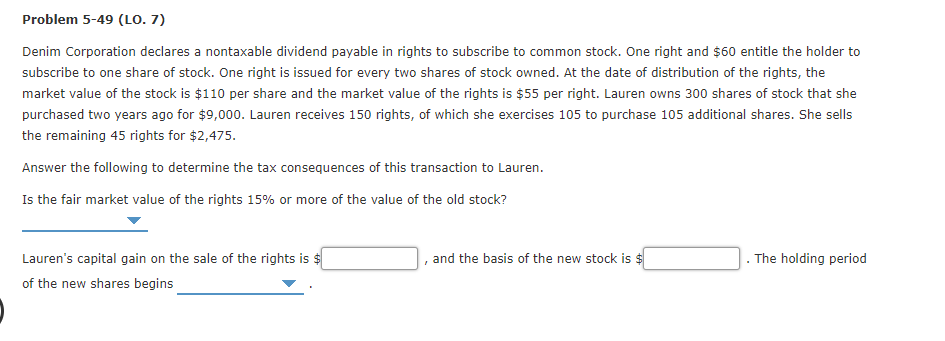

Problem 5-49 (LO. 7) Denim Corporation declares a nontaxable dividend payable in rights to subscribe to common stock. One right and $60 entitle the holder to subscribe to one share of stock. One right is issued for every two shares of stock owned. At the date of distribution of the rights, the market value of the stock is $110 per share and the market value of the rights is $55 per right. Lauren owns 300 shares of stock that she purchased two years ago for $9,000. Lauren receives 150 rights, of which she exercises 105 to purchase 105 additional shares. She sells the remaining 45 rights for $2,475. Answer the following to determine the tax consequences of this transaction to Lauren. Is the fair market value of the rights 15% or more of the value of the old stock? Lauren's capital gain on the sale of the rights is $ and the basis of the new stock is . The holding period of the new shares begins

Problem 5-49 (LO. 7) Denim Corporation declares a nontaxable dividend payable in rights to subscribe to common stock. One right and $60 entitle the holder to subscribe to one share of stock. One right is issued for every two shares of stock owned. At the date of distribution of the rights, the market value of the stock is $110 per share and the market value of the rights is $55 per right. Lauren owns 300 shares of stock that she purchased two years ago for $9,000. Lauren receives 150 rights, of which she exercises 105 to purchase 105 additional shares. She sells the remaining 45 rights for $2,475. Answer the following to determine the tax consequences of this transaction to Lauren. Is the fair market value of the rights 15% or more of the value of the old stock? Lauren's capital gain on the sale of the rights is $ and the basis of the new stock is . The holding period of the new shares begins

Chapter5: Corporations: Earnings & Profits And Dividend Distributions

Section: Chapter Questions

Problem 49P

Related questions

Question

See Attached 5.49

Transcribed Image Text:Problem 5-49 (LO. 7)

Denim Corporation declares a nontaxable dividend payable in rights to subscribe to common stock. One right and $60 entitle the holder to

subscribe to one share of stock. One right is issued for every two shares of stock owned. At the date of distribution of the rights, the

market value of the stock is $110 per share and the market value of the rights is $55 per right. Lauren owns 300 shares of stock that she

purchased two years ago for $9,000. Lauren receives 150 rights, of which she exercises 105 to purchase 105 additional shares. She sells

the remaining 45 rights for $2,475.

Answer the following to determine the tax consequences of this transaction to Lauren.

Is the fair market value of the rights 15% or more of the value of the old stock?

Lauren's capital gain on the sale of the rights is $

and the basis of the new stock is $

The holding period

of the new shares begins

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT