Problem 3: The initial cost of a paint sand mill, including its installation is P 800,000. The depreciable life of this machine is 10 years with an estimated salvage value of P 50,000. Using SYD Method -Compute the depreciation charge on the 6th year. -Compute the total depreciation after 6 years. -Compute the book value after 6 years.

Problem 3: The initial cost of a paint sand mill, including its installation is P 800,000. The depreciable life of this machine is 10 years with an estimated salvage value of P 50,000. Using SYD Method -Compute the depreciation charge on the 6th year. -Compute the total depreciation after 6 years. -Compute the book value after 6 years.

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter18: Accounting For Long-term Assets

Section: Chapter Questions

Problem 6CE

Related questions

Question

Problem 3: The initial cost of a paint sand mill, including its installation is P 800,000. The

-Compute the depreciation charge on the 6th year.

-Compute the total depreciation after 6 years.

-Compute the book value after 6 years.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

Transcribed Image Text:10:21 PM | 9.7KB/s

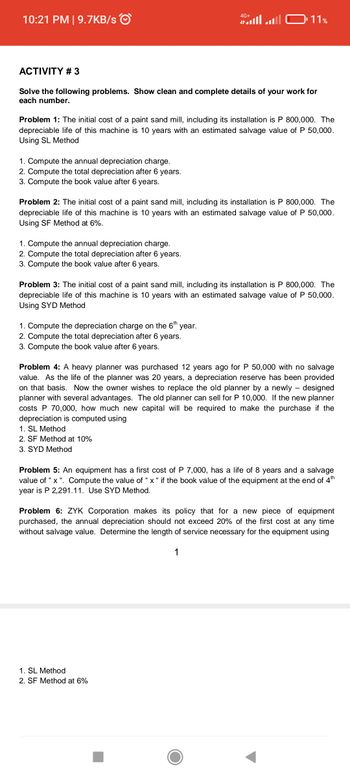

ACTIVITY # 3

Solve the following problems. Show clean and complete details of your work for

each number.

1. Compute the annual depreciation charge.

2. Compute the total depreciation after 6 years.

3. Compute the book value after 6 years.

Problem 1: The initial cost of a paint sand mill, including its installation is P 800,000. The

depreciable life of this machine is 10 years with an estimated salvage value of P 50,000.

Using SL Method

1. Compute the annual depreciation charge.

2. Compute the total depreciation after 6 years.

3. Compute the book value after 6 years.

4G+

IN

Problem 2: The initial cost of a paint sand mill, including its installation is P 800,000. The

depreciable life of this machine is 10 years with an estimated salvage value of P 50,000.

Using SF Method at 6%.

11%

1. Compute the depreciation charge on the 6th year.

2. Compute the total depreciation after 6 years.

3. Compute the book value after 6 years.

Problem 3: The initial cost of a paint sand mill, including its installation is P 800,000. The

depreciable life of this machine is 10 years with an estimated salvage value of P 50,000.

Using SYD Method

1. SL Method

2. SF Method at 10%

3. SYD Method

Problem 4: A heavy planner was purchased 12 years ago for P 50,000 with no salvage

value. As the life of the planner was 20 years, a depreciation reserve has been provided

on that basis. Now the owner wishes to replace the old planner by a newly designed

planner with several advantages. The old planner can sell for P 10,000. If the new planner

costs P 70,000, how much new capital will be required to make the purchase if the

depreciation is computed using

Problem 5: An equipment has a first cost of P 7,000, has a life of 8 years and a salvage

value of "x". Compute the value of "x" if the book value of the equipment at the end of 4th

year is P 2,291.11. Use SYD Method.

1. SL Method

2. SF Method at 6%

Problem 6: ZYK Corporation makes its policy that for a new piece of equipment

purchased, the annual depreciation should not exceed 20% of the first cost at any time

without salvage value. Determine the length of service necessary for the equipment using

1

Solution

Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning