredited by 1% during the year ending December 31, 2006 and undercredited by 1% during December 31, 2009.¹ Based on this information, what should be the balance be in the investor's savings account on December 31, 2009?

Problem 2. On January 1, 1995, an investor opened a savings account at Bank A with a deposit of $3,000 earning simple interest at an annual rate of 5.0%. At the end of business on December 31, 2003 the investor closed the account and invested the accumulated amount in a savings account at Bank B earning 7.0% annual effective rate of interest on a compound interest basis. (1) What should the balance be in the investor's savings account on De- cember 31, 2009? (2) On January 1, 2020, the investor receives a letter from Bank B stating that an internal audit has discovered that interest was overcredited by 1% during the year ending December 31, 2006 and undercredited by 1% during December 31, 2009.¹ Based on this information, what should be the balance be in the investor's savings account on December 31, 2009?

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

ChapterA3: Time Value Of Money

Section: Chapter Questions

Problem 15E

Related questions

Question

Transcribed Image Text:Problem 2. On January 1, 1995, an investor opened a savings account at Bank A

with a deposit of $3,000 earning simple interest at an annual rate of 5.0%. At the end

of business on December 31, 2003 the investor closed the account and invested the

accumulated amount in a savings account at Bank B earning 7.0% annual effective

rate of interest on a compound interest basis.

(1)

What should the balance be in the investor's savings account on De-

cember 31, 2009?

(2)

On January 1, 2020, the investor receives a letter from Bank B stating

that an internal audit has discovered that interest was overcredited by 1% during the

year ending December 31, 2006 and undercredited by 1% during December 31, 2009.¹

Based on this information, what should be the balance be in the investor's savings

account on December 31, 2009?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning