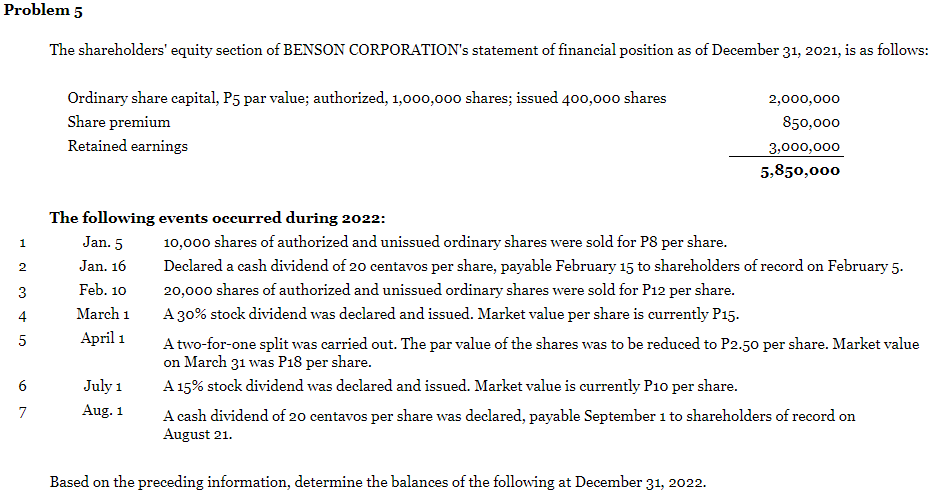

Problem 5 1 2 3 4 5 6 7 10 The shareholders' equity section of BENSON CORPORATION's statement of financial position as of December 31, 2021, is as follows Ordinary share capital, P5 par value; authorized, 1,000,000 shares; issued 400,000 shares Share premium Retained earnings The following events occurred during 2022: Jan. 5 Jan. 16 Feb. 10 March 1 April 1 July 1 Aug. 1 10,000 shares of authorized and unissued ordinary shares were sold for P8 per share. 2,000,000 850,000 3,000,000 5,850,000 Declared a cash dividend of 20 centavos per share, payable February 15 to shareholders of record on February 5. 20,000 shares of authorized and unissued ordinary shares were sold for P12 per share. A 30% stock dividend was declared and issued. Market value per share is currently P15. A two-for-one split was carried out. The par value of the shares was to be reduced to P2.50 per share. Market value on March 31 was P18 per share. A 15% stock dividend was declared and issued. Market value is currently P10 per share. A cash dividend of 20 centavos per share was declared, payable September 1 to shareholders of record on August 21. Based on the preceding information, determine the balances of the following at December 31, 2022.

Problem 5 1 2 3 4 5 6 7 10 The shareholders' equity section of BENSON CORPORATION's statement of financial position as of December 31, 2021, is as follows Ordinary share capital, P5 par value; authorized, 1,000,000 shares; issued 400,000 shares Share premium Retained earnings The following events occurred during 2022: Jan. 5 Jan. 16 Feb. 10 March 1 April 1 July 1 Aug. 1 10,000 shares of authorized and unissued ordinary shares were sold for P8 per share. 2,000,000 850,000 3,000,000 5,850,000 Declared a cash dividend of 20 centavos per share, payable February 15 to shareholders of record on February 5. 20,000 shares of authorized and unissued ordinary shares were sold for P12 per share. A 30% stock dividend was declared and issued. Market value per share is currently P15. A two-for-one split was carried out. The par value of the shares was to be reduced to P2.50 per share. Market value on March 31 was P18 per share. A 15% stock dividend was declared and issued. Market value is currently P10 per share. A cash dividend of 20 centavos per share was declared, payable September 1 to shareholders of record on August 21. Based on the preceding information, determine the balances of the following at December 31, 2022.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter10: Stockholder's Equity

Section: Chapter Questions

Problem 69E:

Stock Dividends

Crystal Corporation has the following information regarding its common stock: S10...

Related questions

Question

PROBLEM 5 - AUDITING PROBLEMS

Compute fot the following:

3. Share premium

4. Retained earnings

Transcribed Image Text:Problem 5

The shareholders' equity section of BENSON CORPORATION's statement of financial position as of December 31, 2021, is as follows:

1

2

3

4

5

6

7

Ordinary share capital, P5 par value; authorized, 1,000,000 shares; issued 400,000 shares

Share premium

Retained earnings

The following events occurred during 2022:

Jan. 5

Jan. 16

Feb. 10

March 1

April 1

July 1

Aug. 1

2,000,000

850,000

3,000,000

5,850,000

10,000 shares of authorized and unissued ordinary shares were sold for P8 per share.

Declared a cash dividend of 20 centavos per share, payable February 15 to shareholders of record on February 5.

20,000 shares of authorized and unissued ordinary shares were sold for P12 per share.

A 30% stock dividend was declared and issued. Market value per share is currently P15.

A two-for-one split was carried out. The par value of the shares was to be reduced to P2.50 per share. Market value

on March 31 was P18 per share.

A 15% stock dividend was declared and issued. Market value is currently P10 per share.

Based on the preceding information, determine the balances of the following at December 31, 2022.

A cash dividend of 20 centavos per share was declared, payable September 1 to shareholders of record on

August 21.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning