Problem 25 Davao Bank loaned P7,500,000 to a borrower on January 1, 2018. The terms of the payment in full on January 1, 2023, plus annual interest payment at 12%. The intere was made as scheduled on January 1, 2019. However, due to financial setbacks, the was unable to make its 2020 interest payment and Davao Bank considers the loan im projects the cash flows from the loan as of December 31, 2020. The bank has a interest at December 31, 2019, but did not continue to accrue interest for 2020 impairment of the loan. The projected cash flows are: Date of cash flow December31, 2021 December31, 2022 Amount projected as of Dec. 31, 2020 500,000 1,000,000

Problem 25 Davao Bank loaned P7,500,000 to a borrower on January 1, 2018. The terms of the payment in full on January 1, 2023, plus annual interest payment at 12%. The intere was made as scheduled on January 1, 2019. However, due to financial setbacks, the was unable to make its 2020 interest payment and Davao Bank considers the loan im projects the cash flows from the loan as of December 31, 2020. The bank has a interest at December 31, 2019, but did not continue to accrue interest for 2020 impairment of the loan. The projected cash flows are: Date of cash flow December31, 2021 December31, 2022 Amount projected as of Dec. 31, 2020 500,000 1,000,000

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter22: Providing And Obtaining Credit

Section: Chapter Questions

Problem 4P: Gifts Galore Inc. borrowed 1.5 million from National City Bank. The loan was made at a simple annual...

Related questions

Question

Transcribed Image Text:Problem 25

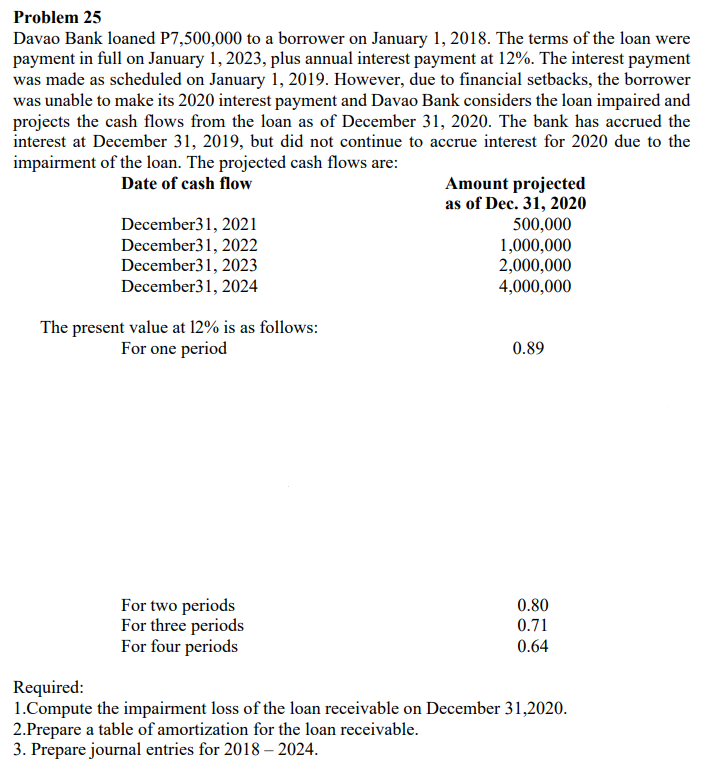

Davao Bank loaned P7,500,000 to a borrower on January 1, 2018. The terms of the loan were

payment in full on January 1, 2023, plus annual interest payment at 12%. The interest payment

was made as scheduled on January 1, 2019. However, due to financial setbacks, the borrower

was unable to make its 2020 interest payment and Davao Bank considers the loan impaired and

projects the cash flows from the loan as of December 31, 2020. The bank has accrued the

interest at December 31, 2019, but did not continue to accrue interest for 2020 due to the

impairment of the loan. The projected cash flows are:

Amount projected

as of Dec. 31, 2020

500,000

1,000,000

2,000,000

4,000,000

Date of cash flow

December31, 2021

December31, 2022

December31, 2023

December31, 2024

The present value at 12% is as follows:

For one period

0.89

For two periods

For three periods

For four periods

0.80

0.71

0.64

Required:

1.Compute the impairment loss of the loan receivable on December 31,2020.

2.Prepare a table of amortization for the loan receivable.

3. Prepare journal entries for 2018 – 2024.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning