Problem 5 Ready Flashlights, Inc. needs P300,000 to take a cash discount of 2/10, net 70. A banker will loan the money for 60 days at an interest cost of PS,500. Required: a. What is the cffective rate on the bank loan? b. How much would it cost (in percentage terms) if the firm did not take the cash discount, but paid the bill in 70 days instead of 10 days? c. Should the firm borrow the money to take the discount?

Problem 5 Ready Flashlights, Inc. needs P300,000 to take a cash discount of 2/10, net 70. A banker will loan the money for 60 days at an interest cost of PS,500. Required: a. What is the cffective rate on the bank loan? b. How much would it cost (in percentage terms) if the firm did not take the cash discount, but paid the bill in 70 days instead of 10 days? c. Should the firm borrow the money to take the discount?

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter22: Providing And Obtaining Credit

Section: Chapter Questions

Problem 4P: Gifts Galore Inc. borrowed 1.5 million from National City Bank. The loan was made at a simple annual...

Related questions

Question

help me answer this problem 5 ty

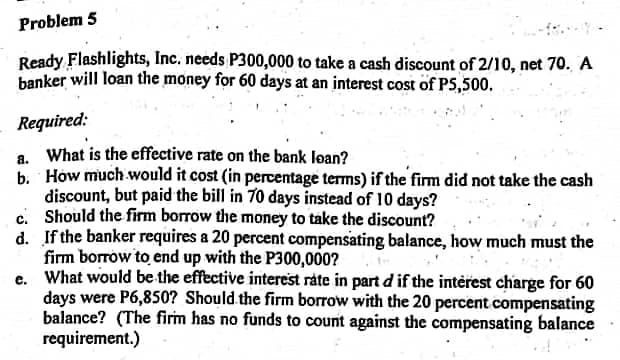

Transcribed Image Text:Problem 5

Ready Flashlights, Inc. needs P300,000 to take a cash discount of 2/10, net 70. A

banker will loan the money for 60 days at an interest cost of PS,500.

Required:

a. What is the effective rate on the bank loan?

b. How much would it cost (in percentage terms) if the firm did not take the cash

discount, but paid the bill in 70 days instead of 10 days?

c. Should the firm borrow the money to take the discount?

d. If the banker requires a 20 percent compensating balance, how much must the

firm borrow to end up with the P300,000?

e. What would be the effective interest ráte in part d if the interest charge for 60

days were P6,850? Should the firm borrow with the 20 percent compensating

balance? (The firm has no funds to count against the compensating balance

requirement.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning